Yes, you can absolutely open a Dubai bank account for non-residents, but it's important to know your options from the get-go. For individuals, this usually means a savings account, not a full-service current account. The most effective route, especially for business, is to set up a UAE company, which unlocks a proper corporate account.

Your First Step to Banking in Dubai as a Non-Resident

Understanding the lay of the land saves a lot of headaches and sets realistic expectations. For many non-residents, the goal is simple: have a safe place to keep funds in the UAE. But the difference between what a resident can get versus a non-resident is massive. A resident with an Emirates ID can walk into a bank and open a current account, complete with a chequebook—which is still a surprisingly essential tool for renting an apartment or making large payments here.

As a non-resident, the banks will steer you towards a savings account. It’s useful for holding money and making digital transfers, but you’ll run into a few key limitations:

- No Chequebook: This is a big one. Without it, securing a rental lease or handling other major local transactions gets complicated.

- Limited Credit: Getting a loan or credit card is often off the table unless you’re willing to lock up a significant amount of cash in a fixed deposit as security.

- Higher Minimum Balance: Banks often require non-residents to keep a higher average balance to avoid monthly fees, sometimes starting from AED 3,000 and going much higher.

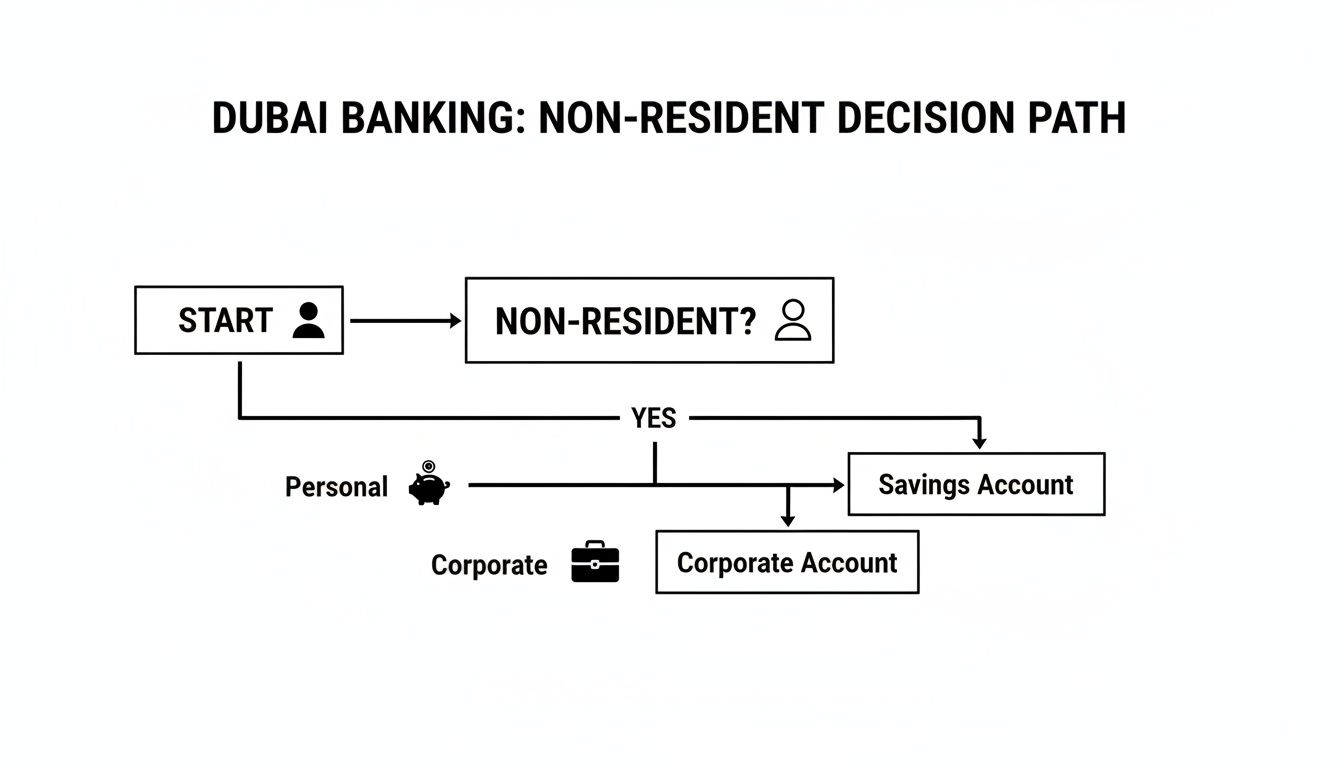

This brings you to a critical decision. Are you just looking for a simple personal account to use occasionally, or do you need a full suite of banking tools for business or investments? This chart breaks down the two main paths you can take.

As you can see, a personal savings account is the direct route, but forming a company is what truly opens the door to a fully functional corporate account.

Why Company Formation is the Strategic Choice

For entrepreneurs, investors, and freelancers, the limits of a non-resident personal account quickly become a roadblock. The smart move? Form a UAE-based company.

Doing this completely changes your standing with the bank. Once you have a trade license and the proper corporate documents, you can apply for a business bank account that has all the features you actually need to operate.

By establishing a corporate entity, you aren't just opening an account; you're building a legitimate financial foundation in the UAE. This pathway gives you access to chequebooks, credit facilities, multi-currency options, and trade finance—tools that are indispensable for running a business.

A quick look at the table below makes the differences crystal clear.

Resident vs Non-Resident Bank Accounts at a Glance

