Deciding where to set up your business in Dubai—in a Free Zone or on the Mainland—is probably the single most important choice you'll make. It’s a classic dilemma, and the answer isn't always obvious.

The core difference is simple enough: Free Zones are specialised economic areas perfect for international trade, offering 100% foreign ownership. A Mainland setup, on the other hand, gives you unrestricted access to trade directly across the entire UAE market.

Choosing Your UAE Business Jurisdiction

When you're weighing up free zone vs mainland Dubai, you’re not just picking a spot on a map. You're committing to a completely different legal and operational framework. Each jurisdiction is built for a certain kind of business, so getting to grips with their core differences is the first real step toward a smart, strategic decision that fits your long-term vision.

Neither one is flat-out "better." The right choice is all about your business model, who you're selling to, and where you want to be in five years. This side-by-side look will give you a clear picture of Dubai's dynamic business landscape.

Free Zone vs Mainland Dubai At a Glance

This table breaks down the essential differences to help you see which path aligns better with your business goals.

| Attribute | Free Zone Company | Mainland Company |

|---|---|---|

| Business Scope | Can trade internationally and within its designated free zone. Requires a local distributor or agent to trade directly in the UAE mainland market. | Can trade freely anywhere in the UAE and internationally without restrictions. Eligible to bid on government contracts. |

| Ownership | 100% foreign ownership is standard. No local Emirati sponsor or partner is required, offering complete autonomy to foreign investors. | Allows 100% foreign ownership for most commercial and industrial activities. Some strategic sectors may still require local partnership. |

| Office Space | Flexible options are available, including virtual offices, flexi-desks, and shared co-working spaces. Physical office space is not always mandatory. | A physical office registered with Ejari is typically a mandatory requirement. The office size often determines the company's visa quota. |

| Governing Authority | Regulated by the specific Free Zone Authority (e.g., DMCC, IFZA). Each zone has its own set of rules, regulations, and licensing procedures. | Regulated by the Department of Economy and Tourism (DET) and other government bodies like the Ministry of Human Resources and Emiratisation. |

| Visa Eligibility | Visa allocation is generally based on pre-approved packages offered by the free zone, independent of physical office size. | The number of visas is directly linked to the size of the leased physical office space. Larger offices allow for more employee visas. |

| Corporate Tax | Offers 0% corporate tax on "qualifying income" for companies that meet specific criteria, making it highly attractive for international businesses. | Subject to a standard 9% corporate tax on profits exceeding AED 375,000, in line with federal UAE tax laws. |

As you can see, the choice has significant implications for everything from your daily operations to your bottom line.

The primary decision factor often boils down to this: If your primary market is outside the UAE or within a specific industry hub, a Free Zone offers unparalleled operational and tax efficiency. If you plan to sell goods or services directly to consumers and businesses across the UAE, a Mainland setup is essential.

For a lot of entrepreneurs, the Mainland option simply offers the greatest flexibility for local business. If you're leaning that way, it's worth digging into the specifics of setting up an LLC company in UAE to understand the requirements and benefits. This path positions your business for direct market access and the ability to work on government projects from day one.

Understanding Dubai's Dual Economic Model

To really get to the heart of the free zone vs mainland Dubai decision, you have to understand the thinking behind Dubai's unique economic structure. This isn't some happy accident; it’s a brilliant, deliberate model designed to do two very different things at once. Think of it as the engine powering one of the world's most dynamic business environments.

On one side, you have the Free Zones. These were purpose-built to act as magnets for foreign investment and global trade. The idea was simple: create specialized, self-governing business hubs that could pull in international talent and capital with as little red tape as possible.

The Global Gateways: Free Zones

At their core, Free Zones are economic islands designed for international business. Each one is run by its own independent authority that sets the rules for everything from licensing to visas and compliance. This setup allows them to offer some seriously attractive perks you won't always find on the Mainland.

These incentives were engineered to appeal directly to foreign entrepreneurs and multinational corporations looking for a strategic base in the region. The main draws have always been:

- Complete Foreign Ownership: This was the original game-changer, giving expats 100% control of their companies without needing a local partner.

