If you're thinking about starting a business in the Emirates, the LLC in UAE is hands-down the most popular and practical way to go. For most entrepreneurs, it offers a powerful combination of benefits: 100% foreign ownership for a huge range of mainland activities and, crucially, protection for your personal assets. It’s a secure foundation to build your venture on.

Why an LLC Is the Smart Choice for Your UAE Venture

When you first look into setting up a business in the UAE, the number of options can feel a bit much. But time and again, for both local founders and international investors, the Limited Liability Company (LLC) comes out on top. It just strikes that perfect balance between operational freedom and personal security.

The biggest draw is right there in the name: limited liability. This legal structure creates a solid wall between the business and you, the owner. If the company ever runs into financial trouble or legal issues, your personal assets—your house, your car, your savings—are kept safe. That peace of mind is priceless, letting you take smart business risks without putting your personal finances on the line.

Unlocking Full Ownership and Market Access

A real game-changer was the amendment to the UAE Commercial Companies Law. Not too long ago, foreign investors on the mainland needed an Emirati sponsor who would hold a 51% share. That's no longer the case. Now, for over a thousand commercial and industrial activities, you can have 100% ownership of your mainland LLC.

This shift has flung the doors wide open for entrepreneurs from all over the world to take full control of their businesses, from big strategic moves to how profits are shared. Setting up an LLC gives you direct access to the booming local UAE market. You can trade freely with other mainland companies and even bid on major government contracts—opportunities that are often out of reach for companies based in a free zone.

Flexibility That Grows With Your Business

The LLC isn't just about protection; it's also incredibly adaptable. It doesn't matter if you're a solo founder or starting with a group of partners, the structure works. An LLC can support anywhere from a single shareholder right up to 50, which gives you a clear path for bringing on new investors as you grow.

This makes it a great fit for all sorts of ventures:

- A Dubai-based tech startup aiming for rapid growth.

- A retail shop opening its doors in an Abu Dhabi mall.

- A consultancy firm with clients all across the Emirates.

- An international trading company using the UAE as its strategic hub.

An LLC is more than just a legal box to tick. It’s a strategic tool. It gives you the credibility you need to open a corporate bank account, lease office space, and get visas for yourself and your team, firmly establishing your business in the UAE.

Ever since the laws were updated, the LLC has become the go-to onshore structure for private businesses. It's often called 'the most common form for doing business onshore (mainland UAE)' precisely because of its flexibility and robust liability protection for its 1 to 50 shareholders. You can find more insights on UAE business structures from legal experts at Chambers and Partners.

Choosing Your Business Playground: Mainland vs. Free Zone

One of the first, and biggest, decisions you'll make when forming your LLC in UAE is where to set it up. This isn't just about picking an office address; it's about choosing the entire legal and operational world your company will live in. You have two main paths: the UAE mainland or one of the many specialised free zones.

Each route comes with its own set of advantages and limitations that will directly shape how you do business. Let's break down what that means for you.

Mainland LLC: Your Key to the Local Market

Think of a mainland LLC as your all-access pass to the entire UAE economy. Setting up on the mainland means you can trade directly with any customer, business, or government department across all seven emirates, no strings attached.

If your plan is to open a retail shop, offer services directly to the local community, or bid on valuable government contracts, then a mainland setup is non-negotiable. It's the traditional route, registered with the Department of Economic Development (DED) or a similar authority, and it offers the most flexibility to operate and grow anywhere in the country.

For instance, a mainland trading company can sell its products to distributors in Dubai, Abu Dhabi, and Sharjah without a middleman. A consulting firm can sign contracts with clients anywhere. This direct market access is a massive advantage. Imagine you supply materials to construction companies—a mainland LLC allows you to approach any developer in the UAE directly. A free zone company would need to use a local agent, adding complexity and cost.

