When people ask about the trade license Dubai cost, there's never a single, straightforward answer. It's a bit like asking, "How much does a car cost?" The final price tag can swing from around AED 12,000 for a basic freelance permit to well over AED 50,000 for a mainland trading company with a physical office.

The final figure really hinges on your specific business, your chosen jurisdiction (mainland or free zone), and any extras like visas and office space.

Understanding the Financial Snapshot of Your Dubai Business

Think of budgeting for your Dubai trade license like building your dream home. You start with the cost of the land (your jurisdiction), then add the foundation and structure (your license type and business activity), and finally, the finishes and furnishings (visas, office space, etc.). Each choice directly impacts the final cost. Getting a handle on these core components is the first step to creating an accurate budget and avoiding any nasty surprises down the line.

This initial investment is more than just paperwork; it’s your legal key to unlock opportunities in one of the world's most exciting economic hubs. For a detailed walkthrough of the process, our guide on how to get a trade license in Dubai breaks it all down, from picking your activity to finalising your company structure.

Here's a quick look at the main elements that will shape your budget.

Quick Overview of Key Cost Components for a Dubai Trade License

This table gives you an at-a-glance summary of the primary factors that influence the total cost of a trade license in Dubai. The estimated ranges provide a helpful baseline as you begin your financial planning.

| Cost Component | Description | Estimated Cost Range (AED) |

|---|---|---|

| Business Jurisdiction | The choice between Dubai Mainland and a Free Zone is the biggest cost driver. | Mainland: AED 20,000 – 50,000+ Free Zone: AED 12,000 – 40,000 |

| License Type | Commercial, Professional, or Industrial licenses have different government fees and requirements. | Varies significantly based on activity and jurisdiction. |

| Office Space | From a cost-effective virtual office to a full physical lease, this is a major recurring expense. | Virtual Office: AED 5,000 – 15,000/year Physical Office: AED 30,000+/year |

| Visa Allocations | The number of investor and employee visas needed directly adds to the setup and renewal costs. | AED 5,000 – 8,000 per visa (approx.) |

| Government & PRO Fees | Includes fees for name approval, initial approval, attestation, and other administrative tasks. | AED 5,000 – 15,000+ |

Understanding how these pieces fit together is crucial for building a realistic financial forecast for your new venture.

Have Costs Changed Over Time?

Absolutely. It’s important to know that these costs aren't static. Over the last decade, as Dubai's global appeal has grown, the expenses for setting up a business have naturally trended upwards.

Back in 2014, you could get a basic commercial license for somewhere in the region of AED 10,000–AED 12,000. Fast forward to 2024, and the base fees for that same license now start between AED 15,000–AED 25,000. When you add in all the other necessary components, the total cost often climbs past AED 30,000. That’s a jump of roughly 50%. This trend is a direct reflection of the emirate's incredible economic growth and its solid position on the world stage.

Getting to Grips with Your Core Licence Expenses

To really understand the cost of a trade licence in Dubai, you can't just look at the final number on a quote. You have to break it down. Think of it like a restaurant bill – the total is made up of individual items, each with its own price. Your business setup is no different; it’s a sum of distinct, non-negotiable costs that form your initial investment.

Understanding these core components is the secret to smart budgeting. It shows you exactly where your money is going, helps you spot potential savings, and empowers you to make decisions that fit your financial plan. Let's pull back the curtain on each of these essential costs.

The Impact of Your Licence Type

The first, and most fundamental, choice you'll make is the type of licence your business needs. This single decision sets the baseline for all your other costs. The Dubai economy is organised into specific sectors, and your licence has to match what you actually do. Each type comes with different rules and, you guessed it, different government fees.

The main categories are:

- Commercial Licence: This is for any business involved in buying, selling, or trading goods. It’s the most common type, covering everything from retail shops to massive import-export operations.

- Professional Licence: If you're offering services or have a skilled profession, this one's for you. Think consultants, designers, accountants, and IT specialists.

- Industrial Licence: For companies that are manufacturing, processing, or assembling products. This licence involves more complex approvals because of its operational nature.

