Getting a trade license is your golden ticket to doing business in Dubai. You absolutely can't operate without one. This document, issued by the Department of Economy and Tourism (DET), is your official permission slip that outlines exactly what your company is allowed to do. Think of it less as a piece of paper and more as the foundation of your entire business here.

Your Essential First Look at a Dubai Trade License

Diving into the trade license process can feel a little overwhelming at first, but it really comes down to a few key decisions you need to make right at the start. The biggest one? Choosing the right business jurisdiction. This single choice will shape your ownership structure, who you can sell to, and the overall freedom you have to operate.

This overview is designed to give you that solid, foundational understanding so you can move forward confidently. We'll cut through the jargon, explain what a trade license really means for you, and introduce the main authorities you'll be dealing with. Getting this clarity from day one is the best way to avoid expensive mistakes and frustrating delays later on.

The business scene in Dubai is booming, and a lot of that is thanks to the government's push to make setting up shop easier and more affordable. The numbers speak for themselves: the emirate issued a staggering 35,500 new company licenses in the first half of 2025 alone. This explosion of new businesses shows just how much recent reforms have cut down the cost and time it takes to get started. You can learn more about these impactful business reforms and how they're changing the game.

Understanding the Three Main Jurisdictions

So, where should you set up? Your choice will really depend on what your business does and where you see it going. Dubai is carved into three main jurisdictions, and each has its own set of rules and advantages.

To help you see the differences clearly, here’s a quick breakdown:

Dubai Business Jurisdictions at a Glance

|

Jurisdiction |

Typical Ownership |

Market Access |

Ideal For |

|---|---|---|---|

|

Mainland |

100% foreign ownership (for most activities) |

Direct access to the entire UAE market, including government contracts. |

Businesses aiming to trade locally, open physical stores, or work with government entities. |

|

Free Zone |

100% foreign ownership |

Primarily international; limited access to the UAE mainland market. |

International trade, export/import businesses, and companies in specific sectors like tech or media. |

|

Offshore |

100% foreign ownership |

No access to the UAE market. For international business only. |

Holding companies, international consulting, and asset protection. |

Let's dig a little deeper into what each of these means for you.

-

Mainland: If you want to trade directly with customers anywhere in the UAE or bid on government projects, this is your spot. Mainland companies, often set up as a Limited Liability Company (LLC), give you the most flexibility to operate across the country.

-

Free Zone: Dubai has over 40 specialised free zones, each acting as a hub for specific industries like tech, media, or commodities. The big draw here is 100% foreign ownership and major tax exemptions, which makes them a fantastic choice for businesses focused on international markets.

-

Offshore: An offshore company is a bit different. It’s legally registered in the UAE, but it can't do any significant business within the country. This structure is mainly a tool for international trading, protecting assets, and optimising your tax position globally.

Key Takeaway: Choosing between mainland, free zone, or offshore is more than just ticking a box on a form. It fundamentally defines your customer base, your ownership rights, and your company's legal standing. Getting this decision right from the beginning is absolutely critical for your long-term success.

Choosing the Right Trade License for Your Business

Picking the right trade license is more than just paperwork; it’s the foundational decision that defines what your business can legally do in Dubai. This choice dictates the activities you can perform, the clients you can work with, and ultimately, how your company can grow. Think of it as the DNA of your business.

In Dubai, the framework is built around three core categories, each tailored for specific business operations. Your business plan needs to fit perfectly into one of these to ensure you get approved without a hitch and can start operating legally from day one. Let's break them down with some real-world examples.

The Commercial License: For Trading and Retail

This is the go-to license for most businesses and easily the most versatile. The Commercial License covers any activity related to buying, selling, or moving goods. It’s not just for physical shops in a mall; it's the engine behind import/export, logistics, and the massive e-commerce scene.

Let's say you're launching an online store selling handcrafted leather bags. You'd need a Commercial License to legally import your raw materials, hold stock, and sell your finished products to customers anywhere in the UAE. The same license applies if you're opening an electronics store or a general trading company that deals in a bit of everything.

Any business that primarily trades goods falls under this umbrella. The recent boom in business setups tells the story: e-commerce and retail now make up roughly 30% of all new licenses. This surge included a staggering 4,700 licenses for e-commerce alone, plus thousands more for general retail and import/export. You can read more about UAE business registration trends to see just how popular this route is.

