So, you're thinking about planting your roots in the UAE? Smart move. The UAE investor visa isn't just a piece of paper; it's a long-term residence permit for individuals ready to make a significant financial contribution to the country's booming economy, usually through real estate or a business investment.

Think of it as a key that unlocks lasting stability and incredible opportunity. The most talked-about option is the prestigious 10-year Golden Visa, but there are also more accessible 2-year and 5-year routes. This guide is your roadmap to securing one in one of the world's most dynamic economic hubs.

Securing Your Future With The UAE Investor Visa

This is about more than just a document. We're talking about a blueprint for building a secure, long-term future for you and your family. The UAE designed the investor visa to attract sharp entrepreneurs and property buyers, offering an exceptional lifestyle in return for contributing to the nation's growth. It's a strategic move for anyone looking to truly establish themselves in the region.

We’ll walk through the different pathways available, from the most sought-after options to those with a lower barrier to entry. This isn't a one-size-fits-all programme; it's a collection of carefully designed routes that cater to different investment levels and long-term goals.

Understanding Your Visa Options

The visa landscape is intentionally structured to fit various levels of investment and commitment. Getting to grips with these differences is the very first step toward making a decision that aligns with your financial and personal goals.

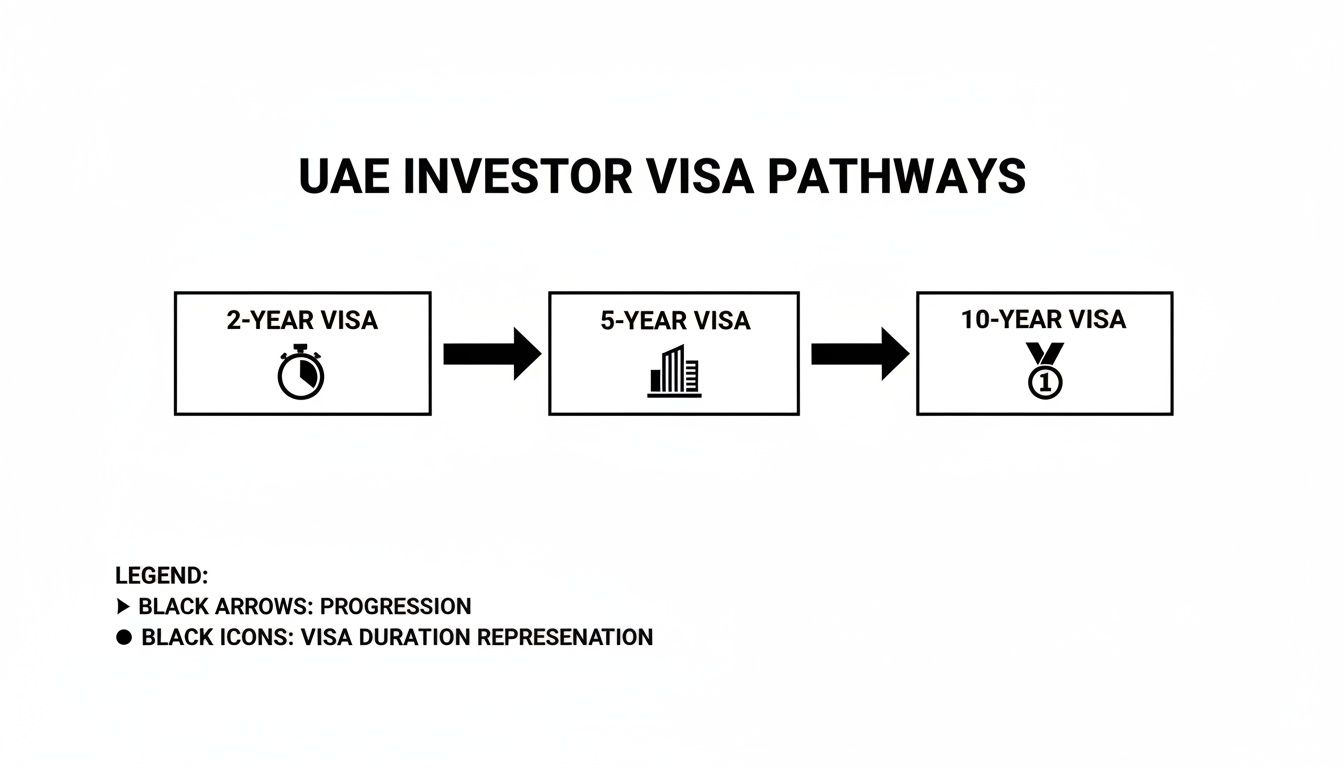

Here are the main pathways you'll come across:

- The 10-Year Golden Visa: This is the top-tier option. It’s for those making a substantial investment and offers the longest residency period with the best benefits.

