Ever thought about a business playground with its own set of rules, built just for global entrepreneurs? That's pretty much what free zone companies in Dubai are. These special economic zones are designed to give international business owners a leg up with major incentives and a straightforward setup process.

What Exactly Is a Dubai Free Zone Company?

Picture a designated business district inside Dubai that doesn't play by the same rulebook as the rest of the emirate. Each of these zones has its own independent authority that handles everything from issuing business licences to governing the companies that operate there.

This creates a unique business environment, completely separate from the UAE "mainland," which falls under federal laws. For international investors, the real magic lies in the operational and financial freedom this structure provides.

The Core Appeal for Global Entrepreneurs

So, what’s the big draw? It all comes down to control and efficiency. For any entrepreneur from outside the UAE, setting up in a free zone means you can skip many of the traditional hoops you'd have to jump through with a mainland business. The key perks are:

- Complete Foreign Ownership: You own 100% of your company. No need for a local Emirati partner or sponsor.

- Tax Advantages: Your business can enjoy a 0% corporate tax rate on qualifying income, which is a massive financial win.

- Simplified Procedures: The whole setup is generally quicker and has far less red tape than forming a mainland company.

These zones aren't just legal ideas on paper; they're buzzing commercial hubs. The proof is in the numbers. In the first half of 2023, the Dubai Multi Commodities Centre (DMCC) alone registered over 1,100 new companies, pushing its total to nearly 26,000 businesses. This incredible growth shows just how much overseas demand there is for Dubai as a business epicentre.

In simple terms, a free zone company is your ticket to operating an international business from a strategic UAE base, all while taking advantage of regulatory and tax benefits you won't find anywhere else in the emirate.

How Free Zones Differ from Mainland Businesses

Getting your head around the difference between a free zone and the mainland is absolutely critical. A mainland company, registered with the Department of Economy and Tourism (DET), can trade directly anywhere in the UAE. A free zone company, however, is typically limited to doing business within its specific zone and internationally.

This isn't a minor detail—it shapes your entire business strategy, affecting everything from where your office is located to who your customers can be. For a more detailed breakdown, we’ve put together a guide on the key differences between free zone vs mainland Dubai setups. It's essential reading before you take your next step.

To make things even clearer, let's break down the main advantages side-by-side.

Key Advantages of Dubai Free Zone Companies at a Glance

This table sums up the core benefits that make free zones such an attractive option for international entrepreneurs compared to setting up on the mainland.

| Feature | Free Zone Company | Mainland Company |

|---|---|---|

| Ownership | 100% foreign ownership | Often requires a local sponsor or agent |

| Corporate Tax | 0% on qualifying income | Standard UAE corporate tax rates apply |

| Customs Duties | No customs duties on imports/exports | Subject to standard customs duties |

| Repatriation | 100% repatriation of capital and profits allowed | Repatriation is possible but may be regulated |

| Setup Process | Streamlined, faster, and less paperwork | More complex with multiple government approvals |

| Trading Scope | Primarily within the free zone and internationally | Can trade directly across the entire UAE |

As you can see, the choice really boils down to your business model and target market. If your focus is on international trade and you want maximum control and financial benefits, a free zone is hard to beat.

The Real-World Advantages of a Dubai Free Zone

When people talk about setting up a business in a Dubai free zone, a few key benefits always come up. But these aren't just bullet points on a brochure; they are game-changing advantages that have a direct impact on your freedom to operate, your bottom line, and your ability to grow. Let's break down what these perks actually mean for you as a business owner.

The headline feature, without a doubt, is 100% foreign ownership. This is a massive departure from the traditional mainland business structure, where an Emirati partner was a requirement. It means you, the foreign entrepreneur, keep full control and ownership of your company. No local partner, no local service agent needed. It’s your vision, your decisions, and your profits.

You're in Complete Control

Think about it: you're investing your own money, time, and expertise into building something from scratch. With 100% foreign ownership, that investment is fully protected and entirely yours. This security is why so many international entrepreneurs are drawn to free zone companies in Dubai. It creates a clear, stable ownership structure from the very beginning.