Commercial licences are the most common, making up about 60% of all active licences, with annual costs typically falling between AED 12,000 and AED 50,000. Professional licences are next, accounting for around 30% of the total, with a similar cost range. Industrial licences are the heavyweights, often starting at AED 25,000 before you even think about factory space and permits.

How Business Activities Affect Your Bill

Within each licence type, the specific activities you choose to list will also directly impact the final cost. It's like adding toppings to a pizza – each extra one adds a little to the price. Some activities are considered standard with no extra charge, but others require special approvals from external government ministries or departments.

For instance, a general trading licence costs more than one for a specific product simply because it gives you a much broader scope to operate. Likewise, activities in healthcare, education, or food and beverage need a green light from bodies like the Dubai Health Authority (DHA) or Dubai Municipality, and each of those approvals comes with its own fee.

Jurisdiction and Office Space: Your Biggest Cost Drivers

Where you choose to set up your business—either on the Dubai Mainland or in a Free Zone—is another huge factor in your overall cost. A mainland licence gives you the freedom to trade anywhere in the UAE, but it almost always requires a physical office space, which is a significant recurring expense.

Free Zones, on the other hand, offer more flexibility with cost-effective options like flexi-desks or virtual offices. While this definitely lowers the initial barrier to entry, you need to think about the long-term picture. For a detailed look at how these choices stack up financially, check out our complete guide on the total trading license cost in Dubai.

Key Takeaway: Your physical footprint is directly tied to your operational costs. A mainland setup offers unrestricted market access but at the price of higher property costs. A free zone provides a more affordable start but with geographical limitations on your business activities.

The Scalable Cost of Visas

Finally, don't forget about visas. The number of visas you need for yourself, your partners, and your employees will scale your costs up. Each visa application involves fees for processing, medical tests, and Emirates ID issuance. The more people you bring on board, the higher your total setup cost will be.

It’s essential to plan your staffing needs carefully from day one. This helps you create an accurate budget and avoid surprise expenses popping up during the setup phase.

Comparing Real Costs Mainland vs Free Zone Setups

Talking in hypotheticals and estimated ranges only gets you so far. To really get a feel for what a trade license costs in Dubai, you need to see how the numbers stack up in the real world. So, let’s leave the theory behind and walk through two very different, practical scenarios. This will show you exactly how your choices shape the final investment.

We'll put a freelance consultant setting up in a budget-friendly free zone head-to-head with a more traditional general trading company establishing itself on the Dubai mainland. This side-by-side breakdown makes the costs tangible and helps you map out the financial journey for your own business.

Scenario 1: The Free Zone Freelance Consultant

Picture this: you're a freelance marketing consultant. Your main goal is a quick, affordable setup with as little overhead as possible. A free zone is the obvious choice here, offering a neat package that usually includes your license, a flexi-desk for a business address, and one investor visa.

Here’s what a typical cost breakdown looks like for this setup:

- One-Time Registration Fee: Around AED 1,750 to get your company officially on the books with the free zone authority.

- Trade Name Reservation: A small but crucial fee, usually about AED 750.

- License Fee (Annual): This is the heart of your package, costing approximately AED 6,000 for a professional services license.

- Flexi-Desk/Virtual Office (Annual): This handles your physical address requirement for roughly AED 5,000.

- Establishment Card Fee: A one-time fee of about AED 2,000 to register your company with immigration services.

- Investor Visa Cost: This covers your application, medical tests, and Emirates ID, coming in at around AED 4,500.

All in, the total initial investment for a freelance consultant in a free zone is approximately AED 20,000. It's a lean, efficient model built for solo entrepreneurs and service providers. For an even more detailed analysis, you can explore our comprehensive guide to the Dubai freezone company setup cost, which dives much deeper into the various packages available.

Scenario 2: The Mainland General Trading Company

Now, let's shift gears to a more complex operation: a general trading company on the Dubai mainland. This business model is for entrepreneurs wanting to trade goods directly within the UAE market, which means they'll need a physical office and likely several employee visas.

The cost structure here looks very different:

- Initial Approval & Name Reservation: These first steps with the Department of Economy and Tourism (DET) will cost you around AED 1,000.