The Professional License: For Service-Based Experts

If your business is built around your expertise, talent, or a specific craft, then the Professional License is for you. This category is designed for service-oriented businesses and individuals—think consultants, designers, artisans, and tech specialists.

Imagine a marketing consultant offering strategy advice, a freelance graphic designer creating logos, or a private tutor teaching specialised courses. All these ventures operate under a Professional License. One of the biggest draws here is that this license often allows for 100% foreign ownership on the mainland, meaning you don't need a local Emirati partner. This is a game-changer for many expatriate entrepreneurs.

Expert Insight: It really boils down to this: a Commercial License is for selling goods, while a Professional License is for selling services powered by your skills. If you're trading a physical product, you need a commercial license. If you're selling your expertise, it’s a professional one.

The Industrial License: For Manufacturing and Production

For anyone looking to make, manufacture, or process goods, the Industrial License is non-negotiable. This is for businesses that take raw materials and turn them into finished products. Be prepared for a more rigorous approval process, as you'll need to comply with specific zoning, environmental, and safety regulations.

A company assembling furniture, a factory producing packaged foods, or a workshop manufacturing textiles would all need an Industrial License. While the Department of Economy and Tourism (DET) issues the license, you’ll also need the green light from other bodies like the Dubai Municipality. It's a more involved setup, but it’s the only legal way to manufacture in the emirate.

Specialised and Emerging License Types

Dubai is always looking ahead, and its licensing options reflect that. Beyond the main three, there are specialised licenses to support modern and niche industries.

-

Tourism License: A must-have for any business in the hospitality game, like travel agencies, tour operators, or hotel management firms. This requires special approval from the Department of Economy and Tourism (DET).

-

E-commerce License: While technically a commercial activity, specialised licenses like the DED Trader license are perfect for home-based or social media entrepreneurs. They offer a more affordable way to get started.

-

Freelance Permit: Many free zones offer these permits, allowing individuals to work as independent contractors. It’s ideal for creatives, tech pros, and media specialists who want to operate under their own name.

Choosing the right license from the start is critical. It doesn’t just keep you compliant; it shapes your company’s legal structure, ownership options, and operational framework for years to come. Get this right, and you’ve laid a solid foundation for success in Dubai's energetic market.

Navigating The Application Process From Start To Finish

Getting a Dubai trade license isn't just a single step; it's a journey with a few key milestones. While it might seem complex at first glance, it's really a series of logical actions that, when done right, pave the way for a successful business launch. This isn't about simply rushing through paperwork. It's about making smart, strategic decisions right from the get-go.

The whole process kicks off with two foundational choices: figuring out exactly what your business will do and picking the right legal structure. These two decisions are closely linked and will shape everything that follows. Let's walk through the entire path, from your initial idea to the moment you're holding your official license.

Defining Your Activities And Legal Structure

First things first, you need to create a detailed list of every single business activity you plan to engage in. Get specific. Are you selling electronics, providing digital marketing services, or manufacturing clothes? Each activity has an official code assigned by the Department of Economy and Tourism (DET). You have to choose from their approved list, and your license will only let you operate within those selected activities.

Once your business activities are crystal clear, it’s time to choose a legal structure. This decision affects your liability, ownership rules, and how your company is managed day-to-day. For most entrepreneurs setting up on the mainland, it usually boils down to two popular options:

-

Limited Liability Company (LLC): This is the go-to for many. It's a flexible structure where the owners' liability is limited to their investment in the company. It's perfect for businesses with multiple partners and gives you a solid corporate framework.

-

Sole Establishment/Proprietorship: This is owned by just one person, who is personally responsible for all the company's debts and liabilities. It's a much simpler setup, often chosen by professional service providers and consultants working alone.

The real-world difference is huge. An LLC acts as a shield, separating your personal assets from the business. A sole establishment doesn't offer that protection, making it a simpler but higher-risk choice for solo flyers.

Reserving Your Trade Name

With your activities and structure sorted, the next move is picking a unique trade name. This is more than just branding—it's a legal requirement with some pretty strict rules. You'll need to submit your proposed name to the DET for approval to make sure it's not already in use or violates any local regulations.