- Full Profit Repatriation: Businesses can send all their profits and capital back home, no questions asked and no restrictions.

- Tax Exemptions: Free Zones offer huge tax advantages, including no import/export duties and a 0% corporate tax rate on qualifying income.

And it has worked spectacularly. The growth of Dubai's free zone ecosystem has been nothing short of phenomenal, cementing the emirate's status as a global business centre. As of 2025, Dubai boasts over 45 specialized free zones, with the total number of registered companies exploding from just a few hundred two decades ago to more than 100,000. This incredible growth shows just how successful they've been, a trend you can dig into deeper when you explore the latest Dubai free zone business trends.

The Local Engine: The Mainland

On the flip side, the Mainland is the traditional, core domestic economy of the UAE. Regulated by the Department of Economy and Tourism (DET), Mainland companies are plugged directly into the local market. This is the setup for businesses that want to trade, operate, and sell their goods or services anywhere and everywhere across the seven emirates without restriction.

If your plan is to open a shop in a mall, bid on a government construction project, or provide services directly to the local population, a Mainland licence is your only real option.

Dubai's dual model truly gives it the best of both worlds. Free Zones serve as incubators for global trade and innovation, while the Mainland drives the local economy. Together, they create a balanced, resilient, and incredibly powerful economic landscape.

Ultimately, choosing between a free zone and the mainland is more than just a logistical exercise. It’s a strategic decision about where your business fits into this bigger picture. Are you building an international-facing company from a tax-friendly hub, or are you aiming to capture a piece of the vibrant and growing UAE market? Answering that is the first real step in picking the right path for your business.

Comparing Daily Operations and Market Access

Beyond the legal structures and initial costs, your choice between a free zone and the mainland will fundamentally shape how your business operates day-to-day. This is where the rubber meets the road—your decision directly impacts who you can sell to, where you can set up shop, and the kinds of opportunities you can chase. The differences in market access and operational rules create two very distinct paths to success in the UAE.

Ultimately, getting these practical details right is what matters most. The best jurisdiction for your company depends entirely on your business model, your target audience, and your long-term vision for growth, both within the UAE and internationally.

Unrestricted Market Access for Mainland Companies

The single biggest operational advantage of a mainland setup is unrestricted market access. A company licensed by the Department of Economy and Tourism (DET) has the freedom to trade directly with any customer, anywhere in the UAE. For certain business models, this is a complete game-changer.

Think about a retail brand planning to open a flagship store in Dubai Mall or a chain of cafes across the emirates. A mainland licence is the only way to legally operate these kinds of physical, customer-facing locations. Likewise, a services company aiming to work with local businesses in Abu Dhabi, Sharjah, or right here in Dubai needs a mainland presence to operate freely.

This open-market capability allows for:

- Direct B2C and B2B Sales: You can sell your products and services anywhere in the UAE without needing a middleman.

- Physical Presence: Set up your offices, showrooms, warehouses, or retail stores in any commercial area you choose.

- Geographic Expansion: As your business grows, you can scale your operations across different emirates without restrictions.

A mainland company is fully woven into the local economy, giving it the agility to react to market trends and build a powerful local footprint.

Navigating Market Access from a Free Zone

Free zone companies, by their very nature, are built for international and zone-specific trade. This means their operational scope within the wider UAE market is deliberately limited. A free zone entity cannot legally sell products or invoice for services directly to customers on the mainland.

To get around this, free zone businesses have to work through a third-party intermediary. This is usually a mainland-registered distributor or agent who buys the goods from the free zone company and then handles the local market sales. It works, but it adds another layer of cost and complexity.

Key Insight: The need for a local distributor is a critical differentiator. For a tech consultancy in a free zone, this might be a non-issue. But for an e-commerce company selling physical products, it adds a crucial logistical and financial step to the supply chain, which will definitely impact your profit margins and delivery times.

This structure is perfectly fine for businesses focused on re-export, international consulting, or providing services to other companies within their own free zone.