This level of autonomy strips away the complexities and potential friction of local partnerships, letting you concentrate on what really matters—running and growing your business.

A Tax Environment Built for Growth

The next major draw is the incredibly business-friendly tax setup. Free zone companies enjoy tax benefits that can seriously boost their financial health. The most significant of these is the 0% corporate tax rate on qualifying income. For businesses that meet the criteria, this means you can reinvest your profits straight back into the company without handing a cut over to the taxman.

On top of that, companies operating in these zones don't pay customs duties on goods they import and then re-export. For anyone in trading, logistics, or manufacturing, this is a huge cost-saver.

Here’s what that looks like in practical terms:

- Zero Corporate Tax: Qualifying businesses keep all their profits, which means more cash flow to fuel expansion.

- Customs Duty Exemption: You can bring goods into the free zone for storage, processing, or assembly and then ship them out again without paying any customs tariffs.

- Full Profit Repatriation: You have the freedom to send 100% of your capital and profits back to your home country. There are no restrictions or currency controls holding you back.

This isn't just about saving money. It's about creating a financially agile environment where your capital can be put to work innovating, expanding, and out-manoeuvring the competition.

A Setup Process That Respects Your Time

In business, time is a resource you can't get back. The setup process in Dubai's free zones is designed with this in mind. Each free zone authority acts as a one-stop-shop, guiding you through all the necessary paperwork, licensing, and administrative hurdles. This cuts right through the red tape you might expect when forming a company.

The entire process is intentionally efficient, with clear steps and dedicated staff to help you along the way. Many free zones even offer all-in-one packages that cover everything from your trade licence to your visa, getting you operational much faster.

World-Class Infrastructure and a Supportive Community

Finally, when you set up in a Dubai free zone, you're not just getting a licence—you're plugging into a world-class business ecosystem. We're talking about state-of-the-art office spaces, lightning-fast IT networks, modern warehouses, and fantastic transport links right on your doorstep.

Better yet, many zones are built around specific industries, creating powerful hubs for innovation. Whether you're in tech, media, commodities, or logistics, you’ll find yourself surrounded by peers, potential partners, and customers. This community creates invaluable opportunities for networking and collaboration, giving you the perfect launchpad for your global ambitions.

Choosing The Right Dubai Free Zone For Your Business

Picking the right free zone in Dubai is a lot like choosing the right soil to plant a seed. Get it right, and your business will flourish. Get it wrong, and you'll face an uphill battle. With over 40 different free zones, each with its own regulations, industry focus, and unique ecosystem, it’s a decision that demands careful thought, not a quick guess.

This isn't a one-size-fits-all situation. An e-commerce startup has completely different needs than a logistics giant or a creative agency. The best choice for you hinges entirely on your specific business activities, your budget, and where you see your company heading in the future.