Free Zone LLC: A Hub for Global Business

On the other side, you have free zones. There are over 40 of them scattered across the UAE, and many are built around specific industries. You've got Dubai Media City for media businesses, Jebel Ali Free Zone (JAFZA) for logistics and trade, and so on. This creates powerful ecosystems where like-minded companies can connect and collaborate.

So, what's the catch? A free zone LLC is generally restricted from doing business directly in the mainland market. If a company in a free zone wants to sell its products to customers on the mainland, it must appoint an officially licensed local distributor.

This model is perfect for businesses focused on international trade or those that need a regional hub for re-exporting goods. The benefits are compelling: 100% foreign ownership, full repatriation of profits, and exemptions from customs duties on imports and exports.

Key Takeaway: Let your business model guide you. If your target customers are inside the UAE, a mainland LLC is almost always the right call. If you're focused on import/export or regional distribution, a free zone offers some serious financial and logistical perks.

To really see the differences side-by-side, let's compare the core features. For a more detailed breakdown of the operational specifics, you can explore our guide comparing free zone versus mainland in Dubai.

Mainland vs Free Zone LLC: A Strategic Comparison

To make this choice clearer, we've put together a table that highlights the fundamental differences between setting up on the mainland versus in a free zone. This should help you weigh the pros and cons based on what your business truly needs to thrive.

| Feature | Mainland LLC | Free Zone LLC |

|---|---|---|

| Business Scope | Can trade freely anywhere in the UAE and internationally. | Primarily allowed to operate within the free zone and internationally. Mainland business requires a local distributor. |

| Ownership | 100% foreign ownership for most commercial and professional activities. | 100% foreign ownership is a standard feature. |

| Government Tenders | Eligible to bid on government contracts and projects. | Generally not eligible to bid directly for government projects. |

| Office Space | Physical office space is often mandatory, with size linked to visa quotas. | Flexible options, including virtual offices, flexi-desks, and physical spaces. |

| Visa Allocation | Typically based on the size of the physical office space. More space equals more visas. | Often comes with a pre-approved visa package, which can be increased. |

| Customs Duty | Standard 5% customs duty on imported goods. | 0% customs duty on goods imported into the free zone for re-export. |

Ultimately, there's no "better" option here—just the right fit for your specific goals. A mainland LLC in UAE gives you unmatched access to the local economy. A free zone LLC, on the other hand, provides a streamlined, tax-efficient base for international operations.

The LLC Formation and Licensing Roadmap

Once you’ve settled the mainland versus free zone debate, it’s time to get down to the paperwork. This is where your business idea begins to take legal shape, moving from a concept to a tangible, recognised entity in the UAE. Navigating the administrative side of forming your LLC in UAE involves several key steps with government authorities, but it’s a straightforward path if you know the route.

Think of this phase as laying the foundation of your company. Every document you file and every approval you secure is another crucial piece that gives your business its legal structure and the right to operate.