- The 5-Year Visa: A very popular choice, especially for property investors who meet a specific, lower investment threshold. It provides solid, medium-term stability.

- The 2-Year Visa: This is an excellent entry point for new entrepreneurs and property owners, giving you a flexible yet secure footing in the UAE market.

This tiered system is brilliant because it means whether you're a seasoned global investor or a budding entrepreneur, there's a UAE investor visa designed to match your vision. It creates a direct, symbiotic link between your capital and your residency.

To help you see exactly which visa might be the right fit, we’ve put together a simple comparison table. It breaks down the key differences in investment amounts, visa duration, and the most common investment routes, making your initial assessment clear and straightforward.

UAE Investor Visa Options at a Glance

| Visa Type | Minimum Investment | Visa Duration | Primary Investment Route |

|---|---|---|---|

| Golden Visa | AED 2,000,000 | 10 Years | Real Estate or Public Investment |

| 5-Year Visa | AED 1,000,000 | 5 Years | Real Estate |

| 2-Year Visa | AED 750,000 | 2 Years | Real Estate |

As you can see, the path you choose depends entirely on your investment capacity and how long you plan to call the UAE home. Each option offers a clear route to residency, backed by a tangible asset.

Choosing Your Pathway to UAE Residency

Trying to figure out the right UAE investor visa can feel a bit overwhelming at first, but it gets much simpler when you understand what each one is designed for. Think of them as different pathways, each built for a specific type of investor, capital level, and long-term goal. Your choice really comes down to whether you're just dipping your toes in the market, setting up a solid mid-term base, or going all-in on the UAE's economic future.

A good way to look at it is like having keys to different doors. The 2-year visa is your market entry key—perfect for new entrepreneurs testing the waters. On the other hand, the 10-year Golden Visa is the ultimate stakeholder's pass, a clear signal that you're making a deep, long-term commitment to the country.

The 10-Year Golden Visa: A Symbol of Commitment

The most sought-after option is the 10-year Golden Visa, which calls for a minimum investment of AED 2 million. This route is really for people who see the UAE as more than just a place to do business; it's for those looking to build a long-term home for their family and their capital.

It offers a level of stability and a range of benefits that are second to none, making it the top choice for serious investors in real estate or other approved investment funds. Going for this visa shows you have strong faith in the UAE's continued growth and want to be a part of that story for the next decade and beyond.

Accessible Routes: The 5-Year and 2-Year Visas

While the Golden Visa is the ultimate prize for many, the UAE has smartly created more accessible entry points for a broader range of investors. Recent reforms have made property investment an incredibly attractive and direct path to residency, even if you're not ready for the AED 2 million threshold. These options are ideal for anyone who wants the security of UAE residency without the major initial capital needed for the Golden Visa.

This flowchart lays out the clear progression between the main investor visa pathways.

As you can see, each visa tier can be a stepping stone to the next, offering a scalable way to secure your long-term residency here.

By 2025, the UAE had significantly expanded its residency options by creating new pathways with lower investment amounts. Real estate advisory reports confirm that you can now secure a 5-year investor visa with a combined freehold property ownership of at least AED 1 million. Even more accessible is the 2-year investor visa, available for property investments starting as low as AED 750,000, which has opened the door for many more aspiring residents.

These tiered options really show the UAE's strategic thinking. The goal is to attract a diverse mix of global investors by offering flexible, scalable solutions. It means you can come in at a level that’s comfortable for you and potentially upgrade as your investments and commitment to the region grow.

Making a Strategic Investment Choice

The type of investment you choose is just as critical as the visa itself. If you're going the property route, you absolutely need to know the difference between freehold and leasehold. For visa eligibility, you need a freehold property, which gives you complete ownership of both the property and the land it sits on. A leasehold, by contrast, just gives you the right to use the property for a set period.