- Office Lease (Annual): This is the big one. A small, mandatory physical office can easily cost AED 35,000 or more per year.

- License Issuance Fee (Tasheel): The main government fee for the commercial license is approximately AED 15,000.

- Local Service Agent (LSA) Fee: While full foreign ownership is now possible for many activities, an LSA is often still needed. Their annual fee typically lands between AED 8,000 – AED 15,000.

- Establishment & Labour Cards: These mandatory registrations with immigration and labour will add another AED 2,500.

- Investor & Employee Visas: Assuming one investor visa and one employee visa, you're looking at around AED 9,000.

The total upfront cost for this mainland setup can easily surpass AED 70,000. The main reason for the significant price jump is the mandatory physical office lease—a key difference from the more flexible free zone model.

To make this even clearer, let's compare two common business types side-by-side.

Cost Comparison: Mainland General Trading vs. Free Zone E-commerce

The table below breaks down the typical costs for setting up a General Trading company on the Dubai Mainland versus an E-commerce business in a popular Free Zone. It's a great way to see where the money goes in each scenario.

| Expense Item | Mainland General Trading (AED) | Free Zone E-commerce (AED) |

|---|---|---|

| Initial Approval & Name Reservation | 1,000 | 2,500 |

| License Fee (Annual) | 15,000 | 7,500 |

| Office Lease / Flexi-Desk (Annual) | 35,000+ | 5,000 |

| Local Service Agent / Reg. Agent (Annual) | 8,000 | N/A |

| Establishment & Labour Cards | 2,500 | 2,000 |

| Investor Visa (1) | 4,500 | 4,500 |

| Estimated Total First Year Cost | 66,000+ | 21,500 |

As you can see, the need for a physical office and a local service agent on the mainland dramatically increases the startup cost. In contrast, the free zone model offers a much lower barrier to entry, which is perfect for e-commerce and service-based businesses.