This table offers a quick comparison, outlining the key differences in features and requirements between bank accounts for UAE residents and non-residents.

| Feature | Non-Resident Account (Savings) | Resident Account (Current) | Corporate Account (Via Company Setup) |

|---|---|---|---|

| Chequebook | No | Yes | Yes |

| Credit Card/Loan Access | Highly restricted | Available, subject to salary/credit score | Available, subject to business performance |

| Minimum Balance | Often high (e.g., AED 3,000+) | Lower, sometimes zero with salary transfer | Varies by bank and business volume |

| Account Type | Savings only | Current and Savings | Full-service corporate accounts |

| Primary Requirement | Passport, visit visa, proof of address | Emirates ID, Residence Visa | Trade License, Corporate Documents |

| Best For | Holding personal funds, occasional use | Daily transactions, rent, bill payments | Business operations, investments, trade |

Ultimately, the right account depends entirely on what you plan to do in the UAE.

Of course, a corporate account is just one part of the bigger picture. If you're planning a longer-term stay or deeper investment, looking into residency is the logical next step. You can dive into the requirements in our complete guide on how to get a residence visa in Dubai. Beyond banking, it's also wise to consider the broader aspects of relocating, like finding suitable new immigrant insurance options, to ensure a totally smooth transition.

Opening a Personal Bank Account Without Residency

While setting up a company is the surest way to get full banking access, you can still open a personal account without being a resident. This is a great option for frequent visitors, consultants who need to manage local expenses, or people who own property here and need a simple way to handle payments. But getting it right means understanding how the banks think and preparing everything perfectly.

Banks in the UAE are serious about international anti-money laundering (AML) and Know Your Customer (KYC) rules. To them, a non-resident is a higher risk than a resident with a clear local footprint. This is exactly why the process is so hands-on and demands an in-person visit—they need to meet you, see your original documents, and hear your reasons for wanting an account.

Why You Absolutely Have to Be Here in Person

Forget anything you've read about opening a personal non-resident account remotely. In almost 100% of cases, you must be physically in Dubai to get the application finalised. This is how the bank does its due diligence, which covers:

- Identity Verification: A banker will copy your passport and, crucially, the UAE entry stamp. This proves you are legally in the country when you apply.

- Signature Confirmation: You'll sign the application and specimen signature card right there in front of them.