There are also specific rules around off-plan properties. To qualify, the property must be from a government-approved developer, and you'll usually need to have paid a significant portion of its value (often AED 1 million or more) to be eligible. The choice also extends to your business structure; understanding the differences is key. For more on this, check out our guide comparing https://alainbcenter.com/free-zone-vs-mainland-dubai/.

For anyone looking into the broader experience of settling in the region, beyond just the investor visa details, this guide to living in Dubai for expats is an invaluable resource. In the end, picking the right UAE investor visa is all about aligning your capital, your long-term vision, and the specific investment criteria to build a secure and successful future in the Emirates.

The Golden Visa: A Deep Dive Into the Premier Pathway

While standard investor visas give you a solid foothold in the UAE, the Golden Visa is on another level entirely. Think of it less like a simple residency permit and more like a long-term partnership with the country itself. It's a strategic move by the UAE government, designed not just to attract investment, but to keep the world-class talent, entrepreneurs, and visionaries who are fuelling its growth.

Earning a Golden Visa means you're seen as a key stakeholder in the nation's future. It offers an incredible amount of stability with a 10-year residency, allowing you and your family to truly build a home without the constant headache of visa renewals. For any serious investor, this long-term security is an absolute game-changer.

Unpacking the Core Investment Routes

Getting your hands on this premier uae investor visa typically starts with a minimum investment of AED 2 million. The good news is you have a few different channels to deploy that capital, each with its own specific rules. Figuring out these pathways is the first step to aligning your investment plans with your residency goals.

The two main routes for investors are:

- Real Estate Investment: This is by far the most popular option. You’ll need to buy one or more properties with a total value of at least AED 2 million. The key is that the investment must be in your name and fully paid for. If you have a mortgage, your paid-up equity must still be at least AED 2 million.

- Public Investment: This route offers a bit more flexibility. You can either deposit AED 2 million into an accredited local investment fund or set up a new company in the UAE with a capital of at least AED 2 million. It’s a perfect fit for entrepreneurs and financiers who want to be actively involved in the local economy.

Each option is structured to ensure your investment brings real, tangible value to the UAE, solidifying your role as a contributor to its ongoing success story.

The Success and Appeal of the Golden Visa

The programme's popularity isn't just talk; the numbers tell a powerful story. The Golden Visa has become a massive magnet for global wealth and talent, with the number of visas issued growing at an incredible pace. This rapid uptake is a clear sign of strong investor confidence in the UAE's long-term stability and vision.

Just look at Dubai's figures between 2021 and 2023. The number of Golden Visas issued shot up from roughly 47,150 in 2021 to around 158,000 in 2023—that's more than a threefold increase in just two years. You can find more Golden Visa statistics and trends on jsb.ae.

This explosive growth isn't just about statistics; it’s a direct reflection of how effectively government policy has translated into investor confidence. The Golden Visa is now a globally recognised symbol of security and opportunity.

Beyond Residency: A Tool for Deep Integration

At the end of the day, the Golden Visa is much more than an entry permit. It’s an invitation to become deeply woven into the economic and social fabric of the United Arab Emirates. It gives you the freedom to live, work, and study without needing a national sponsor, offering a level of autonomy that other visas simply can't match.

This long-term residency encourages investors to think beyond short-term profits. It empowers them to build businesses, raise families, and truly contribute to the community. If you're seriously considering this premier pathway, you can learn more about how to get the Golden Visa in the UAE in our detailed guide at https://alainbcenter.com/how-to-get-golden-visa-uae/. It is the ultimate tool for those who see the UAE not just as a market, but as a home for generations to come.

Your Step-by-Step Application Roadmap

Getting a UAE investor visa might seem like a mountain to climb, but it’s really just a series of straightforward steps. If you have a clear plan, the whole process becomes much more manageable. We've broken it down into a simple, chronological roadmap to take you from gathering your first documents to getting that final visa stamp in your passport.

Think of it like building a house: you can't start putting up walls without a solid foundation. In the same way, your visa application relies on getting all your paperwork perfectly in order before you even think about submitting anything. This first stage is absolutely the most critical part of the journey.

Stage 1: Preparing Your Core Documents

First things first, you need to pull together a portfolio of documents. Each one tells a part of your story and proves you're eligible for the visa. It's tempting to rush this part, but trust me, that's where most delays and rejections come from.