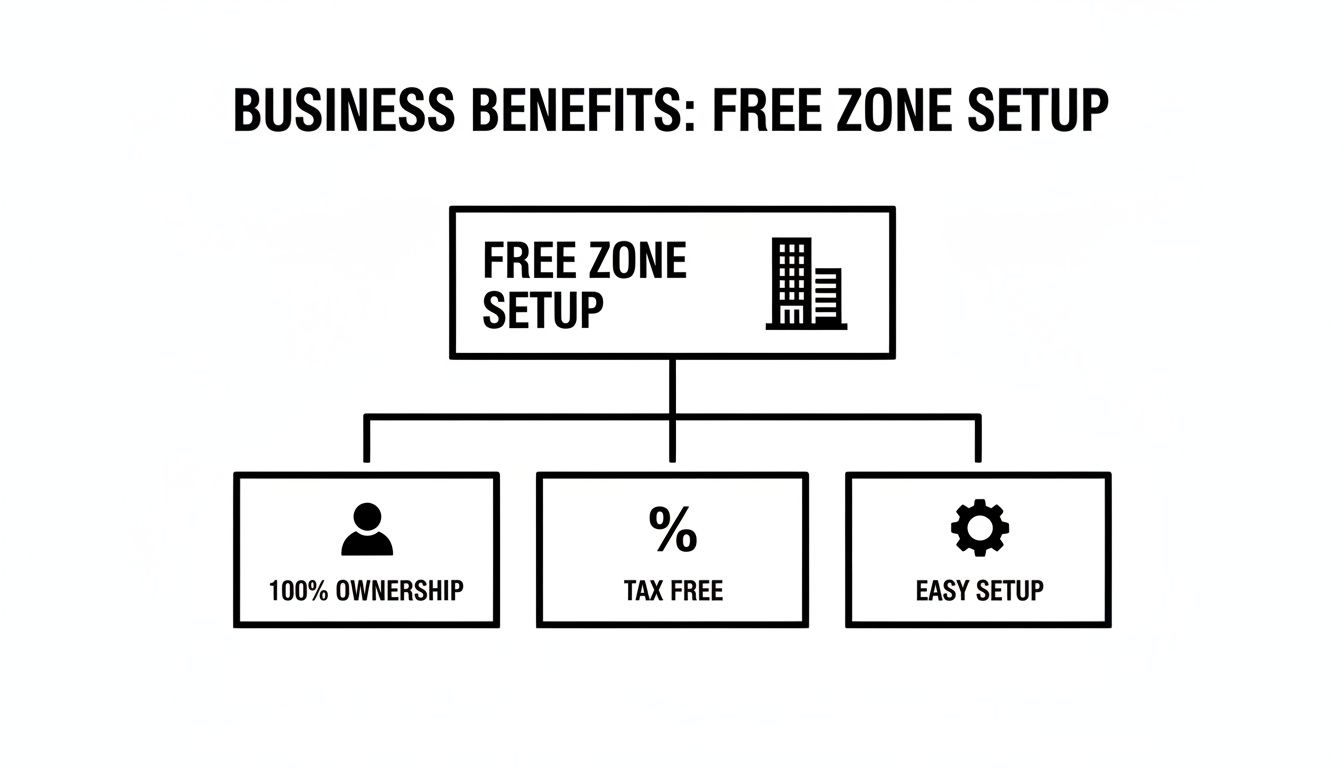

At their core, free zones are built on three powerful advantages for entrepreneurs: 100% foreign ownership, a tax-friendly environment, and a straightforward setup process.

These three pillars are the foundation of the free zone appeal, and understanding them is the first step toward finding the perfect home for your business.

Matching Your Industry To The Zone

The smartest way to narrow down the long list of options is to look for a zone that specialises in your industry. Dubai has masterfully created powerful hubs that cater to specific sectors. This approach creates an environment buzzing with networking opportunities, specialised infrastructure, and authorities who genuinely understand your business.

A fintech company, for example, would feel right at home in the Dubai International Financial Centre (DIFC), surrounded by global banks and investment firms. A media production house, on the other hand, would thrive in Dubai Media City, with its ready-to-use studios and community of fellow creatives.

Here’s a quick look at where certain industries tend to cluster:

- Tech & Innovation: Dubai Internet City (DIC) and Dubai Silicon Oasis (DSO) are the go-to zones for software developers, IT consultants, and tech startups.

- Media & Creativity: Dubai Media City, Dubai Production City, and Dubai Design District (d3) are perfect for everything from advertising agencies to fashion designers.

- Trade & Logistics: Jebel Ali Free Zone (JAFZA) and Dubai Airport Freezone (DAFZA) are unbeatable for import/export, warehousing, and distribution.

- Commodities & Services: Dubai Multi Commodities Centre (DMCC) is a massive, diverse hub for trading anything from precious metals to crypto, along with a huge range of professional services.

A Closer Look At Dubai's Leading Free Zones

While you have plenty of choices, a few major players consistently draw the most attention from entrepreneurs looking to set up free zone companies in Dubai. Each one brings something unique to the table. Let’s compare some of the heavyweights.