- Purpose Assessment: They will want to know why you need the account. Having a solid, legitimate reason is key—like managing rental income from a Dubai property or handling payments for local consulting work.

Put yourself in their shoes. A face-to-face meeting is their main tool for assessing risk, which makes it a non-negotiable step.

Getting Your Documents in Order

Showing up at a bank unprepared is the quickest route to a delay or rejection. Your goal is to hand over a professional, complete package that makes their job easy. While the exact list can differ slightly from bank to bank, your core checklist should always have these items.

- Original Passport: You must bring your actual passport, not a copy. Make sure it has at least six months of validity left.

- UAE Entry Stamp: A clear, recent entry stamp in your passport is non-negotiable proof you're in the UAE legally.

- Bank Reference Letter: This is a formal letter from your main bank back home. It needs to confirm you're a customer in good standing and mention how long you've banked with them (ideally, for a few years).

- Proof of Home Address: A recent utility bill (water, electricity, or landline) or a municipal tax statement from the last three months will work. It must clearly show your name and home address.

- Personal CV: Some banks ask for a brief Curriculum Vitae (CV) to get a better sense of your professional background and where your money comes from.

- Recent Bank Statements: Have six months of personal bank statements from your home country ready. This helps the bank see your financial stability and the source of your funds.

Expert Tip: Before you even book your flight to Dubai, call your home bank and ask for the reference letter. Explain exactly what it's for and make sure they print it on official letterhead and sign it. This one small step can save you weeks of hassle.

Knowing What to Expect from Your Account

Once your Dubai bank account for non-residents is approved, it’s important to know what you can and can't do with it. These are typically savings accounts, not current accounts, and that comes with a few rules.

You'll get a debit card, which is perfect for ATM withdrawals and paying for things in shops across the UAE. You'll also get access to great online and mobile banking platforms to manage your money and make transfers.

What you won't get is a chequebook, which is still a big deal for some transactions in Dubai, like paying annual rent. Getting credit cards and loans is also very difficult. Also, be aware of the minimum balance requirement, which is often between AED 3,000 to AED 5,000 (or the equivalent in another currency). If your balance drops below this, you'll likely be charged a monthly fee.

The Strategic Advantage of a Corporate Bank Account

While a personal non-resident account can get you started, it quickly becomes a bottleneck for any serious business. The real game-changer for entrepreneurs is to move beyond personal banking limits and open a proper corporate bank account. This move, which starts with forming a UAE company, completely transforms your relationship with banks and unlocks the financial tools you actually need to grow.

This approach solves the core challenge non-residents face head-on. By setting up a legal business entity here, you're no longer seen as a high-risk individual trying to open an account from overseas. Instead, you become a legitimate local enterprise. Suddenly, banks are far more welcoming, giving you access to features that are simply off-limits with a personal savings account.

Moving Beyond Basic Banking

Think about it. Trying to run your international consultancy by asking clients to wire funds to a personal account? It doesn’t just look unprofessional; it can raise red flags for both your clients and the bank's compliance team. A corporate account immediately adds a layer of credibility and structure to your finances.

With a corporate bank account, you can finally operate like a real business:

- Chequebooks: Believe it or not, cheques are still a fundamental business tool in the UAE. You'll need them for things like securing an office lease, paying suppliers, and handling post-dated payments.

- Multi-Currency Accounts: You can hold and manage funds in AED, USD, EUR, and other major currencies without getting hit with hefty conversion fees on every single transaction.

- Trade Finance Facilities: If you're in the import/export game, this is non-negotiable. It gives you access to letters of credit and other tools to make international trade smoother and more secure.

- Corporate Credit Cards and Loans: Access to credit lines and business loans finally becomes a possibility, based on your company's financial health and business plan.

This is a world away from a simple savings account. It’s the difference between just parking your money in Dubai and actually doing business from Dubai.

The Company Formation Pathway

Here’s the bottom line: opening a corporate Dubai bank account for non residents is directly tied to establishing a business. You simply can't have one without the other. The journey involves creating a legal entity, usually in one of the UAE's many free zones, which are specifically designed to attract foreign investment.