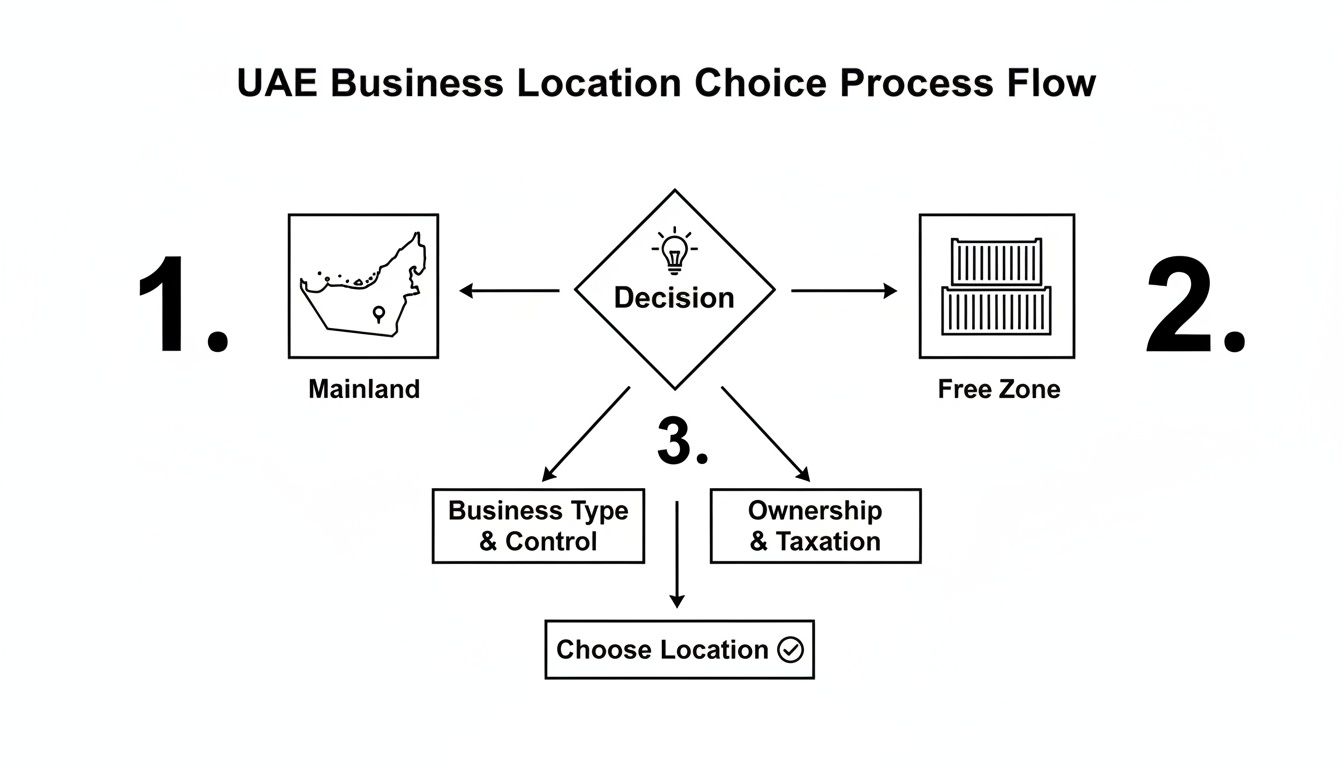

This flowchart breaks down the initial decision-making process, showing how your choice of location shapes the entire setup journey.

As you can see, your choice directly influences your market access and the scope of your operations from day one.

Securing Your Trade Name and Initial Approval

First things first, you need a name for your business. This isn't just a branding exercise; your proposed trade name has to meet the UAE’s strict naming regulations. It can’t violate public morals, include religious or political references, or be a carbon copy of an existing company’s name.

You’ll submit a few name options for reservation with the relevant authority. For a mainland LLC, this will be the Department of Economic Development (DED), while a free zone setup will be handled by its specific authority.

Once your name is approved, the next milestone is getting Initial Approval. This is essentially a preliminary nod from the authorities, confirming they have no objection to you setting up your business. It's the green light you need to proceed with drafting legal documents and other formalities.

The Initial Approval isn't your final license, but it's a critical confirmation that you’re on the right track. It’s the official go-ahead to continue the setup process with confidence.

Think of it like getting pre-approved for a loan; the deal isn't done, but the bank has agreed in principle. This approval is typically valid for six months, giving you a clear window to get the rest of your paperwork in order.

Crafting Your Memorandum of Association

The Memorandum of Association (MOA) is the legal backbone of your LLC. It’s not just a piece of paper—it's the constitution of your company, outlining its core structure, rules, and the relationship between the shareholders. Getting this document right is absolutely essential.

Your MOA will typically include key details like:

- The company's full legal name and address.

- The specific business activities it will undertake.

- The total share capital and each partner's stake.

- The management structure, including the roles and powers of managers.

- Clear rules for how profits and losses will be distributed.