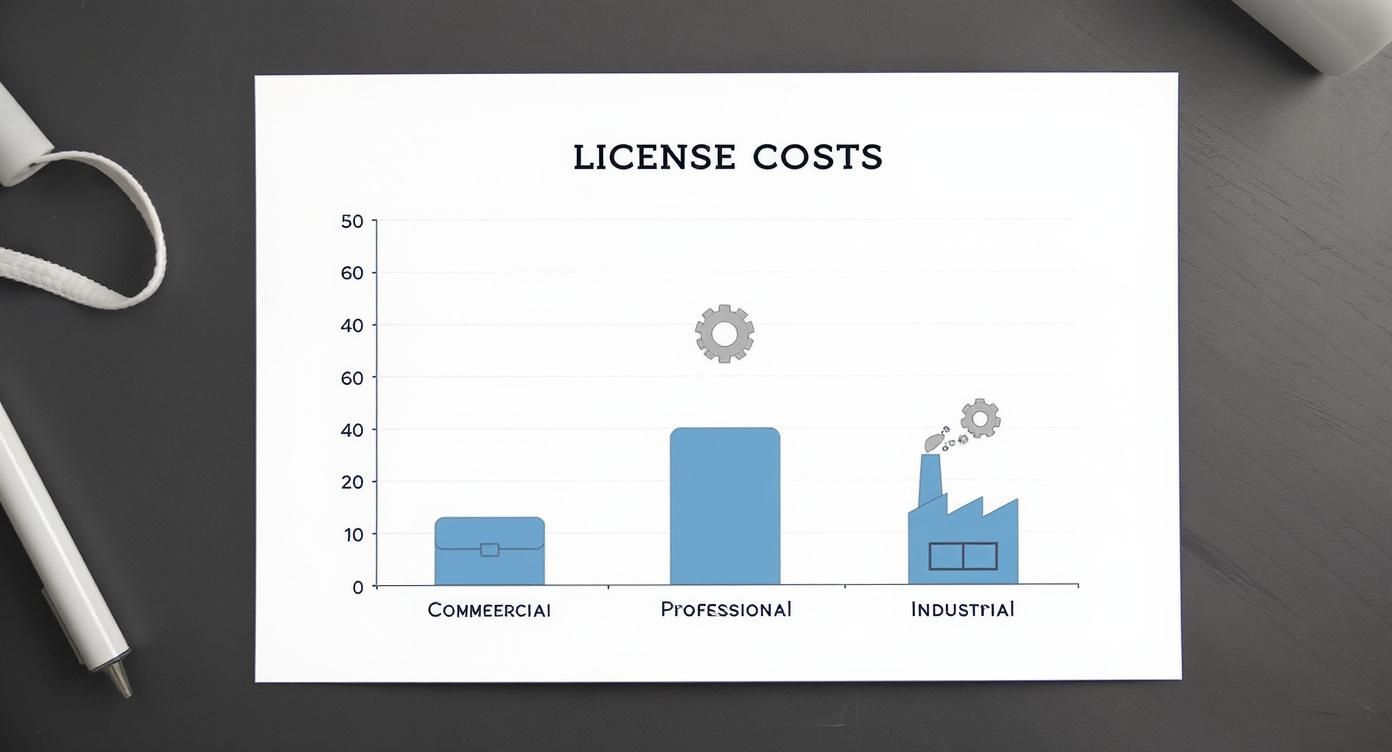

The following chart illustrates how the base costs for different license types vary, a key factor in both mainland and free zone calculations.

The data clearly shows that Industrial licenses carry the highest base cost due to greater regulatory oversight and infrastructure needs, while Commercial and Professional licenses are much more closely priced.

Key Insight: Your choice between mainland and free zone is the single biggest decision that will impact your total trade license cost. A free zone offers a lower entry point, making it ideal for startups and international businesses. A mainland setup, on the other hand, requires a larger upfront investment but grants you unrestricted access to the local UAE market.

Mapping Your Payment Timeline from Day One

Getting your head around what you’ll pay for a trade license is one thing, but knowing when you’ll pay is a whole different ball game. Budgeting for your Dubai business setup isn’t about writing one massive cheque. Instead, it’s a series of costs that pop up at different stages of the process.

Think of it like building a house. You don’t pay for the entire project upfront. You pay for the architectural plans first, then the foundation, then the framing, and so on. Your business setup follows a very similar phased payment structure, starting with smaller administrative fees and building up to the main license and visa costs.

Mapping this financial journey from day one is absolutely key to managing your cash flow and making sure you have the capital ready at each critical step.

Phase 1: Initial Setup Costs

This first phase is all about the foundational, one-time fees needed to get your application off the ground. These are typically the smaller payments that secure your business identity and legal groundwork. You’ll want to budget for these right at the very beginning of your journey.

Key costs you’ll encounter here include:

- Trade Name Reservation: This is the fee that secures your chosen business name with the relevant authority, whether that's the Department of Economy and Tourism (DET) or your chosen free zone. It’s the very first financial hurdle.

- Initial Approval Fee: Once your name is approved, you’ll pay for the initial approval. This is essentially the government giving a thumbs-up to your proposed business activity and company structure.

- Document Attestation and Legalisation: If you're a foreign investor, this part is crucial. Your personal and corporate documents (like passports or Memorandums of Association) often need to be legally translated, attested back in your home country, and then stamped again here in the UAE. Each one of those stamps comes with a fee.

Phase 2: Core Licence and Office Payments

With your initial approvals sorted, you’ll hit the most significant cluster of expenses. This is where the bulk of your upfront trade license Dubai cost is concentrated. These payments go to the government authority to officially issue your license and to secure your business premises.

This phase typically includes:

- Main Licence Issuance Fee: This is the big one—the primary government fee for your trade license, be it commercial, professional, or industrial. The final figure depends heavily on your jurisdiction and business activities.

- Office Lease or Flexi-Desk Payment: For mainland companies, this means paying the annual rent for your physical office space. If you’re going the free zone route, this is when you’d pay for your flexi-desk or virtual office package for the year.

Crucial Insight: The growth in Dubai's business scene has been nothing short of remarkable. With over 300,000 active licenses as of mid-2024, the demand for business services has soared. This has naturally influenced government fees and related setup costs over time, making a clear financial plan more important than ever. You can discover more insights about the increase in business registrations across the UAE on slg-strohallegalgroup.com.