To avoid getting rejected, stick to these guidelines:

-

The name can't be offensive or go against public morals.

-

It cannot include the names of any religion or government authority.

-

It must not be already registered by another company.

-

If you use a person's name, they have to be a partner in the company.

Pro Tip from Al Ain Business Center: We see trade name rejections cause delays all the time. Come prepared with three to five name options, listed in order of preference. That way, if your top choice is taken, you can quickly pivot to the next one without losing momentum.

Securing Initial Approval And Preparing Documents

After your trade name is reserved, you'll apply for Initial Approval. This is a critical certificate from the DET confirming the government has no objection to you setting up your business. Think of it as the green light to move forward with the more detailed parts of your application.

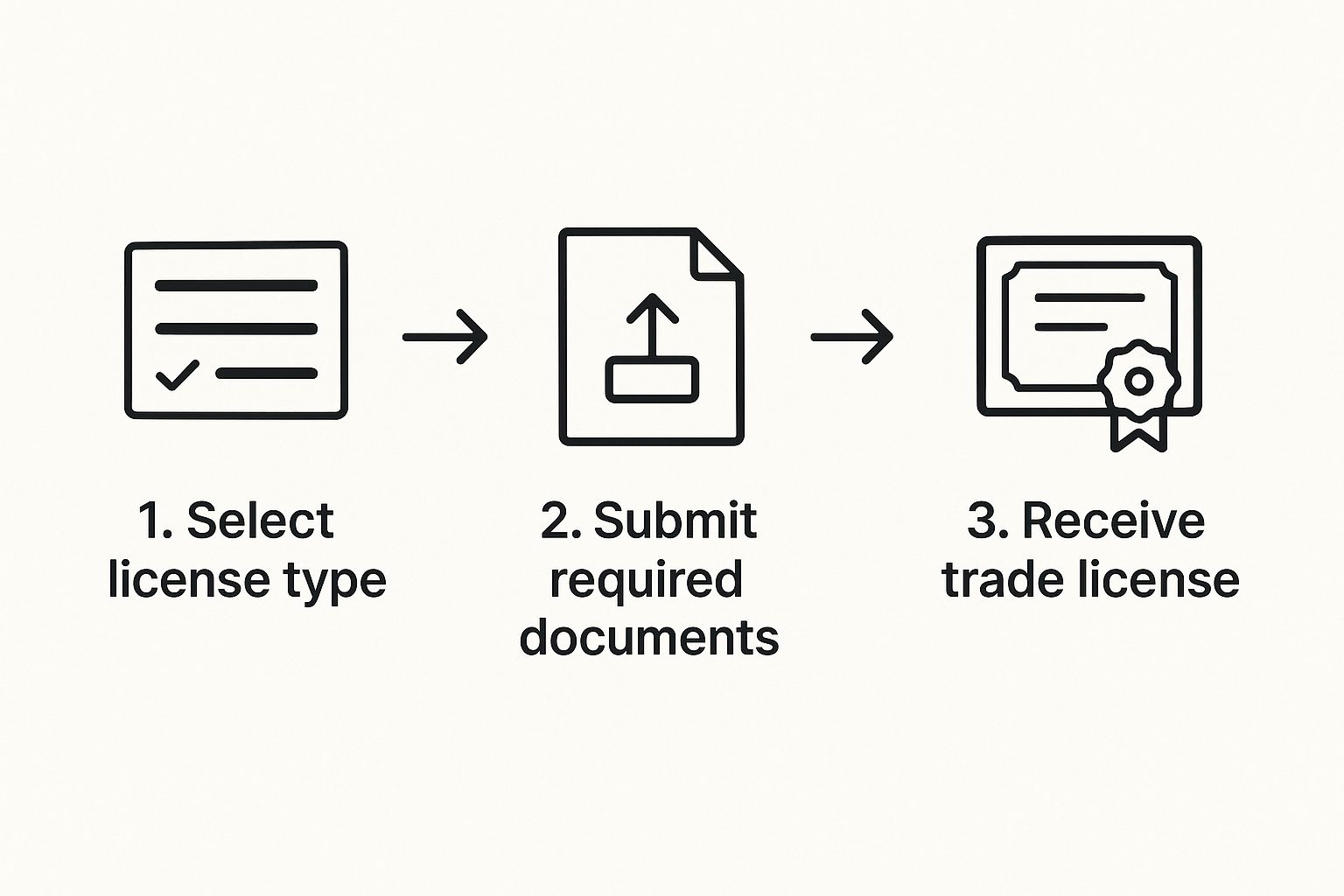

This infographic breaks down the journey you're about to take.