Comparison of Major Dubai Free Zones

To help you get a clearer picture, this table breaks down what some of the most popular free zones are all about. Think of it as a quick-start guide to finding your business’s ideal community.

| Free Zone | Primary Industry Focus | Key Benefit | Typical Business Activities |

|---|---|---|---|

| Jebel Ali Free Zone (JAFZA) | Logistics, Trading, Manufacturing | Unmatched sea-air logistics hub and global connectivity | Import/export, warehousing, industrial manufacturing |

| DMCC | Commodities, Crypto, Services | Diverse business community and prestigious JLT location | Precious metals trading, crypto assets, consulting |

| DIFC | Finance, Fintech, Legal Services | Independent legal framework based on English common law | Banking, wealth management, financial technology |

| DAFZA | Aviation, Logistics, E-commerce | Direct access to Dubai International Airport | Air freight, luxury goods, pharmaceuticals, e-commerce |

| Dubai Media City (DMC) | Media, Advertising, Communication | Established creative ecosystem with industry-specific infrastructure | Broadcasting, marketing agencies, production companies |

This comparison highlights how specialised each zone is. Choosing the right one means you’re not just getting a licence; you’re plugging into a network designed to help your specific type of business succeed.

Navigating Cost and Value

Of course, cost is always a major factor. Fees can vary wildly from one free zone to another, covering everything from the initial trade licence and registration to annual renewals and visa allocations. Some zones are known for their premium facilities and come with a higher price tag, while others are geared towards offering more budget-friendly packages.

But it’s crucial to look beyond the initial invoice and consider the overall value. A more expensive free zone might give you access to better infrastructure, a more prestigious address, or a specific client base that more than justifies the cost. For entrepreneurs focused on keeping startup costs low, it's worth exploring the more affordable options. You can dive deeper by reading our complete guide on finding the cheapest free zone in UAE that still delivers what your business needs.

Ultimately, your goal is to find that sweet spot where industry alignment, operational needs, and your budget all meet. Taking the time to compare your options properly ensures you plant your business in an ecosystem where it won't just survive—it will thrive.