The Decisive Factor of Government Contracts

One of the clearest dividing lines in the free zone vs mainland Dubai debate comes down to public sector work. If your business plan involves bidding for government tenders and contracts, the choice is already made for you.

A mainland licence is a mandatory prerequisite to participate in any government procurement process. Federal and local government bodies, along with semi-government entities, will only award contracts to companies registered with the DET. This opens up a huge and often very profitable revenue stream that is completely off-limits to free zone companies.

For businesses in sectors like construction, IT services, infrastructure, and large-scale consulting, the ability to bid on these projects is often central to their growth strategy, making a mainland setup the only logical choice from the very beginning.

Contrasting Office and Workspace Requirements

Your physical workspace needs also differ quite a bit between the two jurisdictions, which will impact both your budget and your operational flexibility. Mainland setups have traditionally followed stricter rules, whereas free zones are known for offering more modern, adaptable solutions.

This comparison really highlights the difference in their approach:

| Aspect | Mainland Company | Free Zone Company |

|---|---|---|

| Physical Office | A physical office space registered with Ejari is mandatory for most business activities. | A physical office is often optional. Many activities qualify for flexi-desks or virtual office packages. |

| Visa Allocation | The number of employee visas you can get is directly tied to the size of your office (typically one visa per 80-100 sq. ft.). | Visa quotas are usually part of a pre-defined package. You can get several visas without leasing a large physical office. |

| Flexibility | Less flexible. You have to commit to a commercial lease, which comes with significant upfront and ongoing costs. | Highly flexible. Startups and solo entrepreneurs can start with a low-cost virtual office and scale up as their team grows. |

For instance, a freelance marketing consultant would find a free zone's flexi-desk option much more practical and affordable than being forced to lease an office on the mainland. On the other hand, a law firm that needs a private, client-facing office would be a natural fit for the mainland model, where the larger physical space also allows for a higher visa quota for its staff.

Ownership, Visas, and Legal Frameworks: The Nitty-Gritty Details

Beyond your day-to-day operations, the legal and administrative guts of a Free Zone versus a Mainland setup will have a huge impact on your business down the road. These frameworks dictate everything from who truly owns your company to how you build your team. Getting this right is central to the free zone vs mainland Dubai decision.

The rules around ownership, visa quotas, and who you answer to aren't just bureaucratic box-ticking. They directly shape your control over the business, your ability to grow, and the compliance headaches you'll face.

Decoding Company Ownership Structures

For years, this was the simplest part of the conversation. Free Zones were the obvious choice for foreign entrepreneurs because they offered 100% foreign ownership right out of the gate. This was a massive draw for international investors who wanted full control without a local partner.

But landmark reforms have completely changed the game for Mainland companies. The UAE government now allows 100% foreign ownership for most commercial and industrial activities on the Mainland. Honestly, this move has levelled the playing field in a big way, knocking down what used to be the single biggest barrier for foreign investors.

While this change is a game-changer, it isn't a blanket rule. Certain strategic sectors on the Mainland—think areas with significant national interest—might still require an Emirati partner. It's absolutely critical to check the specific rules for your business activity before you commit.

The key takeaway here? 100% ownership is no longer an exclusive perk of setting up in a Free Zone. Your decision should now lean more on operational factors like market access and the specific regulatory environment, not just ownership.

A Closer Look at Visa Regulations

Your ability to hire people and bring them to Dubai is another area where these two jurisdictions diverge. The process for getting residence visas for owners, partners, and employees works very differently depending on where you set up.

Mainland Visa Allocation:

For a Mainland company, the number of employment visas you're eligible for is tied directly to the physical size of your office. The general rule of thumb is about one visa per 80-100 square feet of commercial space you lease. This system means that as your team grows, your real estate costs have to grow with it.

Free Zone Visa Allocation:

Free Zones handle this completely differently. Their authorities usually offer visa packages that are separate from your office size. You can often get a set number of visas—say, one to six—with a simple flexi-desk or virtual office package. This model gives startups, consultants, and smaller teams far more flexibility and is much more cost-effective if you don't need a big physical office.