As you can see, the process is a clear progression—from making your initial choices to submitting everything and finally getting your license.

Once you have that initial approval, you'll need to get your core legal documents in order. For an LLC, the most important one is the Memorandum of Association (MoA). This legal document details the business objectives, share capital, partner information, and how profits and losses will be distributed. It needs to be drafted with care and attested by the proper authorities.

Gathering the right documents is non-negotiable. Missing even one piece of paper can bring the whole process to a standstill. Here's a quick checklist to keep you organised.

Document Checklist for Your Trade License Application

|

Document |

Source |

Purpose |

|---|---|---|

|

Passport Copies |

All partners/shareholders |

Verifies the identity of all individuals involved in the company. |

|

Visa/Emirates ID Copy |

UAE-resident partners |

Confirms the legal residency status of any partners already in the UAE. |

|

Initial Approval Certificate |

Department of Economy and Tourism (DET) |

Official confirmation that the government has no objection to the business. |

|

Trade Name Reservation |

Department of Economy and Tourism (DET) |

Proof that your chosen business name is unique and has been approved. |

|

Memorandum of Association (MoA) |

Drafted by a legal professional/you |

A legally attested document outlining the company’s structure and rules. |

|

Tenancy Contract |

Your landlord/property owner |

The official lease agreement for your commercial business premises. |

|

Ejari Certificate |

Real Estate Regulatory Agency (RERA) |

Mandatory registration of your tenancy contract, proving a valid physical address. |

Having this checklist handy will save you a lot of headaches later on.

Finding A Business Address And Getting Your Ejari

Every single mainland business in Dubai must have a physical address. You can't just use your home address for a commercial or industrial license. This means you’ll need to lease a commercial property—be it an office, a warehouse, or a retail shop—that's appropriate for your business activities.

Once you've signed the tenancy contract for your business space, you have to register it with Ejari. This is the official online registration system from the Real Estate Regulatory Agency (RERA). Your Ejari certificate is mandatory proof of your physical address and is an absolute must-have for your final trade license submission. Without a valid Ejari, your application simply won't proceed.

Final Submission And License Issuance

You've made it to the final stage. Now it's time to gather all your documents and submit the complete package to the DET. This comprehensive file should include:

-

The filled-out application form.

-

Passport copies for all partners and owners.

-

Your Initial Approval certificate and trade name reservation.

-

The attested Memorandum of Association (MoA).

-

Your tenancy contract and the Ejari certificate.

Once everything is submitted and verified, the DET will issue a payment voucher for the final government fees. After you settle that payment, your official trade license will be issued. With the right guidance, this entire process—from defining your business to getting licensed—can be a clear and achievable goal, not a complicated puzzle.

Decoding the Costs and Timelines for Your License

When you’re gearing up to launch a business in Dubai, two things need your immediate attention: your budget and your schedule. Getting a firm grip on the financial and time commitments for your trade license isn't just a good idea—it’s absolutely essential to sidestep any last-minute surprises that could throw a wrench in your plans.

Let's pull back the curtain on exactly what you should expect to invest, both in dirhams and in days.

The final figure is always a combination of fixed government fees and other expenses that shift depending on your specific business. Understanding both sides of this equation from the start is the key to building a realistic budget.

Mandatory Government Fees

Some costs are simply part of the deal for nearly every mainland business. These are the core fees you'll pay directly to government bodies like the Department of Economy and Tourism (DET).

Here's a quick look at the typical fixed costs you'll see:

-

Initial Approval Fee: A nominal charge for the DET to review your business idea and give you the green light to move forward.

-

Trade Name Registration Fee: This is for securing your unique business name. The cost can vary a bit based on the name you choose.

-

License Issuance Fee: The main fee for the final issuance of your official trade license.