Here's your essential checklist:

- Proof of Investment: This is the cornerstone. For property investors, it's your Title Deed. If you're a business investor, you'll need your company's Trade Licence and memorandum of association.

- Financial Statements: You'll have to show recent bank statements, usually for the last six months, to demonstrate you're financially stable.

- Personal Identification: This is the standard stuff—a copy of your passport (with at least six months of validity left), a recent passport-sized photo with a white background, and your current visa if you're already in the UAE.

Each document plays a role, and together they give the authorities a complete picture of your investment.

Stage 2: Initiating the Application

Once your documents are sorted and, if needed, properly attested, it's time to get the ball rolling. This is when you officially submit your case to the UAE authorities through the right channels.

You can usually apply through one of these official portals:

- Dubai Land Department (DLD): The go-to for real estate investors in Dubai.

- Federal Authority for Identity, Citizenship, Customs & Port Security (ICP): This is the main federal portal that handles all sorts of visa services.

- Amer Centres: Government-approved service centres where you can get your application processed in person.

After you submit, your application goes into review. The authorities will look over every single document to make sure it ticks all the boxes for the uae investor visa. You'll either get an initial approval or a request for more information if they spot something missing.

Pro-Tip: Double-check everything before you hit submit. A simple mistake, like an expired passport copy or a blurry bank statement, is one of the most common reasons for applications getting stuck in limbo.

Stage 3: Completing In-Country Procedures

Getting that initial approval is a huge win, but you're not quite at the finish line. The last few steps have to be completed here, inside the UAE. This final phase is all about confirming your identity and making sure you meet the country's health and security standards.

The in-country steps are pretty standard for everyone:

- Medical Fitness Test: You’ll need to pop into a government-approved health centre for a medical exam. It’s a routine check that screens for specific communicable diseases to protect public health.

- Biometrics and Emirates ID Application: Next, you'll visit a designated centre to give your fingerprints and have a photo taken for your Emirates ID card. This card is a mandatory piece of legal identification for every resident in the UAE.

- Visa Stamping: With the medical test cleared and biometrics done, the final step is getting the residency visa stamped right into your passport. This is the moment it becomes official—you are now a UAE resident investor.

Understanding the Costs and Timelines

Any successful investment journey starts with a clear financial plan and a realistic idea of how much time it's going to take. When you're securing a UAE investor visa, the big capital investment is just one part of the picture. There are several administrative costs you'll need to budget for to make sure the whole process is smooth and predictable.

Think of it this way: your main investment is the engine of your car. These other fees are the fuel, oil, and routine checks needed to get you to your destination without any unexpected breakdowns. These are standard costs for any residency application here in the UAE, covering everything from government processing to mandatory health checks. Factoring them in from day one is a smart move that prevents last-minute financial stress and keeps your application moving forward.

Breaking Down the Associated Fees

While your property purchase or business setup will be your largest financial outlay, there are a handful of smaller, essential fees to finalise your visa. These costs can shift slightly depending on which emirate you're in or the specific service centre you use, but they generally fall into the same predictable buckets.

Here’s a look at the typical administrative costs you can expect:

- Application & Entry Permit Fees: This covers the initial paperwork and gets you the entry permit, which is your green light to complete the rest of the steps inside the UAE.

- Medical Fitness Test: Every residency applicant has to go through a mandatory health screening at a government-approved medical centre.

- Emirates ID Application: This is the fee for your national identity card, a crucial piece of ID you'll use for just about everything in the UAE.

- Visa Stamping: The final step where the residence visa is officially stamped into your passport, making your new status official.

These costs are simply part of the process of setting up your new life here. If you're planning for the long haul, it’s also a good idea to look ahead at future expenses. In fact, you can learn more about UAE visa renewal fees in our other guides.

To give you a clearer picture, here’s a table outlining the estimated fees you should budget for, separate from your primary investment.

Estimated Fees for a UAE Investor Visa Application

| Service | Estimated Cost (AED) | Notes |

|---|---|---|

| Entry Permit | 750 – 1,200 | Initial fee to begin the in-country process. |

| Medical Fitness Test | 350 – 800 | Cost depends on the urgency (standard vs. VIP service). |

| Emirates ID | 370 – 570 | For a 2 or 3-year visa. |

| Visa Stamping | 500 – 950 | The final step to place the visa in your passport. |

| Admin/Typing Fees | 200 – 400 | Standard service fees at government typing centres. |

Please note these are estimates and can vary based on the emirate and specific service providers.