The biggest advantage of going this route is that your company's legitimacy becomes the very foundation of your banking relationship. A valid trade licence and establishment card are the keys that unlock the door to top-tier corporate banking services.

This is exactly where a partner like Al Ain Business Center becomes essential. We manage the entire journey for you, turning what seems like a complicated maze into a clear, step-by-step process. Our team will help you pick the perfect free zone for your business, handle all the trade licence paperwork, and make sure your corporate file is perfectly prepped for the bank's review. To get a deeper look at what's involved, our guide on starting a business in Dubai as a foreigner lays out the complete roadmap.

A Signal of Confidence in the UAE Economy

By choosing to set up a corporate presence in Dubai, you're tapping into a powerful economic trend. The UAE's banking sector is attracting massive international capital, which speaks volumes about its stability and pro-business environment.

The numbers back this up. In early 2025, non-resident deposits in UAE banks jumped by an incredible 5.1%, hitting AED 249.1 billion by February. As noted by Khaleej Times, this growth highlights Dubai's appeal for international investors who are looking for both security and opportunity. When you form a company here, you’re not just watching this growth from the sidelines—you become an active part of it.

Choosing the Right Bank and Preparing Your Documents

Picking a bank in Dubai isn’t just about choosing a familiar logo. It's about finding a financial partner that genuinely understands the complexities of non-resident banking. Your choice will directly influence how smooth your application is, the features you get, and your entire banking experience here.

Frankly, some institutions are just better equipped for international clients than others.

The UAE’s banking sector has matured incredibly, keeping pace with its status as a global business hub. This is great news for non-residents. Thanks to national strategies like 'We the UAE 2031', the country hit 94% personal bank account ownership in 2025, a significant jump from 85% in 2021.

This signals a much more inclusive financial environment. In fact, non-resident deposits recently climbed by 5.1%, reaching AED 249.1 billion. This growth means you have some excellent choices, but you need to know where to look.

Top Banks for Non-Resident Applicants

While Dubai is home to dozens of banks, a select few have built a solid reputation for working with non-resident individuals and international companies. They've streamlined their processes and know exactly what due diligence is needed for clients abroad.

Here is a quick look at some of the top contenders we often work with for our clients.

Top Banks for Non-Resident Accounts in Dubai

| Bank Name | Account Type | Key Features | Minimum Balance (Approx.) |

|---|---|---|---|

| RAKBANK | Personal & Corporate | Known for its flexibility with SMEs and non-residents; straightforward application process. | AED 25,000 – 50,000 |

| Mashreq Bank | Personal & Corporate | Strong digital banking (Mashreq Neo); excellent for tech-savvy clients who prioritise online access. | AED 50,000 – 100,000 |

| ADIB | Personal & Corporate | Leading Shariah-compliant Islamic bank; ideal for ethical and Islamic finance solutions. | AED 50,000 – 150,000 |

| Emirates NBD | Personal & Corporate | One of the region's largest banks with a vast network and product range; requirements can be stricter. | AED 100,000+ |

When you're comparing your options, remember to look past the brand name. The critical details are things like their minimum balance requirements, which can vary wildly, and whether they offer multi-currency accounts—a non-negotiable feature for anyone doing international business.

The Document Checklist Your Application Depends On

Let me be clear: the success of your application rests entirely on your paperwork. Banks in Dubai follow very strict compliance regulations. A single missing or incorrect document can cause major delays or even get your application rejected outright.

Preparation isn't just a good idea; it's everything. For a personal account, your file needs to be meticulous. For a corporate account, it has to be perfect.

A well-prepared document file does more than just meet requirements—it tells the bank you are a serious, organised, and low-risk client. This is the first and most critical impression you will make.

Here's a detailed breakdown of what you'll typically be asked for.

Documents for a Personal Non-Resident Account

- Your Passport: The original, valid passport showing your UAE entry stamp.