-

Market Fees: This is calculated as a small percentage of your office's annual rent and collected by the DET.

These fees create the foundation of your setup costs, often landing somewhere between AED 15,000 to AED 25,000 for a standard mainland LLC.

Variable Costs to Factor In

Once you get past the standard government charges, you'll run into other significant costs that depend entirely on how you plan to operate. This is where your budget can really start to change.

The main variable costs include:

-

Office Rent and Ejari: Every mainland business needs a physical address. Leasing an office and registering the tenancy contract (Ejari) is often the biggest variable cost.

-

Visa Fees: You'll need an investor visa for yourself, plus you'll have costs for every employee visa you process. These fees cover everything from medical tests to Emirates ID issuance.

-

Document Attestation: If you have documents from outside the UAE, like degree certificates or corporate papers, they’ll need to be legally attested. This involves fees at several stages.

-

PRO Services: While it's optional, hiring a firm like Al Ain Business Center to handle the paperwork is a cost that pays for itself by saving you huge amounts of time and helping you avoid costly mistakes.

Real-World Scenarios: Think about a solo marketing consultant working out of a small co-working space. Their total setup costs might start around AED 20,000. On the other hand, a small retail shop that needs a prime storefront and visas for five staff members could see their initial costs jump past AED 80,000 once rent, fit-out, and all those visa fees are tallied up.

Mapping Out the Timeline

In business, time is money. Knowing the typical timeline for getting a trade license in Dubai helps you plan your launch, hiring, and operational kick-off without any guesswork.

The good news? For a straightforward mainland license application with all the documents ready to go, the process is surprisingly quick.

Here’s a general breakdown of how long things take:

-

Initial Approval & Name Reservation: This first step is usually wrapped up within 1-3 business days.

-

Document Prep & MoA: Drafting and notarising your Memorandum of Association can take another 2-4 days, mostly depending on when all partners are available to sign.

-

Final Submission & Payment: After you submit everything, including your Ejari, the final payment voucher is typically issued within 1-2 days.

-

License Issuance: The moment you make that final payment, you'll receive your official trade license almost instantly—often within 24 hours.

All in all, you should realistically budget for one to two weeks for the entire process, from start to finish. Of course, this can stretch if your business needs special approvals from other ministries (like for a medical clinic or a school), but for most commercial and professional activities, the timeline is fast and predictable.

How PRO Services Can Simplify Your Business Setup

Trying to get a trade license in Dubai on your own is definitely possible, but it can quickly feel like a full-time job. You'll be juggling complex paperwork, liaising with multiple government departments, and trying to make sense of a constant stream of legal jargon. This is precisely where bringing in a professional business setup consultant, known in Dubai as a PRO (Public Relations Officer), becomes a game-changer.

Think of a PRO service provider like Al Ain Business Center as your dedicated guide through the maze of company formation. These experts are much more than just form-fillers; they become your official representative, handling all the tricky steps needed to get your company off the ground. They're fluent in the language of government procedures and have built relationships with key authorities over many years.

This deep expertise translates into real-world benefits that save you more than just time. A professional team ensures every single document is submitted correctly the first time, slashing the risk of rejections that lead to frustrating and expensive delays.

What Does a PRO Actually Do?

A PRO’s role is incredibly hands-on and covers all the essential administrative and legal legwork needed to launch your business. Their goal is to free you up, letting you focus on your actual business strategy instead of getting bogged down in bureaucracy.

Here's a look at what they typically handle:

-

Document Clearing and Submission: They manage everything from drafting legal documents like the Memorandum of Association to submitting them correctly to the Department of Economy and Tourism (DET).

-

Government Liaison: Your PRO is the one communicating directly with all relevant government bodies—ministries, immigration departments, municipal authorities—so you don’t have to.

-

Visa Processing: They oversee the entire application process for your investor visa, plus visas for your family and any future employees. This includes everything from scheduling medical tests to handling Emirates ID typing.

-

Approvals and Renewals: A good PRO service makes sure you get all the necessary external approvals and also manages the timely renewal of your trade license each year.

This level of support is invaluable, especially in such a dynamic market. The business outlook here remains incredibly positive. The latest Dubai Business Confidence Index (BCI) for Q1 2025 sits at a strong 114.9 points. The services sector is particularly confident, scoring 123 points and signalling robust growth ahead. You can dig into more of these insights in Dubai's business outlook for 2025.