Phase 3: Post-Licence and Visa Processing

License in hand, you’re on the home stretch! This final stage is about getting your company operational from an immigration standpoint. These are the last major payments you'll make during the initial setup.

Expenses in this final phase cover:

- Establishment Card Registration: This card officially registers your new company with the immigration authorities, which is the key that unlocks your ability to apply for visas.

- Investor and Employee Visa Fees: Each visa application comes with its own set of costs for medical tests, Emirates ID issuance, and the final visa stamping in the passport. This is a variable cost that scales directly with the number of people you bring on board.

Following this chronological roadmap helps you see every payment coming, turning what could be an overwhelming process into a clear and manageable financial plan.

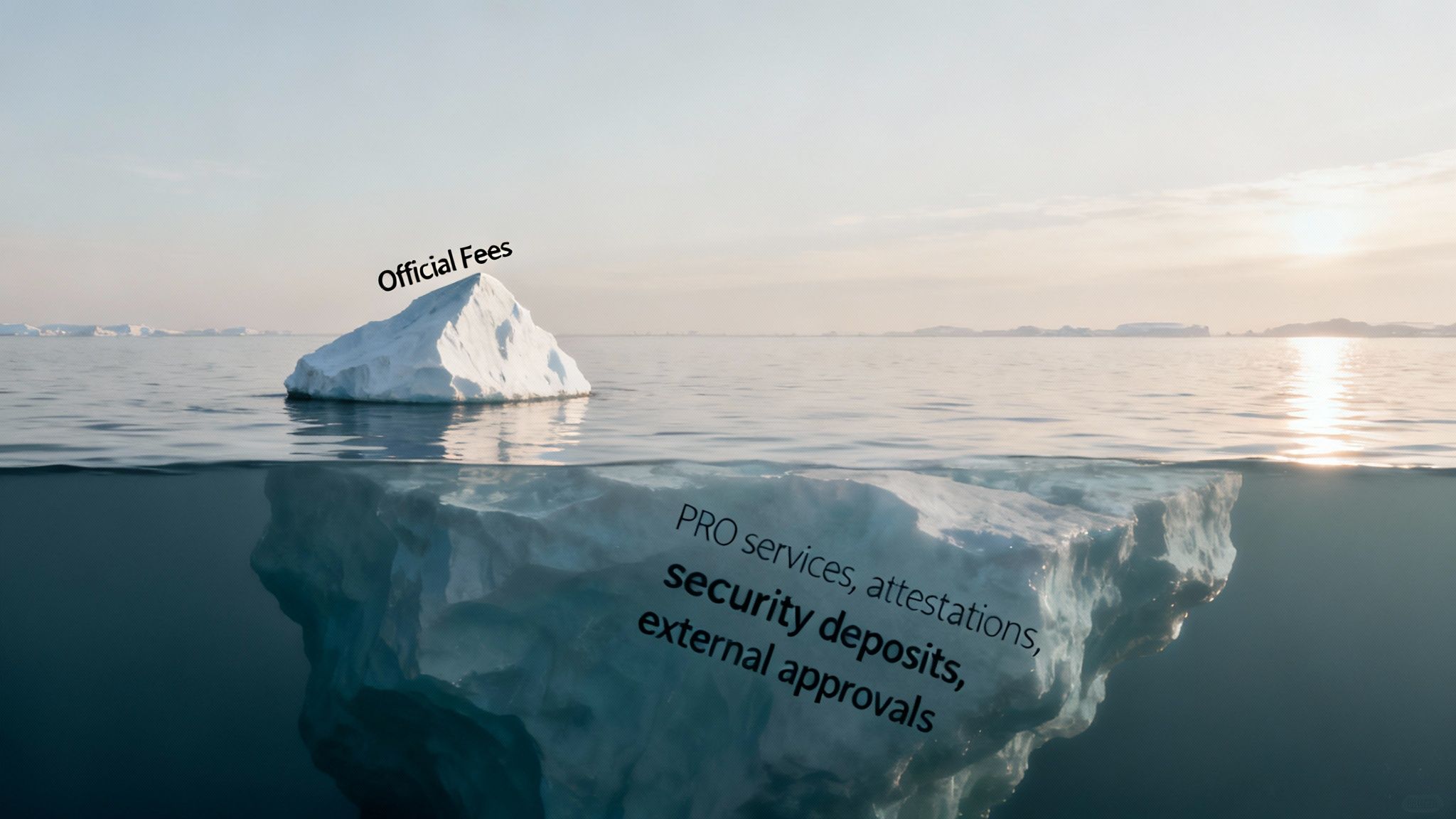

Uncovering the Hidden Costs of Setting Up

The official fee schedule for a Dubai trade license? That's just the starting point. It’s the tip of the iceberg, and what lies beneath can catch even seasoned entrepreneurs off guard. Many budget for the main government charges, only to be hit by a wave of unexpected expenses later on.

It’s a bit like booking a flight. You see a great fare, but by the time you’ve added seat selection, baggage, and other "essentials," the final price looks quite different. The final trade license Dubai cost works the same way, often ballooning with necessary extras that aren't advertised upfront.

Let's shine a light on these often-overlooked costs so you can build a truly realistic budget for your launch.

PRO Service Charges and Document Handling

One of the most common additions to the bill is for PRO (Public Relations Officer) services. Honestly, trying to navigate the various government departments, submit paperwork, and chase approvals yourself can be a full-time job. A professional PRO handles all that legwork, saving you a world of hassle but adding to your overall setup cost.

Then there's the paperwork itself. Any documents you bring from outside the UAE need to go through a formal process of translation and attestation.

- Legal Translation: If your official documents aren't in Arabic, they'll need to be legally translated. No exceptions.

- Attestation: Your personal and corporate documents must be stamped and certified, first by the UAE Embassy in your home country and then again by the Ministry of Foreign Affairs here in the UAE.

Each of these steps has its own fee, and they can add up quickly, especially if you have several partners or a more complex company structure.

External Approvals and Security Deposits