Your Step-By-Step Company Formation Roadmap

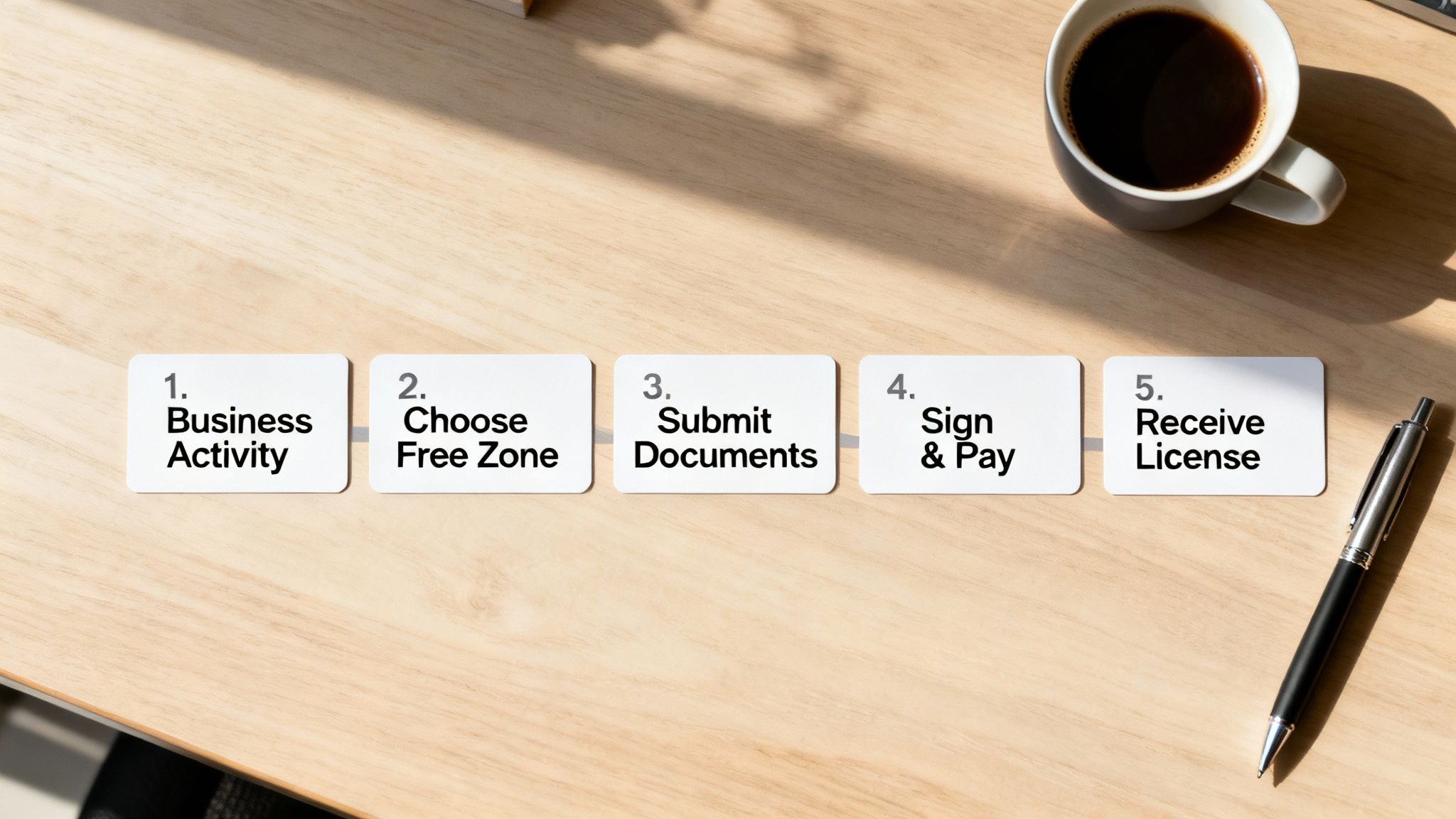

Navigating the setup of free zone companies in Dubai might seem like a complex puzzle, but it’s actually a well-defined process. When you break it down into clear, manageable steps, you can move from idea to official business licence with confidence.

Think of this as your no-nonsense checklist for getting your company off the ground. Each free zone authority acts as your central point of contact, guiding you through the requirements and approvals needed to become fully operational.

Step 1: Define Your Business and Name

Before you do anything else, you need to nail down exactly what your business will do. Are you a consultant, a trader, or a software developer? This decision is absolutely critical because it dictates the type of trade licence you'll apply for and points you towards the most suitable free zones.

At the same time, you'll pick a trade name for your company. The name has to be unique and follow UAE naming conventions—which generally means no offensive language or references to religious or political groups. Your chosen free zone will have an online portal where you can check if your name is available and reserve it.

Step 2: Select the Ideal Free Zone

With your business activity defined, you can now zero in on the right free zone, a choice we explored in the last section. This decision really comes down to your industry, your budget, and what you want to achieve long-term. Remember, you're not just picking a location; you're joining a business ecosystem.

Consider factors like:

- Industry specialisation and the networking opportunities that come with it.

- The total cost, including licence fees, office space, and visa allocations.

- Geographic location and how close you are to key infrastructure like ports or airports.

Once you’ve made your choice, you can officially start the application process with that specific free zone authority.

Step 3: Prepare and Submit Your Application

This is the paperwork stage, where attention to detail is everything. You'll need to gather a specific set of documents to submit to the free zone authority. While the exact requirements can differ slightly between zones, the core documents are pretty consistent.

You'll typically need to have these ready:

- Application Form: The completed registration form from your chosen free zone.

- Passport Copies: Clear copies for all shareholders and managers involved.

- Business Plan: A brief outline of your business goals and activities.

- No Objection Certificate (NOC): This is only required if you're already a resident in the UAE under a different visa.

Having these documents prepared ahead of time will seriously speed up the approval process.

The real key to a smooth application is getting it right the first time. Double-checking every detail before you hit 'submit' can save you from frustrating delays and endless back-and-forth emails with the authorities.

Step 4: Sign Legal Forms and Pay Fees

Once the free zone authority gives your application the initial green light, you'll be asked to sign the legal paperwork. This usually includes the Memorandum of Association (MOA) and Articles of Association (AOA), which are the documents that formally establish your company’s legal structure.

With the legalities signed off, you'll get an invoice for the required fees. This payment covers your company registration, trade licence, and any office or facility lease you've selected. After you've paid, you’re on the home stretch. While every jurisdiction is different, understanding the general principles of company formation for non-residents, such as the process in the UK, can provide some helpful context for your Dubai setup.