To get a better handle on what's involved, our detailed guide explains more about how to get a residence visa in Dubai and the documents you'll need.

Understanding the Governing Authorities

Finally, the regulatory body that oversees your business plays a massive role in your setup experience and ongoing compliance. Each jurisdiction operates under a different authority, creating two very distinct administrative worlds.

A Mainland company is registered with the Department of Economy and Tourism (DET). This means you're dealing with one central government body for your main license, although you might need additional approvals from other ministries depending on what you do.

On the other hand, each of Dubai’s 45+ Free Zones is managed by its own independent Free Zone Authority. This means that rules, costs, and processes can vary wildly from one zone to the next. An authority like DMCC will have different procedures and specialise in different industries compared to IFZA or Meydan. This can be a huge plus if your business fits a zone's focus, as the authority will have deep expertise in your sector. However, it also means you need to do your homework to find the authority that's the perfect match for your business.

A Practical Financial Breakdown of Costs and Taxation

Getting your finances in order is the absolute foundation of a successful business launch. When you’re weighing up a free zone vs mainland Dubai setup, the numbers really do tell a story. It's not just about the initial licence fee; you've got to think about annual renewals, day-to-day running costs, and the big one everyone's talking about: corporate tax. Having a solid grip on these figures from the start is non-negotiable for long-term growth.

The initial cash you'll need to get off the ground is wildly different for each jurisdiction. Mainland setups often come with higher upfront government fees because you're dealing with multiple bodies like the Department of Economy and Tourism (DET). Free Zones, on the other hand, tend to roll everything into neat, predictable packages that are often easier on the wallet initially.

Comparing Initial Setup Costs

When you’re mapping out your launch budget, you have to look at the entire picture. The total cost isn't just one line item; it's a mix of different fees, and they all change depending on where you set up and what your business does.

- Licence and Registration Fees: Mainland licence fees can be steeper, but that's because they give you access to the entire local market. Free Zones fight for your business with competitive, all-in-one packages built to pull in foreign investment.

- Third-Party and Approval Costs: On the mainland, you might find yourself paying separate fees for name approvals, initial approvals, and attestations from different government departments. Free Zone authorities usually bundle all of this into a single, straightforward payment.

- Office Space: This is a huge one. Most mainland companies are required to have a physical office, which means a lease deposit and rent right off the bat. Many Free Zones let you start with a low-cost flexi-desk or even a virtual office, slashing the amount of capital you need to get started.

For a clearer idea of the numbers, check out our guide that details the typical trade license Dubai cost for various setups.

Annual Renewals and Ongoing Expenses

Your financial commitments don't stop once you've launched. Annual renewal fees are a fact of life in both jurisdictions, but how they're structured varies. For mainland companies, renewals mean paying DET fees and renewing your office lease. In a Free Zone, it’s usually a simple package fee paid directly to the authority.

You also have to account for the day-to-day operational costs like utilities, compliance, and admin support. To stay on top of it all, it's vital that you learn how to accurately track business expenses. This kind of financial discipline is what keeps you profitable in the long run, no matter which jurisdiction you choose.

Understanding the New Corporate Tax Landscape

The introduction of corporate tax in 2023 was a massive shift for the UAE business world. Since June 2023, mainland companies are now subject to a 9% corporate tax on any profits over AED 375,000. This move brought the mainland into line with standard international tax systems.

For Free Zone companies, the tax benefits are still a major draw. You can still enjoy a 0% corporate tax rate, but it's not a given. This benefit only applies to "qualifying income," and to get it, you must maintain audited financials and meet strict compliance rules.

This tax advantage has, unsurprisingly, led to a surge in businesses opting for Free Zone registrations. At its core, "qualifying income" is revenue that comes from activities outside the UAE mainland. If your Free Zone company does a lot of business directly with the mainland, you risk losing that coveted tax-exempt status—a perfect example of why strategic planning is so crucial.

