Getting an e-commerce license in the UAE is your non-negotiable first step to launching a legitimate online store. Think of it less as a bureaucratic hurdle and more as your key to unlocking the full potential of your business, from opening corporate bank accounts to integrating with trusted payment gateways.

Why Your Online Store Needs a UAE E-commerce License

Trying to dive into the UAE's buzzing digital marketplace without the proper legal setup is a massive gamble. An e-commerce license isn't just a piece of paper; it's what makes your business real in the eyes of the government, banks, and—most importantly—your customers.

Operating without one can land you in serious trouble, with hefty fines and even the blacklisting of your business activities. A proper license shows you're committed to doing things right, building a foundation of trust that is absolutely essential if you want to be around for the long haul.

Unlocking Essential Business Functions

With a valid e-commerce license in the UAE, you suddenly get access to critical business tools. You can officially open a corporate bank account, which is vital for managing your finances professionally and keeping everything above board. Trying to run business funds through a personal account is a huge red flag for auditors and looks unprofessional to partners and suppliers.

On top of that, reputable payment gateway providers in the region, like Telr or PayTabs, won't even talk to you without a valid trade license. Getting licensed means you can offer your customers secure, familiar ways to pay, which directly impacts your store’s credibility and sales.

Securing a license is the first step in building a legitimate and trustworthy brand. It signals to customers that your business is stable, secure, and compliant with local consumer protection laws.

Fuelling a Thriving Digital Economy

The UAE government is actively nurturing the digital economy with a clear, supportive licensing framework. To get your e-commerce business off the ground, you'll need a specific license from either a mainland Department of Economic Development (DED) or one of the specialised free zones.

This very structure has fuelled incredible growth. The UAE's e-commerce market hit a valuation of USD 11.05 billion in 2025 and is on track to skyrocket to USD 20.54 billion by 2030. This framework also ensures you’re playing by the rules that protect consumers.

Once your online store is legally set up, you can shift your focus to what really matters: making sales. This is where you can start digging into things like strategies for improving e-commerce conversion rates. For a complete walkthrough of getting started, our guide on setting up an online business in Dubai has a ton of extra insights.

Choosing Your Jurisdiction: Mainland vs. Free Zone

Right out of the gate, you’ll face a foundational decision for your UAE e-commerce venture: where to set up shop. This isn't just about picking a location; it's a strategic choice between a mainland and a free zone jurisdiction. This decision shapes everything from who you can sell to and your ownership structure to your day-to-day operational rules. Think of it as the blueprint for your entire online business.

Let’s bring this to life with an example. Say you're launching a boutique brand selling handcrafted leather goods, and your dream customers are wandering the malls of Dubai and Abu Dhabi. You even have plans for a small physical kiosk down the line. A mainland licence, issued by the Department of Economic Development (DED), is your best bet here. It gives you the freedom to trade directly with any customer across the UAE, no middleman required.

Now, flip the script. Imagine your business is all about sourcing electronics from Asia and shipping them out to customers worldwide. In this case, a free zone is practically built for you. A specialised hub like Dubai CommerCity offers game-changing perks like 100% foreign ownership, zero import/export taxes, and the ability to send all your profits home. It’s an ecosystem designed for global trade.

How Your Day-to-Day Operations Change

The practical differences between mainland and free zone setups are significant. A mainland company often means you'll need a physical office space registered with Ejari, which is an added overhead. Free zones, on the other hand, are known for their flexible and budget-friendly options, like flexi-desks or virtual office packages that tick the legal boxes without the hefty price tag.

Visa eligibility is another point to consider. Both jurisdictions let you sponsor employees, but the number of visas you can get is often tied to your office size or the specific package you choose.

The key takeaway here isn't just about the initial setup cost. It's about matching your licence to your business model. Mainland is for direct, boots-on-the-ground access to the local UAE market. A free zone is your launchpad for international and B2B e-commerce.

The Financial and Regulatory Landscape

As you'd expect, costs and red tape differ quite a bit. A mainland licence generally involves more administrative legwork and can have higher upfront costs, often landing in the AED 15,000 to AED 25,000 range. The renewal process and ongoing compliance can also feel a bit more involved.

