Trying to pin down the exact Dubai free zone license cost can feel like hitting a moving target, but a good ballpark figure to start with is anywhere between AED 12,000 to AED 50,000. This initial investment gets your basic setup off the ground, but the final bill will really depend on your specific business activity, how many visas you need, and which free zone you choose. Think of it as a base price that gets tailored to your unique business journey.

Understanding Your Initial Investment

Figuring out your free zone license cost is less about finding a single price tag and more about building a package that fits your needs. The initial figure you see advertised is often just the starting point. Several key factors will nudge that number up or down, making sure the setup is perfectly aligned with what you actually need to operate.

The biggest factor? The core of your business—its activity. A simple professional services or consultancy license will almost always cost less than a specialised trading or e-commerce license that involves handling physical goods. The complexity and regulatory oversight tied to your chosen field directly shape the fees.

Core Cost Components

Your final cost is a sum of several essential parts. Getting a handle on these components helps you see exactly where your money is going and why the price can vary so much between different setups. The most common elements include:

- License Fee: This is the main annual charge that gives you the legal right to operate your business within a specific free zone. The cost is determined by your business activities.

- Registration Fee: A one-time payment to register your company name and formally establish your business with the free zone authority.

- Office or Desk Space: Every free zone requires you to have a physical presence. Options can range from an affordable flexi-desk to a dedicated private office, each with a different price point.

- Visa Allocation: The number of residence visas you need for yourself and any employees significantly affects the total cost, as each visa comes with its own processing fees.

To give you an idea, the average cost to get a business license in a Dubai free zone typically falls between AED 12,000 and over AED 50,000. This variation is down to the bundled service packages that combine the license, visa allocations, and office options into streamlined, cost-effective setups.

To really get a feel for how these fees stack up, you can find more insights about business license costs right here.

The real cost isn't just the license itself; it's the complete package that allows your business to operate legally and efficiently in the UAE. This covers your right to work, a physical address, and official recognition by government bodies.

To get a complete picture, it's also helpful to see how these expenses compare to other setups. For instance, while free zones are a brilliant platform for many businesses, you can learn about the specifics of a different license type in our guide on the Dubai trading license cost. This kind of comparison helps you make a fully informed decision about the best path for your company’s launch and long-term growth.

Quick Breakdown of Dubai Free Zone License Cost Components

To make it even clearer, here's a table summarizing the primary cost factors that influence the total price of your Dubai free zone license.

| Cost Component | Typical Price Range (AED) | What It Covers |

|---|---|---|

| Annual License Fee | 5,000 – 20,000+ | The legal right to conduct your specific business activities within the free zone. |

| One-Time Registration Fee | 3,000 – 10,000 | The initial setup and formal registration of your company with the authority. |

| Office/Facility Lease | 5,000 – 30,000+ (Annual) | Your physical presence, from a flexi-desk to a full private office. |

| Establishment Card | 1,500 – 2,500 | A mandatory card that allows your company to apply for employee visas. |

| Per-Visa Fees | 3,000 – 6,000 (per visa) | The cost for processing each residence visa for owners and employees. |

This table provides a snapshot of the individual pieces that come together to form your total investment. Keep in mind that these are estimates, and the final costs will depend on the specific free zone and package you select.

Deconstructing Your Free Zone Invoice: A Line-by-Line Guide

Getting your first invoice for a Dubai free zone license can be a bit overwhelming. It often looks like a long, confusing list of charges, and it's natural to wonder what exactly you're paying for.

Think of it like getting a detailed quote from a builder for your new house—every part has a specific purpose and price. Getting to grips with these components is absolutely essential for accurate budgeting and making sure there are no nasty financial surprises waiting for you down the line.

Let's pull apart this document and look at each core component you're almost certain to see. We can group these costs into two main buckets: one-time setup charges and recurring annual fees. Together, they make up your total initial investment.

One-Time Setup and Registration Fees

Before you can even think about your annual license, you have to formally bring your company into existence within the free zone. This means paying a few initial, one-off fees that lay the groundwork for your entire business.

- Registration Fee: This is the administrative charge for getting your company's legal structure officially on the books with the free zone authority. It's the foundational cost that makes your business a recognised legal entity in that specific jurisdiction.