- Bank Reference Letter: An official letter from your current bank in your home country confirming you're a customer in good standing.

- Recent Bank Statements: Usually, the last six months of statements from your home bank to demonstrate a healthy financial history.

- Proof of Address: A recent utility bill or another official letter with your name and overseas address.

- Personal CV: A brief professional summary helps the bank understand your background and source of funds.

Documents for a Corporate Bank Account

This is where it gets more involved. The list is longer and demands professional attention to ensure everything is formatted, translated, and attested correctly.

- Shareholder & Signatory Documents: Passports, visa copies (if they have one), and Emirates IDs (if any shareholders are residents) for all partners and the person signing on the account.

- Company Formation Documents: Your complete corporate file. This includes the Trade Licence, Certificate of Incorporation, Memorandum of Association (MOA), and Share Certificates.

- Proof of Business Activity: You'll need more than just a plan. Provide a strong business plan, but also back it up with existing invoices, client contracts, or a professional company website to prove you're operational.

- Office Tenancy Contract (Ejari): This shows the bank your company has a physical address in the UAE.

Getting company documents attested and legalised can be a maze of bureaucracy. This is where having an expert team handle it for you, like our PRO services at Al Ain Business Center, becomes a game-changer. We make sure every single document meets the bank's exact standards, helping you avoid the common mistakes that derail so many applications.

To get a complete picture of the process, you can find more information in our detailed guide on how to open a bank account in the UAE.

Common Mistakes to Avoid in Your Application

Trying to open a Dubai bank account for non-residents can sometimes feel like walking through a minefield. One tiny misstep, and your application gets stuck in limbo for weeks—or worse, rejected outright. Knowing the common pitfalls ahead of time is the best way to make sure your efforts lead to a brand new bank account, not a dead end.

The single biggest mistake we see? Submitting an incomplete or inconsistent document package. Banks in the UAE are under immense regulatory pressure, and their compliance teams have zero wiggle room for missing paperwork. It’s not about having most of the documents; you need every single one, and they have to be perfect.

For example, we've seen applications stumble because a bank reference letter wasn't on official letterhead or was missing a signature. Another classic slip-up is a utility bill used for proof of address where the name doesn't exactly match the passport. These might seem like minor details to you, but they are major red flags to a compliance officer.

The Problem with a Vague Business Profile

When you're applying for a corporate account, a weak or poorly defined business plan is a guaranteed path to rejection. Banks need to know precisely what your business does, your expected transaction volumes, and where your money will be coming from and going to. A vague description like "general trading" or "consultancy services" just won't cut it.

You have to be specific. Are you an IT consultant, a management consultant, or a marketing consultant? Who are your typical clients? A detailed business profile does more than just tick a box for due diligence; it paints a picture of a legitimate, well-structured company.

This need for clarity also applies to your financial projections. You must provide realistic estimates for your incoming and outgoing transfers. This helps the bank gauge risk and ensures your future account activity matches what you told them upfront, which prevents your account from being flagged later on.

Expert Insight: Think of your application as a business proposal you're making to the bank. Your goal is to convince them that you are a credible, low-risk partner. A professional, detailed, and transparent application is your best tool for building that initial trust.

Underestimating the Source of Funds Scrutiny

Another critical area where applications fall apart is the documentation for the source of funds and wealth. Banks are legally required to verify where your money comes from. Simply writing "personal savings" is not enough and will almost certainly lead to more questions and delays.

You need to back it up with concrete evidence. This could mean providing:

- Employment Contracts: To show your salary and career history.

- Property Sale Agreements: If the funds came from a real estate deal.

- Shareholder Dividend Slips: If your income is from investments.

- Inheritance Documents: To clearly show the origin of inherited wealth.

Failing to provide this level of detail makes the bank’s job harder and raises immediate concerns. The more organised and transparent you are about your financial history, the smoother the whole process will be. Getting this documentation ready in advance shows you're serious and professional.