Free zones often bundle their services into straightforward packages, with some starting as low as AED 5,750. These all-in-one deals frequently cover your licence, establishment card, and even a shared workspace, making them incredibly appealing for startups and solo entrepreneurs.

To help you see the differences more clearly, here’s a direct comparison:

Mainland vs. Free Zone E-commerce Licence: A Head-to-Head Comparison

| Feature | Mainland (DED Licence) | Free Zone Licence |

|---|---|---|

| Market Access | Unrestricted trade across the entire UAE; can open physical shops. | Primarily for trade within the free zone and internationally; requires a distributor for mainland sales. |

| Ownership | Typically requires a local UAE national partner (though 100% foreign ownership is now possible for many activities). | 100% foreign ownership is standard. |

| Office Requirement | A physical office space with an Ejari registration is usually mandatory. | Flexible options like virtual offices and flexi-desks are widely available. |

| Initial Cost | Generally higher, from AED 15,000 to AED 25,000. | More affordable, with packages starting around AED 5,750. |

| Customs Duty | 5% customs duty is applicable on imported goods. | 0% customs duty on imports and exports within the free zone. |

| Visa Eligibility | Usually linked to the size of your physical office space. | Determined by the licence package you select. |

Choosing the right path depends entirely on your business goals. For a deeper dive into this topic, our guide on free zone vs mainland in Dubai breaks it down even further.

The UAE's e-commerce ecosystem is booming, with over 45,000 online stores now up and running. This incredible growth has pushed the market's value to $11.01 million in 2023, with forecasts hitting $23.62 million by 2032. You can explore more about UAE e-commerce statistics and trends to see the opportunity. Whether you go for a DED or a free zone licence, you're stepping into a well-regulated and rapidly expanding market.

Ultimately, your decision should come down to answering these four simple questions:

- Target Market: Are you selling locally within the UAE or to a global audience?

- Ownership: Is having 100% foreign ownership a non-negotiable for you?

- Budget: Do you prefer lower startup costs, or are you willing to invest more for broader market access?

- Physical Presence: Do you need a proper office, or is a virtual setup enough for now?

Once you have clarity on these points, you'll know exactly which jurisdiction is the right foundation for your e-commerce licence in the UAE.

How to Secure Your E Commerce License

Alright, you've weighed your options between a mainland and free zone setup. Now for the exciting part: actually bringing your company to life. This is where we get into the nuts and bolts of forming your business, from picking a legal structure and reserving your trade name to gathering the right paperwork and finally, submitting your application.

Think of this phase as building the legal foundation for your online store. It all starts with choosing your legal structure. Are you going it alone? A Sole Establishment might be the simplest path. But if you have partners or want to protect your personal assets as the business grows, a Limited Liability Company (LLC) is often the smarter, more popular choice.

Defining Your Business Identity and Activities

Before you even think about paperwork, you need a name. Your trade name has to be unique and compliant with UAE standards – that means it can't already be taken, it shouldn't violate public morals, and it should give a clear idea of what you do. You can check for available names and reserve your favourite through the economic department's portal or the specific free zone authority you're working with.

At the same time, you need to be crystal clear about your business activities. It's not enough to just say "e-commerce." You'll need to specify if you're in general trading or something more niche, like "E-commerce trading of apparel" or "Online sale of electronics." This decision is critical because it shapes the approvals you'll need and sets the legal boundaries for your operations.

I've seen so many people get stuck here. A common mistake is picking a name that's too generic or, even worse, one that accidentally infringes on an existing trademark. Do yourself a favour: run a thorough search and have a few backup names ready to go. A little bit of foresight can save you weeks of frustrating delays.