Depending on your business, you might need a green light from authorities beyond the Department of Economy and Tourism or your free zone. For instance, a restaurant needs clearance from the Food Control Department and Dubai Municipality. A logistics company needs approvals from the Roads and Transport Authority (RTA). Every one of these external approvals comes with its own fee.

A big one people forget is refundable security deposits. If you lease a physical office, your landlord will require a deposit. Similarly, some free zones or government bodies ask for a security deposit for certain activities or visa allocations, which ties up your capital.

Getting a handle on these potential expenses from day one is the key to avoiding budget blowouts. The smartest move you can make is to ask any business setup consultant for a complete, itemised quote that spells out every single one of these variables. That’s how you ensure there are no nasty financial surprises on your journey to launching in Dubai.

How to Lower Your Business Setup Expenses

Getting your dream business off the ground in Dubai doesn't have to mean emptying your pockets before you make your first sale. Yes, there are government fees you can't avoid, but a smart strategy can dramatically cut your initial costs. Making the right choices from day one can save you thousands, freeing up capital to invest in growing your business, not just setting it up.

It’s not about cutting corners that matter. It's about understanding how the system works and making it work for your budget. By thinking carefully about your jurisdiction, office needs, and visa allocation, you can build a lean, efficient foundation for your new company. This is easily one of the smartest first steps any entrepreneur can take when looking at their trade license Dubai cost.

Choose Your Location Wisely

Where you choose to set up your business is single-handedly the biggest factor affecting your setup costs. While the mainland has its perks, taking the time to explore different free zones can unlock some serious savings.

Don't assume all free zones are the same. Some are tailored for specific industries and roll out the red carpet for startups with incredibly competitive packages. Do your homework. Look for free zones that offer multi-year license deals at a discount or have lower initial registration fees. The goal is to find a zone that aligns with your business activity and offers the best overall value, not just the cheapest sticker price.

Rethink Your Office Space

For most new ventures, a traditional physical office is an expensive and often unnecessary burden. The shift towards flexible work solutions is a massive win for entrepreneurs trying to keep a lid on their expenses.