Step 5: Receive Your Official Business Licence

This is the final and most rewarding step. After all the documents are signed and the fees are paid, the free zone authority will issue your official business licence. This is the piece of paper that gives you legal permission to operate within that free zone.

Along with your licence, you'll get other vital company documents like your share certificates and establishment card. With these in hand, you're officially in business. You can now open a corporate bank account, apply for employee visas, and start operating in Dubai.

Getting to Grips with Costs and Compliance

Launching your free zone company in Dubai is exciting, but a great idea alone isn't enough. You need a crystal-clear financial picture from the get-go. This means understanding both the initial investment to get the doors open and the ongoing responsibilities that keep your business compliant and in good standing.

Effective budgeting is all about seeing the full spectrum of expenses. There are one-time setup fees to get you operational, and then there are the recurring annual costs that are simply part of the journey. Getting this right from day one is the key to avoiding nasty financial surprises and building a stable foundation for growth.

Breaking Down the Initial Setup Costs

The first financial hurdle is the one-time fees needed to officially register your business. Think of it as the capital required to build your company's framework. While the exact amounts can vary quite a bit between the 40+ free zones, the core components are generally the same.

Your main upfront investments will usually include:

- Company Registration Fee: This is the administrative charge for getting your business name and legal structure on the books with the free zone authority.

- Trade Licence Fee: The cost of the licence itself, which is directly tied to your chosen business activities. A general trading licence, for instance, will typically set you back more than a niche service licence.

- Office or Facility Costs: Whether you’re grabbing a flexi-desk, a dedicated office, or a full-blown warehouse, there will be an upfront payment, which is almost always the first year's rent.

- Establishment Card Fee: This little card is your company's ticket to interacting with immigration and other government bodies, making it essential for processing visas.

The good news is that these costs are paid directly to the free zone authority, which acts as a handy one-stop shop for most of the setup. For a more granular look at these expenses, our guide on the Dubai free zone license cost really drills down into what you can expect to pay.

Planning for Annual Recurring Expenses

Once your company is up and running, your financial focus pivots from setup costs to predictable annual expenses. These are the operational costs that maintain your company's legal status and physical presence. Forgetting to budget for these can land you in serious compliance trouble.

The main recurring costs you'll need to plan for are:

- Trade Licence Renewal: This is a non-negotiable annual fee to keep your business legally operational. It's usually the largest recurring expense.

- Office/Lease Renewal: The yearly rent for your office space, flexi-desk, or facility.

- Visa Renewal Fees: Any residence visas for yourself or your staff need to be renewed, typically every one to two years.

- Establishment Card Renewal: This card also comes with an annual renewal fee to keep it active.

Think of these recurring costs as the essential maintenance for your business engine. Just like a car needs an annual service to run smoothly, your company needs these renewals to stay compliant and legally active in the UAE.

Navigating Compliance and Legal Obligations

Beyond the financials, operating one of the free zone companies in Dubai brings some important legal duties. These rules are here to ensure transparency and uphold the UAE's high standards for business conduct. Staying compliant isn't just a good practice—it's mandatory.

Proper accounting is one of the most critical aspects. All free zone companies must maintain accurate financial records, including balance sheets and profit-and-loss statements. When it comes time to renew your trade licence, many free zones will also require you to submit an annual audit report prepared by a licenced auditor.

You also need to be aware of the Economic Substance Regulations (ESR). These rules require companies involved in specific activities to prove they have a genuine operational presence in the UAE. This isn't just red tape; it's a key factor in qualifying for the tax benefits that make free zones so attractive.

Speaking of taxes, this is where free zones really shine. As of 2025, Dubai’s free zones offer qualifying companies effective tax neutrality on their qualifying income. Many entities can secure a 0% corporate tax rate, as long as they meet economic-substance and audit requirements. This provides a massive advantage over mainland companies, which face a standard 9% corporate tax on profits over AED 375,000. To fully grasp this tax arbitrage, you can explore more insights about Dubai's free zone benefits on beyondnumbers.ae.