Which Setup Is Right for Your Business Model

The choice between a free zone vs mainland Dubai setup isn't just a box-ticking exercise; it's a strategic decision that needs to mesh perfectly with how your business actually operates. Let's move past the general pros and cons and look at which jurisdiction genuinely serves specific company types.

When you match your operational needs to the right legal framework from the get-go, you're building on a solid foundation. Getting it wrong can lead to operational headaches and wasted money down the line. But getting it right? That’s your launchpad for growth.

The International E-Commerce Trader

If you're running an e-commerce business with an eye on international sales and regional distribution, a Free Zone is almost always the answer. The real wins here are logistical simplicity and financial efficiency. You can import goods without dealing with customs duties, warehouse them, and then re-export them to customers worldwide.

On top of that, you benefit from a 0% corporate tax on qualifying income, which is a massive advantage. A hub like Jebel Ali Free Zone (JAFZA) offers incredible logistics infrastructure, making it a powerhouse for import-export businesses. This setup keeps you clear of the complexities of trading directly within the UAE, streamlining your supply chain for a global market.

The Local Restaurant or Retail Shop

For any business that deals directly with the public in Dubai—a café, a clothing boutique, or a restaurant—a Mainland setup is your only option. It's non-negotiable. You’ll need a licence from the Department of Economy and Tourism (DET) to operate legally.

This licence gives you the freedom to set up shop anywhere in Dubai, whether it’s a bustling shopping mall or a prime high-street location. Critically, it allows you to trade directly with the local market without any restrictions, which is fundamental for any B2C business targeting residents and tourists.

The Global Tech Consultant

Are you a tech consultant, a freelancer, or a digital marketing agency with clients all over the world? A Free Zone is a perfect fit. Since your customer base is global, you don't need direct access to the UAE mainland market. A Free Zone provides a low-cost, highly flexible setup with options for virtual offices and co-working spaces.

This model is ideal for securing a residence visa while running a legitimate global business from a tax-efficient base in Dubai. The regulatory environment is much simpler, which means less admin for you and more time to focus on your clients.

The Construction Company Bidding on Projects

For companies in construction, engineering, or any related field looking to secure government contracts or work on large-scale private projects, a Mainland licence is mandatory. Period. Government tenders and major local contracts are exclusively awarded to companies registered on the mainland.

This is one of those clear-cut decisions where your target market dictates the entire setup. Trying to operate from a Free Zone would completely lock you out of this incredibly lucrative part of the UAE economy.