- Flexi-Desk or Virtual Office: This is usually the most budget-friendly route, especially in a free zone. It gives you a legitimate business address and access to meeting rooms without the eye-watering cost of a long-term lease.

- Co-working Spaces: Perfect for networking and collaboration, these spaces keep your initial and monthly costs predictable and low.

A new consultant could save upwards of AED 25,000 in their first year alone simply by choosing a flexi-desk over a small physical office. That one decision turns a huge capital expense into a small, manageable operational cost.

Consolidate and Plan Ahead

Getting strategic with the fine print of your license and thinking long-term can also uncover hidden savings. Don't just tick the standard boxes; see how you can optimise the setup.

A great tactic is to bundle multiple, related business activities under a single license whenever the rules allow. This move alone can save you from paying for several different licenses to cover your range of services. Also, make it a point to ask about multi-year license packages. Many authorities offer 10-15% discounts for founders who pay for two or three years upfront, which locks in your rate and cuts down on your annual admin work.

Finally, be honest about your immediate visa requirements. Don't pay for a huge visa allocation you won't touch in your first year. Start with the essentials and simply upgrade your package as your team grows. This kind of careful planning ensures you're only paying for what you need right now, keeping your initial trade license Dubai cost as lean as possible.

Answering Your Top Questions on License Costs

As you move from big-picture budgeting to the nitty-gritty details, a lot of specific questions about the trade license Dubai cost tend to pop up. This is a crucial step, and getting clear answers can make all the difference. We’ve been there with countless entrepreneurs, so let's tackle the questions we hear most often.

Think of this as moving beyond vague estimates to get the practical clarity you need to finalise your financial game plan. Nailing these details helps you make smarter choices, sidestep common traps, and build a budget that's both realistic and ready for anything.

Can You Get a Dubai Trade License Without an Office?

Yes, absolutely. In fact, it’s one of the smartest ways for new businesses to keep initial costs down. The secret lies in picking the right jurisdiction, and free zones are usually the go-to for this. Most are specifically set up to help startups and international entrepreneurs with flexible, budget-friendly options.

Instead of locking yourself into a pricey annual office lease, you can go for a flexi-desk or a virtual office package. This ticks the legal box for a registered business address but costs just a fraction of a physical space, making it a perfect fit for consultants, freelancers, and service-based businesses. While some mainland professional licenses have similar flexibility, it’s worth remembering that most commercial trading on the mainland still demands a proper physical office lease.

What Is the Average Annual Renewal Fee?

Here’s some good news for your long-term planning: your annual renewal fee is almost always less than what you paid for the initial setup. You can generally expect your renewal to be around 80-90% of your first year's total cost. The main reason for the drop is that a lot of the initial fees are one-time-only.

For instance, things like document attestation, legal translation, and those first government approval fees won't show up again. But you absolutely must budget for the recurring costs that keep your business compliant.

These will include:

- The core license fee.

- The renewal for your company's Establishment Card.

- Your annual office lease or flexi-desk package fees.

- Any sponsorship or local service agent fees, if they apply to your setup.

It’s much healthier to think of your license as a subscription rather than a one-off purchase. This mindset helps you manage your finances much more effectively, year after year.

Crucial Tip: A classic mistake we see is people forgetting about renewal costs when they calculate their total investment. Always, always factor in these recurring fees to get a true picture of what it really costs to run your business in Dubai long-term.

Is a Mainland Licence Always More Expensive?

Not necessarily, and this is where you need to put your long-term thinking cap on. A mainland setup often comes with a higher price tag upfront, mostly because of that mandatory physical office lease. However, that doesn't automatically make it the more expensive choice over the years.

Some free zone packages can look incredibly cheap at first glance, but you have to read the fine print on their annual renewal fees and any operational limits. A basic free zone package might be a low-cost entry point, but the only way to know the true value is to compare the total cost over a two or three-year period. This is how you figure out which jurisdiction really offers the best value and freedom for your specific business.

Ready to navigate the costs and complexities of your Dubai business setup with confidence? The expert team at Al Ain Business Center provides transparent, all-inclusive packages that eliminate hidden fees and streamline the entire process. Start your journey with a free consultation today!