The Real Value of Professional Guidance

Investing in a PRO service isn't just about outsourcing paperwork; it's an investment in efficiency, accuracy, and your own peace of mind. The initial fee often pays for itself by preventing common but costly mistakes that can completely derail a business launch. For example, a simple error on an application or a missed deadline can easily set you back weeks.

A common mistake we see is entrepreneurs underestimating the complexity of getting external approvals for specialised business activities. A good PRO foresees these requirements and prepares the necessary documentation in parallel, saving weeks of potential delays.

Ultimately, using a PRO service transforms the process of how to get a trade license in Dubai from a confusing challenge into a clear, manageable project. With an expert team handling the administrative heavy lifting, you gain the confidence that your business is being built on a solid, compliant foundation right from day one.

Got Questions About Your Dubai Trade License? We've Got Answers

Setting up a business in Dubai is an exciting journey, but it’s completely normal for questions to pop up as you move from your big idea to the practical steps. We get asked about the nuts and bolts of the process all the time by entrepreneurs just like you.

Let's clear up some of the most common queries. We want you to feel totally confident as you navigate the path to getting your trade license.

Can I Get a Dubai Trade License Without a Physical Office?

This is a big one, and the short answer is yes, you absolutely can for many business types. Dubai's business framework is impressively modern and designed to support flexible setups, which is great news for service-based companies and digital ventures.

For example, if you're in consulting, IT, or e-commerce, you're often eligible for a virtual office solution or can register your license to a co-working space membership. This gives you a legitimate business address for all your paperwork without the cost of leasing a traditional office.

There are even specific licenses built for this model. The DED's 'Trader' license is a fantastic option for home-based entrepreneurs and people running businesses through social media, letting them operate legally right from their residence.

Keep This in Mind: While there's a lot of flexibility, it doesn't apply to everyone. If your business involves trading physical goods or manufacturing, a mainland commercial or industrial license will almost certainly require a physical office or warehouse with a registered Ejari. It all comes down to your specific business activity.

How Long Does It Really Take to Get the License?

It's usually faster than most people think, as long as all your ducks are in a row. For a straightforward mainland license without any complex third-party approvals, you can expect the whole process to take between one to two weeks.

Here’s a rough breakdown of that timeline:

-

Trade Name & Initial Approval: This is usually the quickest part. We often see this completed in just 1-3 working days.

-

Document Prep: Drafting and notarising your Memorandum of Association (MoA) can take another 2-4 days, mostly depending on how quickly all partners can get together.

-

Final Submission & Payment: Once you submit everything, including your tenancy contract (Ejari), the final license is typically issued within 24-48 hours after you've paid the fees.

Of course, if your business needs a special green light from another government body—like the Dubai Health Authority for a medical clinic or the KHDA for an education-related business—the timeline will extend. A good business setup specialist can give you a very accurate estimate based on your specific needs.

I Have My License! What's Next?

Getting that trade license in hand is a huge milestone, but it's the starting pistol, not the finish line. There are a few more critical steps to get your company fully operational.

Right after your license is issued, your immediate focus should be on these tasks:

-

Get Your Company Immigration Card: You can't apply for any visas without this. It's the key that unlocks the residency process.

-

Process Your Visas: Start with your own investor visa. Once that's in process, you can begin sponsoring visas for any employees you're ready to hire. This involves both the Ministry of Human Resources and Emiratisation (MOHRE) and the GDRFA.

-

Open a Corporate Bank Account: This is non-negotiable. You’ll need your new trade license and other company documents to open an account and keep your business finances separate and professional.

-

Register for VAT: Based on your expected revenue, you'll likely need to register for Value Added Tax (VAT) with the Federal Tax Authority (FTA). It's better to get this sorted early.

Getting these post-license steps right is just as important as the application itself. It ensures your business is not just legal, but fully compliant and ready to thrive in the UAE.

Ready to turn your business idea into a reality? The experts at Al Ain Business Center are here to guide you through every step of getting your trade license in Dubai. Contact us today for a free consultation and let's get you started. Visit us at https://alainbcenter.com.