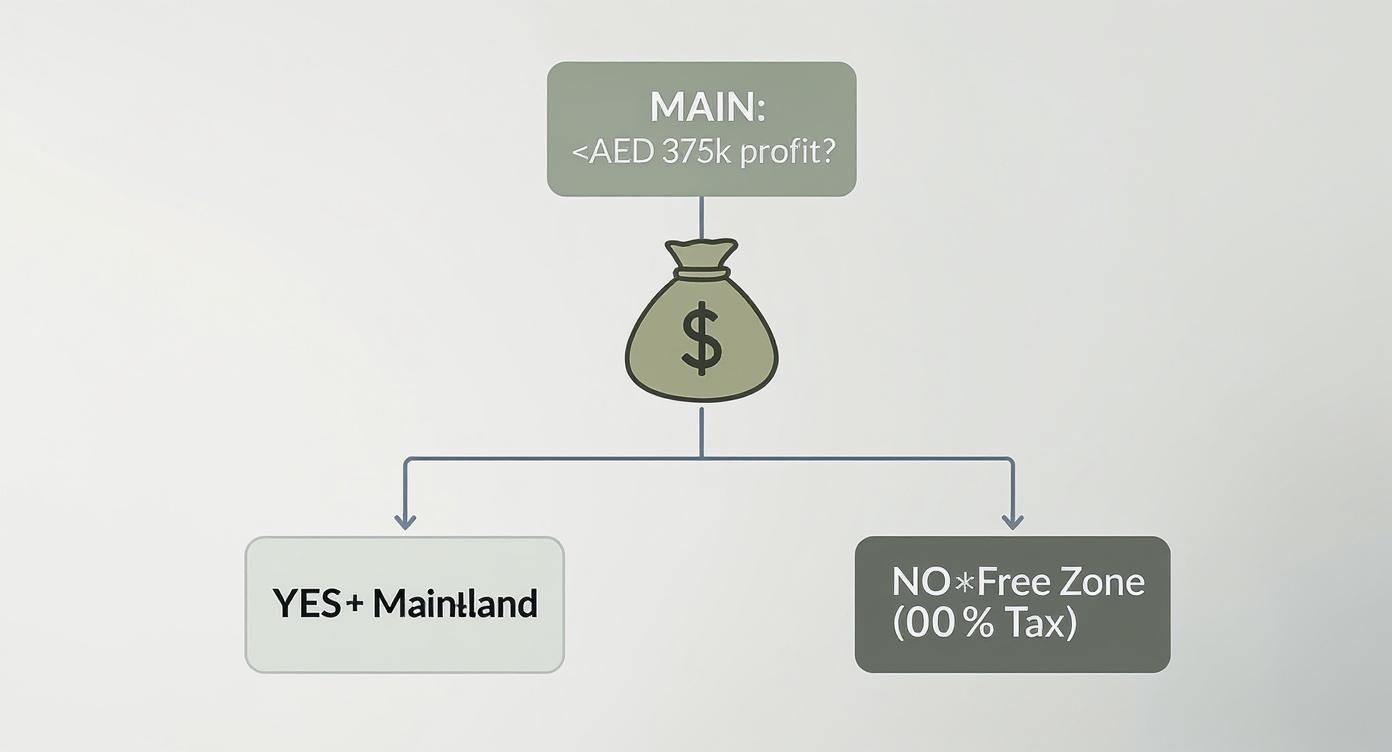

This infographic helps break down the tax implications based on your company's profitability.

As the flowchart shows, if your annual profit is expected to stay below AED 375,000, a Free Zone's 0% tax rate is a major advantage. Once your profits on the mainland cross that threshold, you'll be subject to the standard 9% corporate tax.

Your Questions, Answered

When it comes to the free zone vs mainland Dubai debate, a lot of specific, practical questions pop up. It’s one of the first big hurdles for any entrepreneur here. Let's clear up a few of the most common ones we hear all the time.

Can a Free Zone Company Do Business on the Mainland?

This is a big one. The short answer is no, not directly. A free zone company is legally ringfenced to operate within its specific zone or to conduct business internationally.

If you want to tap into the local UAE market, you'll need a go-between. The standard route is to partner with a mainland-registered distributor or agent who can sell your goods and services for you.

The other option is to open a branch of your free zone company on the mainland. This gives you direct access, but it means a separate application process and approvals from the Department of Economy and Tourism (DET), plus its own set of licensing and compliance rules.

Can I Switch from a Free Zone to the Mainland?

Yes, you can, but it's not a simple switch or a quick paperwork update. You're essentially starting over from scratch.

The process involves completely liquidating your free zone company—closing its bank accounts, cancelling all visas, and getting final clearance from the free zone authority. Only then can you begin the full mainland company registration process.

Think of it as a complete teardown and rebuild, not a renovation. This really highlights why it’s so critical to get the jurisdiction right from day one. Making the wrong choice can lead to a lot of administrative headaches and unnecessary costs down the line.

What's Better for a Small Startup or a Freelancer?

For most freelancers, consultants, and small digital-first startups, a free zone is usually the most logical and budget-friendly starting point. The biggest draw is the ability to get a licence without needing a full-blown physical office.

You can often get started with a flexi-desk or virtual office package, which dramatically cuts your initial setup costs.

Plus, free zone visa allowances aren't tied to the square footage of your office, giving you much more flexibility to grow your team. This mix of lower overheads and simpler administration makes it the perfect launchpad for solo entrepreneurs and small, agile teams focused on international clients.

Making these foundational choices correctly sets the stage for your future success. The team at Al Ain Business Center has guided countless entrepreneurs through both free zone and mainland setups, ensuring they make the right strategic move from the very beginning. Start your UAE business journey with us today.