For a mainland LLC, the MOA must be drafted in both Arabic and English and then notarised by a UAE Notary Public. This step requires all shareholders (or their legal representatives) to be physically present to sign the document. A poorly drafted MOA can lead to serious disputes down the road, so this is one area where you don't want to cut corners.

Assembling Your Document Portfolio

With your notarised MOA ready, it's time to gather all the documents needed for your final trade license application. This is where many people hit a snag. Simple mistakes like incomplete forms or missing paperwork can cause significant delays, so staying organised here will save you a world of headaches.

While the exact list can vary slightly, here’s what a typical document checklist looks like:

- Completed Application Form: A signed form from the DED or free zone authority.

- Passport Copies: Clear copies for all shareholders and the appointed manager.

- Visa and Emirates ID Copies: For any shareholders who are already UAE residents.

- Notarised MOA: The original signed and stamped document.

- Initial Approval Certificate: The confirmation you received earlier.

- Tenancy Contract (Ejari): Proof of a physical office address is required for mainland companies.

Depending on your business activities, you might also need extra approvals from other government bodies. For instance, a private clinic would need a green light from the Dubai Health Authority (DHA), while an engineering firm might require a no-objection certificate from the municipality.

Understanding the full scope of business licenses in UAE and their specific requirements is key to avoiding last-minute surprises. This is often where professional guidance proves invaluable.

Final License Issuance

Once your complete application, along with all supporting documents, is submitted, the relevant authority performs a final review. If everything is in order, they’ll issue a payment voucher for the trade license fee.

After payment, your official trade license is issued. Congratulations! This document, along with your Commercial Registration certificate and MOA, officially marks the birth of your LLC in UAE. You are now legally cleared to start your business activities and move on to the next steps, like applying for visas and opening a corporate bank account.

Securing Your Visa and Corporate Bank Account

With your trade licence officially issued, your LLC in UAE is legally born. This is a huge milestone, but don't pop the champagne just yet. Two critical steps remain before you can truly start operating: securing your residence visa and opening a corporate bank account.

From my experience, these are often the final hurdles where entrepreneurs can face unexpected delays if they aren't fully prepared.

Successfully navigating this stage is all about understanding the process and having your documents perfectly organised. It's the bridge between having a company on paper and having a fully functional business with you at the helm, physically present in the UAE.

Navigating the UAE Visa Process

As a shareholder in your new LLC, you're eligible for an investor or partner visa. This is your ticket to legally reside and work in the UAE. While it might seem daunting, the process follows a clear, multi-stage path that is surprisingly straightforward once you know the steps.

First things first, your company has to apply for an Establishment Card, which you might also hear called a Company Immigration Card. This card essentially registers your business with the immigration authorities, giving it the power to sponsor visas for owners and employees. Think of it as your company's official immigration file.

Once that card is in hand, the sequence for your personal visa kicks off:

- Entry Permit Application: This is an initial e-visa allowing you to enter the country to complete your residency formalities. If you're already in the UAE on a tourist visa, you can do what's called a "status change."

- Medical Fitness Test: Next, you'll visit a government-approved health centre for a standard medical screening. It’s a routine check that includes a blood test and a chest X-ray.

- Emirates ID Biometrics: You’ll then head to a Federal Authority for Identity and Citizenship (ICA) centre. Here, they'll take your fingerprints and a photograph for your all-important Emirates ID card.

- Visa Stamping: The final step. Your passport is submitted to immigration, and the residence visa is stamped inside, which is typically valid for two years.

This entire process ensures you are fully registered within the UAE system, granting you all the rights of a resident. It’s a well-trodden path, and efficiency is key.

The Challenge of Opening a Corporate Bank Account

While the visa process is procedural, opening a corporate bank account can be much more subjective. UAE banks have become incredibly strict with their due diligence and Know Your Customer (KYC) requirements to combat money laundering and ensure financial stability. Just flashing your new trade licence isn't enough to guarantee approval.