- Trade Name Reservation Fee: Your company name is a huge part of your brand identity. This fee locks it in, securing it exclusively for your use within that free zone. The authorities will check to make sure your chosen name is unique and ticks all the boxes according to UAE naming rules.

These upfront fees are the very first step, getting your company on the official register. You'll only pay them once, right at the start of your journey.

The Annual License Fee Explained

The biggest recurring expense on your invoice will be the annual license fee. This is the heart of your Dubai free zone license cost. It’s what gives your company the legal green light to carry out its specific business activities for one full year.

The amount you pay is directly linked to what your business actually does. For instance, a simple professional services license for a consultant will almost always be cheaper than a general trading license that allows for importing and exporting a massive range of products. The more complex or heavily regulated your business activity, the higher this fee tends to climb.

You can think of the annual license fee as your company's subscription to operate legally within the free zone. It covers your right to do business and tap into the zone's infrastructure and benefits for the next 12 months.

Essential Supporting Fees

Beyond the main license, a couple of other mandatory items will pop up on your invoice. These aren't optional add-ons; they're critical pieces of the puzzle needed for your company to operate and, importantly, sponsor employees.

- Establishment Card: This is one of the most vital documents you’ll receive. The establishment card acts as your company's official link to the immigration and labour departments (GDRFA and MOHRE). Without it, you simply cannot apply for residence visas for yourself, your partners, or any staff you hire. It's a small card with a huge responsibility, usually costing between AED 1,500 and AED 2,500.

- Visa Processing and Associated Costs: If your business setup package includes residence visas, you'll see line items for processing them. This fee covers the initial application, but keep in mind it doesn’t include the follow-up costs for each individual's medical tests and Emirates ID application. Those are paid separately later on during the final visa stamping stage.

When you're breaking down the costs on your setup invoice, it’s vital to account for every single charge. For a wider view on how these costs compare in different scenarios, you can get more insights by understanding company incorporation fees in other jurisdictions. By taking the time to familiarise yourself with each line item, you turn a confusing invoice into a clear roadmap of your investment, making sure you’re fully prepared for what it takes to launch your business in Dubai.

How License Costs Compare Across Top Dubai Free Zones

Choosing a free zone in Dubai is a bit like picking a neighbourhood to live in. Each one has its own unique character, community, and, of course, price tag. While they all offer those headline benefits of 100% foreign ownership and significant tax advantages, the actual Dubai free zone license cost can swing wildly from one zone to the next, reflecting what they specialise in and who they're trying to attract.

Getting a handle on these differences is the key to finding the perfect home for your business—one that fits your operations and your budget. Some zones are premium, industry-specific powerhouses, while others are built to offer incredible value for startups and smaller companies.

Let's break them down.

Premium Industry-Specific Hubs: DMCC and DAFZA

Think of zones like the Dubai Multi Commodities Centre (DMCC) and the Dubai Airport Free Zone Authority (DAFZA) as the prestigious "downtown" districts of the free zone world. They're highly regulated, packed with global players, and built around very specific, powerful industries.

- Dubai Multi Commodities Centre (DMCC): Just as the name implies, DMCC is the global epicentre for commodities trading—everything from gold and diamonds to tea and coffee. A license here isn't just a piece of paper; it carries real weight and prestige. The cost reflects this, with starting packages often beginning around AED 30,000 to AED 50,000. For that premium, you get access to world-class trading infrastructure and a network of over 21,000 companies.

- Dubai Airport Free Zone Authority (DAFZA): Situated right next to one of the planet's busiest airports, DAFZA is the go-to for businesses in logistics, aviation, and high-value import-export. Its unbeatable location and top-tier facilities come at a cost, with license packages typically starting higher than average. You’re essentially paying for unparalleled connectivity and operational speed.

With these zones, you're not just buying a license; you're embedding your business right into the heart of a powerful, industry-specific ecosystem.

Versatile and Popular All-Rounders: IFZA

If DMCC is the financial district, then think of the International Free Zone Authority (IFZA) as the vibrant, mixed-use community that appeals to just about everyone. It’s become one of the most popular and flexible options for good reason.

IFZA has built its reputation on competitive pricing, a remarkably quick setup process, and a massive list of approved business activities. This makes it an absolutely fantastic choice for consultancies, service-based companies, and general trading businesses that don't need heavy industrial infrastructure.