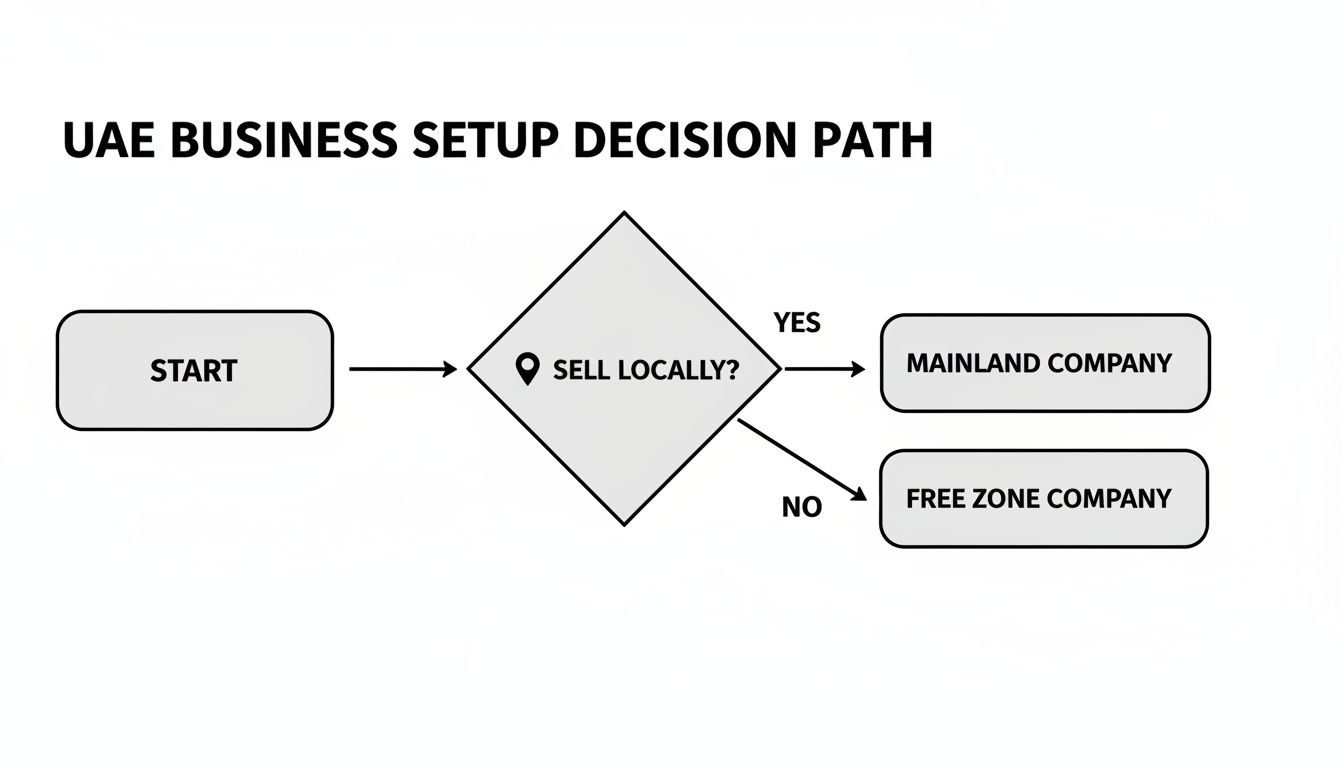

The choice of where to set up is a massive fork in the road, as this chart clearly shows. It boils down to one simple question.

The flowchart simplifies the core decision: who are you selling to? If you want to sell directly to customers across the UAE, a mainland license is your most direct route. If your focus is more on international trade, a free zone is built for that.

Assembling Your Application Package

With your name secured and activities defined, it's time to gather your documents. This is where being meticulous pays off. The exact list can vary a bit depending on your chosen jurisdiction, but the core requirements are pretty standard across the board.

You’ll generally need to have these ready:

- Passport Copies for every shareholder and the person you've appointed as manager.

- Visa Status Information, which could be entry stamps or copies of any existing residence visas.

- A Completed Application Form from the right authority (the DED for mainland or your chosen free zone).

- A Concise Business Plan that lays out your e-commerce model, target audience, and some basic financial projections.

If you’re setting up an LLC on the mainland, you'll also have to get a Memorandum of Association (MOA) drafted and notarised. This is the legal document that defines your business objectives, share capital, and the roles of each partner. Many free zones make this part easier with standardised templates. For anyone new to this, understanding the bigger picture of how to get a trade license in Dubai provides some really helpful context for this whole procedure.