Bankers want to see a legitimate, tangible business. A virtual office might be sufficient for your licence, but for a bank account, proof of a physical presence carries significant weight. A real tenancy contract (Ejari) for an office space shows you're serious about operating here.

Expert Insight: Banks are assessing risk. They need to be convinced that your business is real, has a clear purpose, and poses no compliance threat. Your application file must tell a story of a credible, operational enterprise.

Beyond the office, banks will scrutinise your business plan, shareholder profiles, and the nature of your planned transactions. They want to understand your revenue model, your target clients, and where your initial funds are coming from. Providing a well-documented file with a clear business profile is absolutely crucial.

Many founders find this step frustrating, but understanding what the banks are looking for can make all the difference. To get a real head start, check out our guide on how to open a bank account in the UAE, which offers detailed strategies for success.

Preparing a comprehensive file with all the required documents, including your new Emirates ID and a solid business summary, will greatly improve your chances. The goal is to demonstrate that your LLC in UAE is more than just a name on a licence.

Staying Compliant After Your LLC Is Formed

Getting your trade licence for a new LLC in UAE is a huge milestone, but believe me, the work doesn't stop there. Think of company formation as the starting line. Ongoing compliance is the race you have to keep running. Staying on the right side of UAE regulations isn’t just about ticking boxes; it's vital for your company's long-term health and reputation. A single misstep can lead to hefty fines and major disruptions you just don't need.

The UAE has rolled out several key regulations recently to boost transparency and align with global standards. As a business owner, it’s your job to get up to speed with these from day one. Being proactive here will keep your business in good standing and save you from some nasty surprises down the road.

Key Compliance Duties You Cannot Ignore

Two of the biggest areas you need to focus on are the Economic Substance Regulations (ESR) and Ultimate Beneficial Owner (UBO) declarations. They might sound intimidating, but their goal is simple: to make sure business operations are transparent.

-

Economic Substance Regulations (ESR): This applies if your company is involved in specific "Relevant Activities," like banking, insurance, or simply acting as a holding company. If your LLC fits this description, you have to prove you have a real economic presence in the UAE. This usually involves showing that your main income-generating activities actually happen here, which is managed through an annual ESR notification and report.

-

Ultimate Beneficial Owner (UBO): This is all about identifying the real people who own or control your business. The aim is to clamp down on illegal financial activities. You're required to declare who your UBOs are to the authorities and, crucially, keep this information updated if anything changes. The penalties for not doing this are significant.

Think of these regulations as your way of proving the business is a legitimate, active company with a real purpose in the UAE—not just a paper entity. Keeping these records accurate isn't optional.

Financial Record Keeping and Corporate Tax

With the introduction of Corporate Tax in the UAE, sharp bookkeeping has gone from "good practice" to "absolutely essential." Every single business, including every LLC in UAE, must maintain precise financial records and statements. Here’s the key part: even if your profits are below the AED 375,000 tax threshold, the legal requirement to keep audited financials still applies.

This isn't just a tax thing, either. Clean books give you a crystal-clear picture of your company's financial health, helping you make smarter, more informed decisions. It also means you're always ready for a potential audit and makes life much easier when dealing with banks or investors.

The Role of PRO Services in Staying Compliant

Let's be honest, managing annual renewals, government paperwork, and new regulatory filings can easily eat up all your time. This is exactly where professional Public Relations Officer (PRO) services become an absolute game-changer. A good PRO partner is your company's direct line to all government departments.

A PRO can take a whole list of tasks off your plate:

- Making sure your trade licence and establishment card are renewed on time.

- Handling all the paperwork for employee visas, from applications to cancellations.

- Submitting your ESR and UBO declarations correctly and before the deadline.

- Managing document attestations and other official clearances.

Handing this over to a PRO service frees you up to do what you do best: grow your company. It’s a smart investment in your own efficiency and peace of mind, ensuring you never miss a critical deadline again.