The real draw for IFZA is its focus on value. License packages are often bundled with multiple visas and flexi-desk options, creating a highly attractive, all-in-one solution for entrepreneurs and SMEs. Starting costs are typically in the AED 15,000 to AED 25,000 range.

Cost-Effective and Emerging Hubs: SPC Free Zone

For startups and entrepreneurs where every single dirham counts, emerging hubs like Sharjah Publishing City (SPC) Free Zone offer some of the most competitive license costs in the entire UAE. And while it's technically in Sharjah, its close proximity to Dubai and incredibly simple setup make it a top contender.

Free zones across Dubai and its neighbouring Emirates are the engine of the UAE's economic diversification, fuelling the growth of non-oil sectors. Official data shows that free zones account for a massive 41% of all new business registrations in Dubai, proving just how vital they are. As this Gulf News report highlights, zones like SPC are leading the charge by offering cost-efficient licensing that can cover over 1,500 activities under one license with zero corporate tax.

SPC's packages can start as low as AED 12,000, making it one of the most budget-friendly gateways available. This affordability, combined with the flexibility to bundle thousands of activities on one license, is a game-changer for new businesses. For anyone looking for the absolute most economical entry point, our guide on the cheapest free zone in UAE provides an even more detailed breakdown.

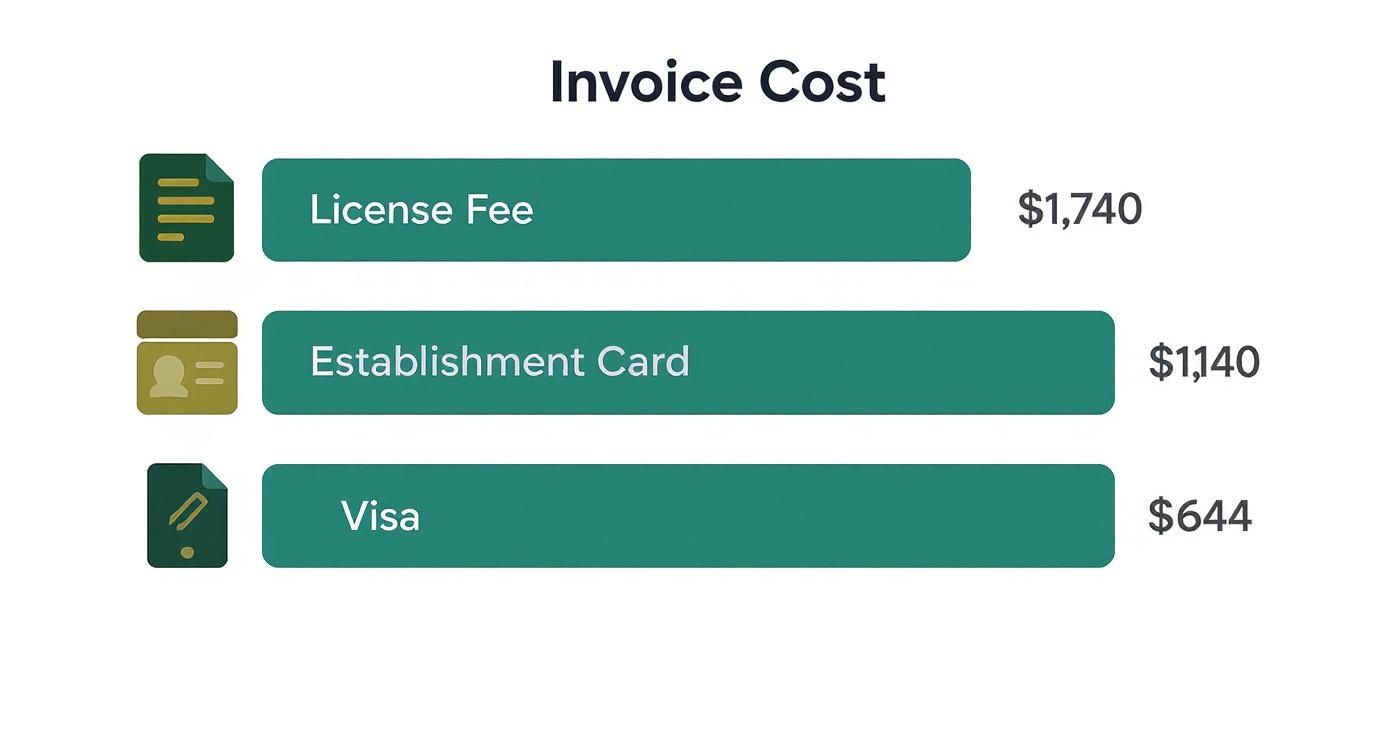

Looking at an invoice helps you see how these costs break down. The main components are typically the license itself, the establishment card, and the visa fees.