Submitting and Finalising Your License

Once you've got your document package in order, you’ll submit it for initial approval. This is a key checkpoint where the authorities give your proposed business a once-over to ensure it ticks all the regulatory boxes. After you get the green light, you’ll likely need to secure an office space – this means getting an Ejari for a mainland setup or a flexi-desk contract in a free zone.

The last hurdle is paying the government fees and submitting all your final documents, including that lease agreement. After one last review, the authorities will issue your official e-commerce license. With that license in hand, your business is officially legal. Now you can finally open a corporate bank account, apply for visas, and get ready to launch your store to the world.

So, What Will This Actually Cost You? A Look at Fees and Timelines

Let's talk numbers. To get your e-commerce venture off the ground smoothly, you need a realistic grip on your budget and timeline right from the start. Knowing what to expect financially and how long things will take avoids those nasty surprises down the road and lets you map out your launch with confidence.

The total cost isn't just one lump sum; it's a mix of initial, one-time fees and ongoing annual expenses. Your first big spend will be getting the company officially formed and on the books.

One-Time Setup Costs

Think of these as your launch day expenses—the essential fees to get your business legally registered and ready for action.

- Trade Name Reservation: This is your first official move. Setting aside your chosen business name will typically run you between AED 1,000 and AED 2,000.

- Initial Approval: Before you get the final license, the authorities need to give your business activity and structure the green light. This is a standard administrative fee wrapped into the setup package.

- License Issuance: This is the big one—the main government fee for the license itself. If you're going for a mainland setup, this can bring the total initial cost to somewhere between AED 15,000 and AED 25,000. On the other hand, many free zones are incredibly competitive, with starter packages from as low as AED 5,750.

A classic mistake I see new entrepreneurs make is underbudgeting for these initial government fees. It's always smart to budget for the higher end of the estimated range. This gives you a crucial financial cushion for any unexpected admin charges or small tweaks you might need to make during the application.

Recurring Annual Expenses

Once you're set up, you need to think about the ongoing costs required to keep your license active and your business compliant. These are the operational costs that will pop up on your books every single year.

These include:

- License Renewal: Your e-commerce license isn't a one-and-done deal; it needs to be renewed annually. The fee is usually in the same ballpark as the initial issuance cost, sometimes a little less.

- Office Space or Flexi-Desk: A mainland license almost always demands a physical office, which can mean significant rental costs. Free zones, however, offer much more budget-friendly options like flexi-desks or virtual offices, often costing between AED 2,000 to AED 4,000 a year.

- Visa Fees: If you or your employees need a residency visa, each one comes with its own issuance and renewal costs. You can expect to pay between AED 3,500 and AED 7,000 per visa.

How Long Does It Take to Get the License?

When you're launching a business, time is just as precious as money. The time it takes to get your e-commerce license in hand can vary quite a bit depending on where you set up.

If you go with a streamlined free zone like IFZA or SPC Free Zone, you could have your license in just a few business days. They’re built for speed.

A mainland license, however, tends to be a bit more of a marathon. You're typically looking at a timeline of one to three weeks. This is because there are more hoops to jump through, like getting potential external approvals and registering your physical office lease with Ejari. Factoring these timelines into your plan is key to setting a launch date for your online store that you can actually hit.

Staying Compliant After You Get Your License

Getting your e commerce license UAE is a massive milestone. It's a huge win, but honestly, it’s just the starting line, not the finish. The real work begins now, shifting from the one-time setup process to the daily discipline of running a legal, sustainable operation.

Your very first move should be opening a corporate bank account. This isn't just a suggestion; it’s non-negotiable for professional financial management and keeping your bookkeeping clean from day one.

From there, you’ll need to get intimately familiar with the UAE's tax landscape. Keep a close watch on your revenue, because once your annual turnover hits the mandatory threshold of AED 375,000, you are legally required to register for Value Added Tax (VAT) with the Federal Tax Authority (FTA).