Charting Your Application Timeline

Just as crucial as the budget is the timeline. The UAE investor visa process is known for being efficient, but it still has several distinct stages you need to go through. Having a realistic timeframe helps you plan your move, manage your commitments back home, and avoid unnecessary stress.

From start to finish, you can generally expect the entire process to take between 2 to 4 weeks. This assumes all your documents are correct and ready to go, and there are no unexpected hold-ups.

The UAE’s Golden Visa is a perfect example of how visa policy drives the market. With its AED 2 million threshold for a 10-year residency, it has directly boosted high-end property sales. Market analysis for 2024–2025 clearly shows this link, proving how these residency programmes shape investment trends. You can learn more about how the Golden Residency programme connects investment with long-term stability on the official government portal.

Planning for both the financial and time commitments is non-negotiable. A well-prepared applicant who understands these elements is far more likely to experience a seamless and successful visa journey.

Your UAE Investor Visa Questions Answered

When you start digging into the details of a UAE investor visa, plenty of questions pop up. What about an off-plan property? How does a mortgage affect things? Who can I bring with me? Getting these answers sorted is key to building a solid application and moving forward with real confidence.

We've pulled together the most common questions we hear from investors just like you. Think of this as your go-to guide for clearing up those final doubts before you jump into your investment and residency journey in the Emirates.

Can I Qualify for an Investor Visa With an Off-Plan Property?

Yes, absolutely. You can definitely use an off-plan property to secure a UAE investor visa, but there are a few important boxes to tick. First, the property's value must hit the minimum threshold for the visa you're aiming for, like the AED 2 million needed for the popular Golden Visa.

Crucially, you have to buy it from a government-approved developer. You'll need the registered sale and purchase agreement (known as an Oqood), and you must have paid a significant chunk of the property's value already—often at least AED 1 million for Golden Visa applicants. These rules are in place to make sure the investment is real, secure, and genuinely contributes to the local property market.

Is It Possible to Use a Mortgaged Property for the Visa?

It certainly is. You can use a mortgaged property, but here’s the critical detail: the government is interested in your paid-up equity, not the total price tag of the property. This is a distinction that catches a lot of people out.

For the 10-year Golden Visa, if your property has a mortgage, you'll need to show clear proof that you've personally paid at least AED 2 million towards its value to the bank. This means getting an official No Objection Certificate (NOC) and a detailed statement from your bank confirming your paid equity. The focus is squarely on the actual capital you have invested yourself.

This equity-first approach makes sure the visa is granted based on an investor's real financial stake in the UAE, not just on borrowed funds. It’s a true measure of your commitment to the country's economy.

What Family Members Can I Sponsor on My Investor Visa?

The family sponsorship perks, especially with the Golden Visa, are a huge draw for investors because they are incredibly generous. As the main visa holder, you can sponsor your immediate family, giving everyone long-term stability in the UAE.

This comprehensive sponsorship covers:

- Your spouse

- Your children (with no age limit for unmarried sons and daughters)

- Your parents, who can be sponsored for the same visa duration as you

This is easily one of the biggest advantages of the UAE investor visa programme. It lets your whole family live, work, and study under one secure residency, making the move to a new life here feel seamless and complete.

Do I Need to Live in the UAE to Keep My Visa Valid?

One of the most powerful features of the Golden Visa is that there’s absolutely no minimum stay requirement. You can keep your UAE residency without having to live here full-time, which is perfect for global investors who travel constantly or run businesses in different parts of the world.

For other investor visas, like the 2-year or 5-year options, the rules are different. You generally need to enter the UAE at least once every six months (or 180 days) to keep the visa active. The freedom offered by the 10-year Golden Visa is a massive strategic advantage, giving you unparalleled flexibility to manage your global lifestyle while keeping a secure base in the Emirates.

Getting the details right on a visa application takes precision and a deep understanding of the rules. At Al Ain Business Center, our experienced consultants handle every aspect of your UAE investor visa application flawlessly, from checking documents to getting that final approval. Let us make your journey to UAE residency smooth and successful. Start your application with confidence today.