As you can see, the annual license fee is often the largest single expense, followed closely by the establishment card and individual visa processing charges.

Ultimately, the "best" free zone isn't about finding the cheapest or the most expensive one. It’s about finding the one that delivers the most value for your specific business. By comparing these top contenders, you can look beyond the price tag and choose a jurisdiction that will actively support your company's growth for years to come.

Uncovering Hidden Costs in Your Business Setup Budget

The advertised price for a Dubai free zone package is a great starting point, but it rarely tells the whole story. Think of it like buying a base model car; the sticker price looks fantastic, but the final cost climbs once you add all the features you actually need. Your total investment for setting up a business will almost always include critical expenses that aren't highlighted in that initial quote.

Getting a handle on these "hidden" costs is the key to creating a budget that works. If you overlook them, you could face serious cash flow problems right when your new business needs stability the most. Planning for these extra expenses from the get-go will make your launch much smoother and far more predictable.

Professional and Consultancy Fees

Trying to navigate the maze of paperwork and legal steps for company formation can be overwhelming, especially if you're new to the UAE. This is exactly where business setup consultants prove their worth.

While their fees are an extra line item on your budget, the value they bring is immense. These pros handle everything from submitting documents to communicating with government authorities, which saves you a ton of time and helps you avoid expensive mistakes. It's best to think of their fee, which will vary depending on how complex your setup is, as a necessary part of your startup investment.

Mandatory Insurance and Document Legalisation

Once you have your license, a few other immediate costs pop up, mostly related to visas and legal compliance. These aren't optional—they're required for you and any staff you plan to hire.

- Mandatory Health Insurance: In Dubai, it's the law for every single visa holder to have valid health insurance. This is an annual, recurring cost for yourself and for each employee you sponsor, so it must be factored into your yearly operational budget.

- Document Attestation: Your personal and academic documents, like university degrees or marriage certificates, will almost certainly need to be attested. This is a multi-stage process involving verification in your home country and then by the UAE Ministry of Foreign Affairs, and each stamp along the way comes with a fee.

Think of these costs as the necessary compliance checks that legitimise your presence and operations in the UAE. They are the foundational steps that transform your business from an idea on paper into a fully functional and legally sound entity.

Ongoing and Operational Expenses

Beyond the one-time setup charges, several other expenses can surface during your first year and continue annually. Knowing about these helps you paint a much more complete financial picture. A crucial step here is learning how to create an effective business budget that accounts for all these moving parts.

Some of these other costs might include:

- Office Security Deposits: If you choose a physical office over a flexi-desk, you’ll almost certainly need to pay a refundable security deposit. This can be a significant upfront cost you need to be ready for.

- Bank Account Opening Assistance: While many banks don’t charge a fee to open a corporate account, the process can be tricky. Some entrepreneurs hire consultants to help with the application and navigate the strict compliance requirements.

- Annual Audit and Compliance: Certain free zones require companies to submit professionally audited financial statements every year. The cost of hiring a registered auditor is an ongoing operational expense you must plan for to stay compliant.

Smart Strategies to Lower Your Setup Costs

Securing your Dubai free zone license doesn't have to mean draining your startup capital. With a few smart decisions, you can bring down your initial Dubai free zone license cost and give your business a financially healthy start right out of the gate. It's all about making choices that fit what your business actually needs, not overspending on flashy extras you'll never use.

One of the simplest ways to save is to think long-term from day one. Many free zones love entrepreneurs who are in it for the long haul and offer some pretty sweet discounts for multi-year license packages. Paying for two or three years upfront can often knock 15-25% off your annual fee, which translates to thousands of dirhams back in your pocket immediately.

Optimise Your Office Space

Another massive opportunity to save money is your choice of office. Let’s be honest, while a dedicated physical office might sound prestigious, it’s often an expensive and unnecessary headache for consultants, digital entrepreneurs, and other service-based businesses.