Your Annual Compliance Checklist

To keep everything straight, a simple annual checklist is your best friend. The exact requirements can differ slightly, but for most mainland LLCs, these are the big-ticket items you'll need to handle to stay compliant.

| Task | Frequency | Description |

|---|---|---|

| Trade Licence Renewal | Annually | Renew your licence with the DED or relevant authority. You'll need a valid tenancy contract (Ejari). |

| Establishment Card Renewal | Annually | This keeps your company's immigration file active, which is essential for sponsoring visas. |

| Financial Audits | Annually | Get your financial statements professionally audited as required by UAE law. |

| ESR Filing | Annually | Submit your ESR notification. If required, you'll also need to file a detailed report. |

| UBO Register Update | As needed | Any time there's a change in ownership, your UBO register must be updated immediately. |

Staying on top of this list ensures your LLC in UAE operates smoothly, securely, and completely within the law.

Common Questions on UAE LLC Formation

When you're diving into the process of setting up an LLC in the UAE, a few key questions always come up. Getting straight answers from the get-go can save you a world of time, prevent some expensive missteps, and give you the confidence you need to push forward. Here are the clear, simple answers to the questions we hear most often from entrepreneurs just like you.

What Is the Typical Cost to Set Up a Dubai Mainland LLC?

There’s no single price tag for a Dubai mainland LLC; the final cost really hinges on your specific business activity and your office needs. That said, we can work with some reliable ballpark figures. If you're going for a professional licence, you can generally expect the setup costs to start somewhere between AED 18,000 and AED 25,000.

For a commercial trading licence, the initial outlay is a bit higher, usually landing in the AED 25,000 to AED 40,000 range. These numbers typically cover the main government fees like your trade licence issuance, the initial approval, and reserving your trade name. It's really important to remember these are just the setup costs. You’ll also need to factor in ongoing expenses like mandatory office rent, visa processing for you and your staff, and any special external approvals your industry requires.

Pro Tip: Always ask your business setup consultant for a detailed, itemised quote. This is the best way to make sure there are no surprise fees lurking and that you have a complete financial picture before you sign anything.

Does Forming an LLC Grant Me a UAE Residence Visa?

Yes, it certainly does. The moment you become a shareholder or partner in your new LLC, you’re eligible to apply for a UAE investor or partner residence visa. Think of it as your personal key to living and working in the country. This visa is typically valid for two years and is renewable.

This is one of the biggest perks of forming an LLC in UAE. Once your own visa is stamped into your passport, you can then sponsor residence visas for your immediate family, including your spouse and children. Your company also gets its own file to apply for employee visas. The number of staff visas you can get is usually tied to the size of your physical office space and the type of business you're running.

The path to getting your visa is quite straightforward:

- First, you get an Establishment Card for your LLC.

- Next, you apply for your personal entry permit.

- Then, you complete the required medical test and biometrics for your Emirates ID.

- Finally, you get the residence visa stamped right into your passport.

Is a Local Emirati Sponsor Still Required for a Mainland LLC?

This is easily one of the most important and welcome changes to UAE company law in recent memory. For the vast majority of business activities, a foreign investor can now own 100% of a mainland LLC. You no longer need a local Emirati sponsor holding a 51% share, as the old rule has been scrapped for most industries.

This shift gives international entrepreneurs complete ownership and control over their mainland companies. Of course, a few strategic sectors—mainly those connected to national resources or essential public services—might still require a local partnership. But for most commercial and professional businesses, from trading and e-commerce to consulting and tech, you can enjoy full foreign ownership.

It is worth mentioning that some professional service licences may still require what's called a Local Service Agent (LSA). But don't worry, an LSA is very different from a sponsor. They hold zero shares, have no say in management, and don't take any of your profits. Their role is simply to act as a government liaison for your licence, and for that, they are paid a fixed annual fee.

Ready to turn your business idea into a reality in the UAE? The team at Al Ain Business Center has over a decade of experience making the LLC formation process smooth and successful. Start your company formation journey with us today!