The massive growth in non-resident banking in Dubai is proof of its appeal, but it also means banks are more diligent than ever. Official bulletins from the CBUAE show non-resident deposits often trending upward, moving from AED 230,994 million in early 2025 to peaks of AED 277,185 million by mid-year. Meanwhile, corporate non-resident claims have surged past AED 107,722 million. This huge volume of international capital requires strict checks, making a perfectly prepared application absolutely essential. You can explore the official CBUAE report for a deeper dive into these financial trends.

Frequently Asked Questions

When it comes to opening a Dubai bank account for non residents, a few questions always pop up. Getting straight answers is vital, whether you're here for business, investing in property, or getting your new company off the ground. Let’s tackle the most common queries we handle for our clients every day.

Can I Open a Dubai Bank Account Remotely?

This is easily the question we get asked the most, and the answer isn't a simple yes or no. For a personal non-resident savings account, a completely remote opening is almost unheard of. UAE banks follow strict Know Your Customer (KYC) rules, which nearly always means you'll need to meet them in person to verify who you are and sign the paperwork.

The story is a bit different for a corporate account, though. While the final signature on the bank forms usually requires the shareholder to be present, a huge chunk of the prep work can be done from anywhere in the world. The entire company formation journey, from picking a free zone to getting your trade licence, can be handled by a consultant like Al Ain Business Center without you ever setting foot in the country.

Some of the more forward-thinking banks are starting to play with digital verification, but it's always smartest to plan for at least one quick trip to Dubai. This visit helps you finalise everything with the bank, ensuring you're fully compliant and the account gets activated without a hitch.

What Is the Minimum Deposit to Open an Account?

There’s no one-size-fits-all answer here. The minimum deposit—or more commonly, the minimum balance—can vary wildly from one bank to another and depends heavily on the type of account. It's crucial to check the specific requirements with your chosen bank before you start the application.

Here’s a rough idea of what to expect:

- Personal Non-Resident Savings Accounts: Some banks might not ask for an initial deposit, but most will insist on a minimum average monthly balance. This is typically somewhere between AED 3,000 to AED 5,000. Dip below that, and you can expect to be charged a monthly service fee.

- Corporate Bank Accounts: The bar is set much higher for business accounts. The minimum balance requirement usually starts around AED 25,000 and can easily go up to AED 50,000 or more, depending on the bank and your business activities.

Always ask for the "schedule of charges." It’s a transparent breakdown of all the bank's fees, including penalties for not meeting the minimum balance. Getting this upfront can save you from nasty surprises later on.

How Long Does the Account Opening Process Take?

Patience is a virtue here. The timeline really depends on the account type and how organised you are. For a personal non-resident account, if you land in Dubai with all your documents in perfect order, things can move pretty fast. After your in-person meeting, the account could be up and running within a few business days to a week.

A corporate account is a different beast altogether. It's a multi-stage process that’s tied to your company formation. While setting up the business itself can be quick—often done in about a week—the bank’s internal checks for a corporate client are far more intensive. You should realistically set aside anywhere from two to four weeks for the bank to complete its due diligence, run compliance checks, and give the final approval. Working with a professional can help you avoid simple mistakes that cause frustrating delays.

Will I Get a Chequebook and Credit Card?

For a personal non-resident account, the answer is a firm no. These accounts are designed for savings and come with a debit card for ATM and shop purchases, plus online banking. They simply don't include chequebooks or credit facilities.

If you need those tools, you have two main options. The first is to get a UAE residence visa, which allows you to open a proper resident current account. The second, and more strategic move for entrepreneurs, is to set up a company. A corporate bank account unlocks the full suite of banking services, including the all-important chequebook which is still essential for many business transactions in the UAE, like paying for office rent or settling supplier invoices.

Trying to figure out the complexities of opening a Dubai bank account for non residents is much easier with an expert in your corner. Al Ain Business Center handles the entire process, from setting up your company to submitting a perfect bank application, making sure you tick every box for a successful outcome. Start your journey with us today!