Opting for a flexi-desk or a spot in a co-working space is a total game-changer. These options satisfy the legal requirement for a physical address but at a tiny fraction of what a private office costs. You’re not just saving on the annual lease; you're also dodging hefty security deposits and utility bills. For an even leaner setup, you can check out our guide on getting a virtual office in Dubai to see how that can slash your overheads even further.

Match the Zone to Your Budget

Finding the right free zone is absolutely critical. They aren't all created equal, and their price tags can vary wildly. Choosing one that fits your budget and operational needs is the key to keeping costs under control. Don't just default to the big, well-known premium zones—take some time to explore emerging hubs that offer incredibly competitive packages without skimping on the essential benefits.

Do your homework. Compare not just the initial license fee, but also the renewal costs, visa allocation fees, and any other mandatory service charges. A lower-cost zone that perfectly supports your business is a much smarter move than an expensive one with features you don't need.

The most cost-effective setup isn't about finding the absolute cheapest option. It’s about hitting that sweet spot—the perfect balance between affordability, credibility, and the specific infrastructure your business needs to really thrive.

Bridge the Mainland Gap Affordably

In the past, one of the biggest limitations of a free zone company was not being able to trade directly on the UAE mainland. This often pushed businesses into a much more expensive mainland setup. But now, a powerful and affordable new route has opened up.

The recently introduced Free Zone Mainland Operating Permit, which costs just AED 5,000 a year, allows free zone companies to operate legally on Dubai's mainland. This initiative from Dubai’s Department of Economy and Tourism (DET) is a formal, cost-effective way for free zone businesses to tap into the lucrative mainland market for a fraction of the traditional cost. By using these kinds of strategies, you can make your startup capital go much further, setting yourself up for a successful and sustainable launch.

Your Top Questions About Free Zone Costs Answered

As you get closer to setting up your Dubai free zone company, you'll naturally have a few specific questions pop up. It's completely normal. Let's tackle some of the most common ones we hear from entrepreneurs, so you can move forward with total clarity.

Can I Pay for My Dubai Free Zone License in Instalments?

Absolutely. Many free zones and setup consultants understand that managing cash flow is critical when you're starting out. To make the initial investment easier, they often offer payment plans. This could mean splitting the total cost into two, three, or even four payments over several months.

Your best bet is to ask your chosen free zone authority or your setup agent directly. They’ll lay out all the available options and terms for your specific package, helping you launch your business without unnecessary financial pressure.

What Is the Cheapest Free Zone License in Dubai?

This is the million-dollar question, isn't it? While prices are always shifting, zones like Sharjah Publishing City (SPC) and International Free Zone Authority (IFZA) consistently offer some of the most competitive packages, often starting in the AED 12,000 to AED 15,000 range.

But a word of caution: "cheapest" doesn't always mean "best." The right choice really hinges on what your business needs. The number of visas, your specific business activities, and whether you need an office will all shape the final cost. Always look beyond the shiny initial price and compare the total package value and long-term renewal fees.

The most affordable license is the one that gives you everything you need to operate legally, without making you pay for extras you'll never use. A smart comparison is the key to getting real value for your money.

Do I Have to Pay Corporate Tax with a Free Zone License?

This is a big one, and the answer is nuanced: it depends. If your company meets the criteria for a 'Qualifying Free Zone Person' and earns 'Qualifying Income' (as defined by the Federal Tax Authority), you could be eligible for a 0% Corporate Tax rate.

However, it's crucial to know that any income your free zone company earns from mainland UAE customers will generally fall under the standard 9% Corporate Tax rate. The tax laws have a lot of fine print, so we strongly recommend sitting down with a professional tax advisor to figure out exactly what your obligations are and stay compliant.

How Long Does It Take to Get a Free Zone License After Paying?

The timeline can really vary from one free zone to the next. Some are incredibly fast—IFZA, for instance, is known for its efficiency and can often issue a license in just a couple of working days after all the paperwork and payments are sorted.

On the other hand, some zones might take a week or two. And remember, that's just for the license itself. The whole process, including getting your visa, medical tests, and Emirates ID, can take several weeks. Make sure you factor this full timeline into your launch plan to avoid any last-minute holdups.

Ready to navigate the business setup process with an expert guide? Al Ain Business Center offers clear, fixed-price packages that eliminate surprises and get your company running smoothly. Start your UAE business journey with us today!