Common Questions About Dubai Free Zone Companies

Setting up a business in a Dubai free zone is an exciting step, but it's completely normal to have a few questions buzzing around your head as you get closer to making the leap. We hear them all the time from entrepreneurs just like you who are trying to understand the day-to-day practicalities.

Let's clear up some of the most common queries. Think of this as the final piece of the puzzle, giving you the clarity and confidence to move forward.

Can My Free Zone Company Trade with Mainland Dubai?

This is probably the number one question we get, and the answer isn't a simple yes or no—it has some important details. A free zone company is primarily set up to do business within its zone and internationally. You can't just directly invoice a customer based on the mainland.

But that absolutely doesn't lock you out of the lucrative local UAE market. There are a few well-trodden paths to legally connect with mainland businesses:

- Appoint a Local Distributor: If you're selling physical goods, this is the most popular route. You partner with a mainland company that has the right licence to distribute your products across the UAE for you.

- Use a Third-Party Logistics (3PL) Provider: These companies are experts in handling storage and distribution, acting as your on-the-ground logistics arm on the mainland.

- Establish a Mainland Branch: For businesses wanting a more direct presence, setting up a branch of your free zone company on the mainland is an option. This branch would then be fully licensed for local trade.

The best choice really boils down to your business model, whether you're in goods or services, and what your long-term ambitions are for the region.

What Types of Business Licences Are Available?

Free zones are designed to be specific. They offer a range of licences that are tailored to particular business activities, ensuring everything you do is above board. While the official names might vary slightly from one zone to another, they all fall into a few core categories.

Getting this right is crucial for operating legally. The main types you'll come across are:

- Commercial Licence: This is for any business involved in trading—buying, selling, import, and export of goods.

- Professional or Service Licence: This one covers consultancies, marketing agencies, IT specialists, artisans, and other service-based professionals.

- Industrial Licence: If your business involves manufacturing, processing, packaging, or assembling products, this is the licence you'll need.

- E-commerce Licence: A more recent and popular option, this is specifically for businesses that operate exclusively online through a website or digital platform.

It's essential to select the licence that precisely covers all your intended business activities. Operating outside the scope of your licence can lead to significant fines and legal complications, so it's a detail worth getting right from the very start.

How Many Residence Visas Can My Company Sponsor?

The number of residence visas your free zone company can sponsor is tied directly to the physical space you lease. It’s a straightforward formula used by the authorities: the more office space you have, the more visas you're allocated. This ensures companies maintain a genuine presence that matches their team size.

For instance, a basic flexi-desk package might only come with one or two visas. If you upgrade to a small private office of around 10-15 square metres, your visa quota could jump to three or four. Naturally, larger offices or warehouses come with a much higher visa allowance.

For investors and entrepreneurs looking at a long-term future in the UAE, it’s also worth exploring the prestigious UAE Golden Visa program. This program offers a path to 10-year residency for qualified individuals and can be a fantastic option alongside your business setup.

Is a Physical Office Mandatory?

Yes, you must have some form of physical address within your chosen free zone. But don't let that make you think you need to immediately sign a lease on a massive, expensive office. The free zones are known for their flexibility and offer solutions that fit every budget and business stage.

Here are the typical options you'll find:

- Flexi-Desk: The most cost-effective choice. It gives you access to a shared desk for a set number of hours each month. It's perfect for solopreneurs or brand-new startups.

- Shared Office: A small step up, this provides you with a dedicated desk within a co-working environment.

- Private Office: For small teams or businesses needing more privacy, you can lease a fully serviced private office in various sizes.

- Warehouse or Workshop: For industrial and trading businesses, you can lease larger facilities for manufacturing, storage, or logistics.

The key takeaway is that your physical setup needs to match your visa requirements and business activities. A flexi-desk is a great place to start, but as your team grows, you'll need to upgrade your space to accommodate more people.

Ready to turn your business idea into a reality in Dubai? The process can seem complex, but with the right partner, it becomes simple and straightforward. Al Ain Business Center has over a decade of experience in helping entrepreneurs launch and grow their companies with a 100% success rate. Let our expert team handle the paperwork, licensing, and visas so you can focus on what you do best. Start your journey today by visiting https://alainbcenter.com.