Navigating VAT and Consumer Rights

Being VAT compliant is more than just a one-off registration. It means issuing proper tax invoices for your sales, keeping meticulous records of every transaction (both sales and expenses), and filing your VAT returns on time, which is typically done quarterly. Getting this wrong can lead to some hefty penalties, so it's smart to look into accounting software or get professional advice early in the game.

At the same time, you need to operate squarely within UAE consumer protection laws. This isn't just about dodging fines; it’s about building a brand that customers genuinely trust. Your focus should be on:

- Clear Policies: Your terms for returns, refunds, and exchanges must be completely transparent and easy for a customer to find on your website. No hidden clauses.

- Accurate Descriptions: All your product information, from specs to pricing, has to be truthful. Misleading customers is a quick way to ruin your reputation.

- Secure Transactions: You are fully responsible for protecting customer payment details. This means using secure, compliant, and trusted payment gateways.

I always tell my clients that adhering to these standards is their best marketing tool. In a crowded digital market, a reputation for being reliable and fair is what creates loyal customers who feel safe shopping with you. That directly fuels your long-term success.

Protecting Customer Data

Data privacy is another critical pillar you can't ignore. How you collect, store, and use your customers' information is under a microscope. You must have a crystal-clear privacy policy and ensure all that data is handled securely to prevent any breaches.

And it doesn't just stop at local regulations. If you plan on marketing to customers outside the UAE, you’ve got to get up to speed on global standards. For instance, understanding the principles behind GDPR email compliance is vital for staying on the right side of the law and building that all-important trust, especially when handling international data.

This robust regulatory framework is precisely what gives consumers the confidence to shop online, fuelling the market's incredible growth. The UAE's e-commerce sector is projected to climb from $8.8 billion in 2024 to a massive $13.8 billion by 2029. That surge is built on the back of licensed, compliant businesses like yours that make digital payments feel seamless and secure. Your commitment to compliance isn't just a legal chore; it's a direct contribution to this trusted ecosystem.

Common Questions About UAE E Commerce Licenses

When you're diving into setting up an e-commerce business, it’s natural for a few key questions to pop up again and again. Getting straightforward answers is the best way to move forward with confidence and sidestep those common mistakes that can put your launch on hold.

Here are some of the most frequent queries we get from entrepreneurs just like you.

Can I Run an E Commerce Business in the UAE Without a License?

Let's be crystal clear: the answer is a firm no. In the UAE, running any kind of commercial business, even one that's purely online, is illegal without a proper trade license.

Trying to fly under the radar can bring serious trouble. We're talking substantial fines, getting your business activities blacklisted, and other legal headaches you really don't want. Securing a uae e commerce license isn't just a formality—it's the only way to operate legally and build a legitimate, sustainable business.

Do I Need a Physical Office for an E Commerce License?

This is a classic question, and the answer really hinges on where you decide to set up—your jurisdiction.

If you go for a mainland license, the answer is almost always yes. You'll need a physical office address registered with Ejari, which obviously adds a significant cost to your initial setup.

This is where free zones really shine for online businesses. Most are built with flexibility and cost-efficiency in mind, offering solutions like flexi-desks or virtual office packages. These options tick the legal box for a registered address without the hefty price tag of a traditional office lease, making them a perfect fit for startups.

A common misconception is that "online" means no physical address is needed. In the UAE, every licensed company must have a registered address. The key is choosing a jurisdiction that offers a solution matching your budget and operational needs.

What Is the Difference Between an E Trader and E Commerce License?

It's easy to mix these two up, but they serve very different purposes.

Think of an E-trader license as more of a permit for individuals. It’s designed for UAE and GCC nationals, or certain residents, to run a small-scale business from home, usually through social media channels like Instagram. It comes with some pretty strict limits—for example, you can't hire staff or open a corporate bank account.

An e-commerce license, on the other hand, establishes a formal company. It gives you the power to sponsor employee visas, hire a team, and scale your business without any of those restrictions. For any serious e-commerce venture, this is the proper and necessary path to take.

Ready to navigate the licensing process without the guesswork? The expert team at Al Ain Business Center provides end-to-end support to get your e-commerce business launched quickly and correctly. Start your journey with a free consultation at https://alainbcenter.com.